Cardanos Ada Added To Coinbase Pro In Time For Founder Charles Hoskinsons

Content

We’ll also let you know in advance if we decide to stop offering a cryptocurrency. The cryptocurrencies available through our crypto services from time to time are shown in the app.

Is it safe to link bank account to Coinbase?

Is It Safe to Link My Bank Account to It? Yes! Coinbase protects all private information shared by its clients in much the same way as banks do.

In a direct listing, a company’s employees and existing investors will convert their ownership stakes into shares that are then directly listed on a stock exchange to be purchased by institutional and retail investors. This negates the need for an underwriter, which is usually a large bank. Other external factors can have a significant impact on the value of cryptocurrencies. According to BBC News, a price crash in 2018 was attributed to China and South Korea’s crackdown on digital coin exchanges, which led to a sell-off “across the market globally”. A leading cryptocurrency exchange has reported a twelve-fold increase in value as it prepares the ground for a stock market flotation after the rally in digital assets including bitcoin.

You can cancel an “auto exchange” or a “recurring buy”, but only before we accept your instruction. This means you can only cancel an “auto exchange” before your “target rate” is hit, and you can only cancel a “recurring buy” the day before it is due to occur or reoccur. You can set up an “auto exchange”, and buy cryptocurrency in the future, if the exchange rate hits the target rate you set. We’ll let you know if we start offering any other cryptocurrencies.

Twitter Boss Jack Dorsey Sets Up Bitcoin Node For Cryptocurrency

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary. Coinbase’s business model is based on its two core products. The first is an exchange for trading the aforementioned cryptocurrencies – known as a Global Digital Asset Exchange . The second is a user-facing platform for trading bitcoin, bitcoin cash, ether, litecoin and others.

- , a stable digital currency, is built on the Ethereum platform and is Coinbase’s own cryptocurrency.

- In mid-August, an upwards trend, denoted by the green line, emerged.

- In early FebruaryElon Musk’s electric car company announced it had bought $1.5bn worth of Bitcoin, which sent its value rocketing.

- Learn how shares work – and discover the wide range of markets you can spread bet on – with IG Academy’s free ’introducing the financial markets’ course.

Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. If gravity causes the parabolic moves in the crypto asset class to end and prices drop, trading volumes could dry up, impacting Coinbase’s revenues. Moreover, government regulations that run contrary to the overall market’s libertarian philosophy could take some of the wind out of the bullish sails.

Bitcoin

Although a listing date hasn’t yet been disclosed, shares will trade under the ticker COIN. Trading or investing in digital currencies requires participation in a platform and a wallet or custodian to store the tokens. Coinbase is a digital currency exchange with headquarters in San Francisco, California, in the US. As the chart highlights, after trading to a record high of $20,650 in December 2017, Bitcoin retreated and consolidated below the peak over the next three years. Bitcoin made higher lows of $3,120 in December 2018 and $4,210 in March 2020 before surpassing the December 2017 levels in December 2020, exploding to a high of $59,550 in March 2021.

To put that into context, the market cap of gold is $11.006 trillion and silver is $1.425 trillion. Coinbase Global revealed an eye-popping valuation on Wednesday, reflecting the craze over cryptocurrencies. ) debit card and app that facilitates spending cryptocurrencies for goods and services by converting crypto into US dollars. If the price action in the CME and ICE since their IPOs is a guide, the shares will sell like hotcakes.

Coinbase has attracted more than $500M investment from financial institutions such as BBVA and the New York Stock Exchange as well as venture capital companies such as IVP, Tiger Global and Greylock Partners. On Thursday 17 December, the digital currency exchange Coinbase Inc announced on its blog that it had ‘confidentially submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”)’. It is probably no coincidence that the announcement has come as the best known crypto currency, Bitcoin, has posted record prices. Coinbase, among the most well-known cryptocurrency platforms globally, has registered about 114.9 million shares for its listing, according to its filing. The eye-popping valuation underscores how the perceived value of Coinbase has rallied in lock-step with the surge in the price of cryptocurrency bitcoin. Remember, unless you are a Premium or Metal customer, you can make a set amount of free exchanges in crypto, commodities and foreign currencies every month. However, after that, you will start paying a fair usage fee.

