Comparison Of Inflationary Non

Content

We deflate the expenditure approach to set the annual level of volume GDP. As such, the two measures of volume GDP are not confronted – we align to expenditure at the top level, and each component is then aligned independently at the detailed level. In contrast, these experimental volume estimates of GDP have been produced in the SUTs framework as well, such that the confrontation of volume estimates of production and expenditure are taking place at a lower industry- and product-level. This will help ensure a holistic approach to data quality takes place to inform the estimates and therefore facilitate a more consistent application of balancing adjustments and more plausible implied production deflators. This not only reflects that this is based on a wider range of annual surveys and administrative information, but it is also recording the correct concept of GVA rather than turnover as a proxy indicator. This also means that at industry level, the current price and volume relationship is now preserved, which historically has not been the case. Another feature to consider in these experimental estimates is that we have incorporated broader changes to how the balancing of current price and volume estimates of GDP in the SUTs framework has been undertaken for these experimental estimates.

This also helps explain why we do not consider these estimates to be necessarily fully reflective of those that will be published in next year’s Blue Book. It reflects the work we have carried out as so far and the work we still need to do. Further work is required to confront the two volume measures of GDP – production and expenditure – in advance of Blue Book 2021. As part of this, we will review the current price GDP balance, which in this experimental release is consistent with Blue Book 2020.

Does Deflation Or Inflation Pose The Biggest Threat To Portugal?

Figure 10 presents the percentage of telecommunication services that are consumed by each industry. Aside from others within the information and communication industry, those most impacted include finance and insurance services and gambling and betting services . All else the same, this would have lowered the volume GVA growth for these industries.

During the “closed” years – that is, the periods subject to SUTs balancing – the volume estimates of output are aligned with the expenditure measure of GDP, reflecting the higher-quality consumer price deflators used. The adjustments to bring the lower-level industry GVA into line are made proportionally over the services industries. This explains why there are changes to the headline volume estimates of GDP, as these have not yet been implemented in the official estimates. This will also impact on these experimental industry-level estimates, reflecting how this will lead to revised volume estimates of output and intermediate consumption for certain industries.

Fiscal and monetary policy stimulus should help cap some of these disinflationary forces, but is unlikely to fuel inflationary pressures over the next two years,” adds Luke. Ultimately, most analysts think that the COVID-19 crisis will eventually cause a significantglobal economic deflation.Since more people now telecommute and fewer people travel to work due to widespread restrictions, the travel demand might keep going down. This could gradually lead tolower energy pricesand a considerabledecline in the oil industry. In this scenario, it is expected that demand will ultimately lag behind the supply capacity; at this point, the dynamics should drive down the commodity prices. Also, companies that get a boost from the greater circulation of money will be more likely to survive, despite having to trade at a loss for some time.

As we utilise our new framework for producing GDP, we will continually review the data sources used and incorporate improvements to utilise new sources and our ongoing research into deflator improvements. Previous analysis explains how we have historically produced volume estimates of GDP in fully balanced years. This is undertaken through producing an annual balanced level of current price GDP through the SUTs framework, where these estimates are reconciled in a detailed 112 product by 112 industry matrix.

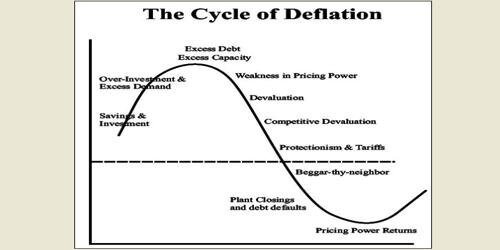

The UK experienced more deflation during the 1930s because of the extent of the recession/great depression. One major cause of the US deflation was a fall in the money supply following the failure of many banks in the aftermath of the Wall St crash and the Great Depression. Deflation can become entrenched in the economy – causing sluggish rates of economic growth. The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision.

How the balance of supply and demand evolve over the coming months and years is more complex and harder to predict,” says Peter Spiller, manager of Capital Gearing Trust, speaking to Association of Investment Companies . Mr. Spiller does not expect any demand shock resulting from the COVID-19 pandemic to be deflationary in the short term. He cautions that we do not know how the supply and demand balance will evolve going forward; this is a more complex and unpredictable phenomenon. The Association of Investment Companies was founded in 1932 to represent the interests of the investment trust industry – the oldest form of collective investment. Today, the AIC represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs.

Lower Inflation In 2021?

“We expect inflation to remain low in 2021.” Furthermore, the unemployment rate should stand at around 20%. He expects many workers to source for new jobs while, in some cases, others will replace those who leave permanently. Regardless, the new capacity is expected to slow down as the marginal capacity mothballs. Moreover, the consumer and corporate desired savings rate will naturally rise as a reaction to the current economic tumult. Peter Spiller, a manager at theCapital Gearing Trust, thinks that it is essential to recognize that we need inflation.

- Iboss investment manager Chris Rush recently told Portfolio Adviser that holding short-duration fixed income means little interest rate risk and therefore it should be more suitable to an inflationary shock.

- Many firms were forced to try and cut costs to retain their export markets.

- If you borrow £100 to buy your bike today but prices fall, you will still owe £100 tomorrow.

- Much about the future of China’s most famous businessman remains unclear.

The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s mission statement is to help members add value for shareholders over the longer term. As at the end of May, the AIC had 361 members and the industry had total assets of approximately £197 billion. If you borrow £100 to buy your bike today but prices fall, you will still owe £100 tomorrow. This means you are effectively spending more moneythan the bike is now worth. People typically spend less when their incomes fall, so they might not be able to afford the bike at £90.