Risks Of Cryptocurrencies

That person or organisation would be referred to as a sub-custodian. By entering into the agreement, you are appointing us as your agent to provide our crypto services .

Our cryptocurrency donations are processed via Coinbase, BitPay and HelperBit, and as such our wallet addresses are subject to change. However, once you begin a transaction via these services, you will be given a wallet address to send funds. In accepting donations of cryptocurrency, SEED Madagascar is keeping pace with changing technology. We aim to make donations accessible to a broad range of donors. Supported currencies include Bitcoin, Bitcoin Cash, Litecoin and Ethereum. The Coinbase Card links to a mobile app, developed in partnership withApto Payments Inc, providing users with spending summaries, receipts and notifications, and where users can choose which cryptocurrency they want to spend.

As Of Today, Buying Bitcoin Has Been Profitable For

But March has seen a strong recovery, with Saturday’s record high causing both Bitcoin and online trading platform Coinbase to trend worldwide on Twitter. Bitcoin’s price hit a record-breaking high over the weekend, reaching $61,500 (£44,150) on Saturday evening. Proactive Investors Limited, trading as “Proactiveinvestors United Kingdom”, is Authorised and regulated by the Financial Conduct Authority. We aim to be as flexible as possible in helping those most vulnerable so unless requested otherwise your donation will go into general project funds and will be channelled where the need is greatest. That way you can be sure your donation will have the greatest impact possible. See our project work for more information on how we do this. £25 Can provide a desk and bench for an underequipped public school, improving learning conditions for children who would otherwise study on the floor.

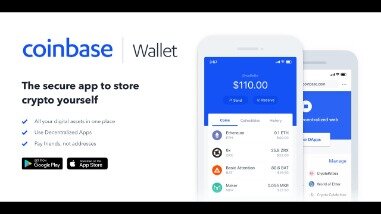

The offering’s structure, requiring no lock-up period, creates the opportunity for current shareholders to extract massive profits. In 2018, a formal valuation put Coinbase’s worth at $8 billion. Meanwhile, the direct IPO allows Coinbase to skip prohibitive investment banking fees by going directly to a market listing. Coinbase is the leading cryptocurrency “bookie.” Right now, Coinbase does not charge customers for storing cryptocurrencies in its popular wallet service. However, the company charges a margin fee of about 0.50% for crypto purchases and sales, with the rate changing depending on market conditions. I favor pick-and-shovel plays in the cryptocurrency sector—that is, a strategy of investing in the underlying technology rather than the final service or product.

It is very important to do your own analysis before making any investment based on your personal circumstances. No news or research item is a personal recommendation to deal or invest in any particular company or product, nor does Valuethemarkets.com or Digitonic Ltd endorse any investment or product. In a regulatory filing, Coinbase said its stock in the private market traded at a weighted average price of $343.58 in the first quarter of 2021 through March 15. In the third quarter ended Sept. 30, Coinbase’s stock traded at an average of $28.83 per share for a valuation of $5.3 billion.

Central banks printing money to offset the financial damage of Covid 19 has led many investors to look for alternatives to fiat currencies. Major global currencies are being devalued by their own governments and crypto currencies have long been espoused as a way of moving value beyond the reach of state policy. At present, Bitcoin’s impressive surge is casting a rosy glow over the entire crypto sector. Brushing aside the 2017/18 boom and crash, the crypto currency is up more than 200% in the last twelve months and currently trading at around $23,000. More traditional investors might want to see more financial information from Coinbase before making any decisions. Business Insider notes that Coinbase ‘has never disclosed any profit or revenue figures’. The same investors may be reassured that the exchange does its banking with JP Morgan and is audited by Deloitte.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Investors can store and manage their bitcoin in a virtual “hot wallet” on Coinbase.