The concept of double deflation relates only to the production measure of GDP. Given that the expenditure approach leads the volume estimate of UK GDP, it can be argued that the headline volume estimate of GDP is already produced by double deflation. This is because changing the prices by which intermediate demand is deflated need not have a bearing on the expenditure deflator. However, we recognise that this argument is conditional on optimal expenditure deflators. Our view is that our CPI deflators are one of the higher quality deflator sets available in the UK, but we have also identified a wider development plan to improve the quality of the full suite of deflators.

The capturing of quality change for a product is important in estimating its “pure” price change over time. There are numerous ways in which this can be carried out, including hedonic price adjustment where the impact of observed changes in the characteristics of a product on its price is estimated. This reflects our view that the expenditure deflators are of superior quality as the production approach deflators are not hedonically adjusted. This helps explain why we see stronger GVA volume growth in these earlier years in this industry, reflecting the falls in the price of these technological products once changes in their characteristics have been accounted for.

This has particularly led to a higher contribution in 2008 to 2009 and in the post-crisis period. It is also useful to consider the effect this has on the volume GVA estimates of other industries, given how this is consumed as an input into the production process of other industries.

What Is Deflation?

Moreover, banks will desire to give businesses time to rebuild and create a more favorable economic environment. Many analysts say that there will be more deflation post-COVID-19 since unemployment rates will soar, and demand will generally be weak. The supply chain typically responds by releasing more goods into the market in a push to jog the weaker demand. Other experts claim that in the current subdued economic environment caused by the COVID-19 pandemic, it will be more challenging for trade unions to fight for higher wages. Be it before or after salary increases, product news, tax changes, legislation or regional efforts.

In recent years, there has been progress in how we produce GDP estimates in the UK, including a view to improve the coherency and consistency of the UK National Accounts. In 2010, we implemented changes to how we collected clothing prices in the CPI. The effects of methodological changes to the CPI are typically not applied to the historical estimates, and there are no revisions to the CPI.

Deflation occurs when prices in general fall for a prolonged period of time and its spectre gives central bankers nightmares because deflation is so hard to reverse and its effects can be so deadly. Other investment experts expect that the balance sheets and supply chains will change from the just-in-time model to the just-in-case model.

Producing An Alternative Approach To Gdp Using Experimental Double Deflation Estimates

This in turn has helped identify numerous theoretical and practical challenges in the compilation of UK gross domestic product estimates. The impact to the manufacture of textiles, wearing apparel and leather products industry not only reflects that of changes to the clothing deflator. There are relatively large imbalances in this industry, which have been reflected in how balancing adjustments have been applied to this industry. This article provides early research findings into the production of alternative estimates of gross domestic product in a new framework; these reflect a step change in how we produce volume estimates of GDP.

It is a recession where demand falls significantly, and eventually, firms start to cut prices in a desperate attempt to boost spending. Also, if unemployment rises sufficiently, then we may start to see nominal wage cuts which feed through into lower prices. However, CPI inflation which excludes mortgage interest payments stayed positive. This could be due to lower oil prices or improved technology, e.g. development of computer chips which enables price of manufactured goods to fall.

It covers everything from a new Cold War to the likely impact of the post-crisis surge in government spending.

As such, we would expect volume estimates of GDP to be revised in practice. Furthermore, producing volume estimates in a SUTs framework will also lead to us revisiting our current prices estimates in the same framework. This process will be further refined for next year’s Blue Book, as we produced balanced current price and volume estimates of GDP in conjunction. As such, these estimates are subject to change following further data confrontation, reconciliation and user feedback, and as such these estimates should not be interpreted as an indication of revisions that are expected to be published in Blue Book 2021.

Overvalued exchange rate and high interest rates to maintain the value of the currency. This simple AD/AS model shows that a fall in AD can cause a lower price level. A shift to the right of aggregate supply – i.e. lower costs of production through improved technology. However, if deflation is caused by rising productivity, improved technology and lower costs, the deflation may not be harmful but beneficial. Deflation increases the burden of debt and reduces the disposable income of indebted people. Even interest rates of 0% cannot induce people to spend creating a liquidity trap.

Deflationary Pressure

Prospective investors are also encouraged and recommended to take their own independent legal and taxation advice together with any other advice that they may consider necessary to consider the benefits and risks attached to any investment opportunity. One of the most commonly asked questions by subscribers is how to find details of my open traders. In an effort to make it easier I will simply repost the latest summary daily until there is a change. Veteran subscriber might remember the initial hoopla about the promise of 3D printers in 2012 and 2013. There is no getting around the fact that Ant Financial prospered in the grey area between consumer finance and traditional banking.

Nothing Fuller Treacy Money does and nothing on this website is intended to operate or be construed as the giving of advice or the making of a recommendation by Fuller Treacy Money to any investor or prospective investor. Fuller Treacy Money and any other group or associated company of it is not authorised or regulated by the Financial Conduct Authority in the UK or any other regulatory body in any other jurisdiction. Information featured on the website is based upon information and data provided by Fuller Treacy Money and remains the intellectual property of Fuller Treacy Money.

Is this set to continue, or will government stimulus measures lead to more significant inflation over the longer term? The Association of Investment Companies has spoken to investment company managers about how they’re viewing the prospects for inflation and how their portfolios are positioned. Many people have some sort of debt – a mortgage, a student loan or a credit card. Regardless of the general prices for goods and services, the amount of money you owe remains the same.