You are also appointing us to provide nominee services, which means that we will act as your ‘nominee’ for the purpose of holding your cryptocurrencies. Just a few days laterNew York based banking firm BNY Mellon announcedplans to hold Bitcoin and other cryptocurrencies for its clients. Bitcoin’s value has been buoyed by a combination of factors, including Wall Street banks announcing plans to hold the cryptocurrency, and big firms like Tesla investing in the coin.

Were Coinbase to launch its IPO in such an encouraging climate, then investors could be looking at spectacular returns. Alternatively, the crypto currency’s volatility could come into play in a rather less profitable way. It might be worth recalling that Bitcoin was trading at around $7000 at the start of the year and fell to below $5000 as the pandemic struck. It is only in the last three months that it has risen from around $10,000 to its current $20,000+ levels. Were Bitcoin’s price to retreat sharply from its current highs then there would be a knock-on effect for any potential public listing by Coinbase. The price or value of cryptocurrencies can rapidly increase or decrease at any time. Unlike normal money, no bank or government can stabilise the value of cryptocurrency if it changes suddenly.

Which crypto to buy now?

Remember that cryptocurrencies are highly volatile that may not suitable for all investors! Bitcoin (BTC) Current market value: 2030 billion US dollars.

Ethereum (ETH) Market value: $23 billion.

Ripple (XRP) Market value: $13 billion.

Bitcoin Cash (BCH) Market value: more than $5 billion.

Litecoin (LTC)

We have seen how the introduction of futures contracts pushed Bitcoin and Ethereum to all-time highs. The next step in the asset class would be a suite of crypto ETF and ETN products that replicate the values of the growing number of digital currencies or crypto baskets. ETF and ETN products tend to increase trading volumes and liquidity in the underlying markets they represent.

However, the rise of the cryptocurrency market has plenty of investors excited about its future. Coinbase is the leading US-based cryptocurrency exchange, with 24-hour trading volume of around $3.2 billion. The Coinbase exchange has a significant market share of global digital currency trading.

For instance, an investor can hold £10 worth of the cryptocurrency, which would equate to roughly 0.00058 of bitcoin. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website.

However, it doesn’t matter which came first; what’s significant is that they both exist. Over the last couple of years, the perception that crypto currencies are of most use to money launderers and dark web users has shifted considerably. There is a growing sentiment that crypto currencies are becoming more respectable in the eyes of previously dismissive financial institutions and suspicious regulators. Other ValueTheMarkets.com contributor, who have not contributed to this piece, do not hold a position or positions in the stock and/or financial instrument mentioned in the piece.

This means that if you ask us to buy cryptocurrency, you may receive a little more or less cryptocurrency than what you had expected and if you ask us to sell cryptocurrency, you may receive more or less e-money than you expected. Our exchange rate for buying or selling cryptocurrency is set by us, based on the rate that the crypto exchanges offer us. It is a variable exchange rate and, which means it is constantly changing. There won’t be any contractual relationship between you and our partnered cryptocurrency exchanges or any sub-custodian we appoint. if you click ‘confirm order’, your instruction will be submitted. We’ll spend the amount of emoney you told us you want to spend . if you click ‘auto-exchange’, your instruction will be submitted.

It could also be seen as a tacit regulatory approval of assets traded on Coinbase’s platform. The company has more than 43 million users in more than 100 countries. The latest filing from Coinbase also signals heightened confidence that the listing will be approved by regulators.

Potentially the first major exchange to list on the US stock market, Coinbase looks set to be a bellwether for the sector. As a result, direct listings don’t have the same ‘safety net’ that IPOs do, because there’s no target price range for the company’s shares –something that’s usually determined by an underwriter. This means that in direct listings, share prices are completely at the mercy of market demand, which can cause increased volatility compared to going public through an IPO.