Canada Blockchain Approved As Bitcoin Price Continues To Tumble

Content

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. 67% of retail investor accounts lose money when trading CFDs with this provider.

Two examples of this are the Bitcoin and Ethereum exchange-traded notes listed on the Nasdaq OMX Stock Exchange. These offer investors exposure to Bitcoin and Ethereum in a familiar, secure, and regulated exchange environment. The value of cryptoassets can go down as well as up and you can lose your entire investment.

Can The Worlds First Bitcoin Etf Maintain Its Success?

To use it, you must accept our Terms of Use, Privacy and Disclaimer policies. Monitor lets you view up to 110 of your favourite stocks at once and is completely free to use. New York’s WisdomTree is seeking approval from the SEC to launch a Bitcoin ETF. Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company’s or index name highlighted in the article. , a member of the index, saw its share price increase by about 50% in 2020.

You should consider whether you can afford to take the high risk of losing your money. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. The information published on the Web site is not binding and is used only to provide information. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information.

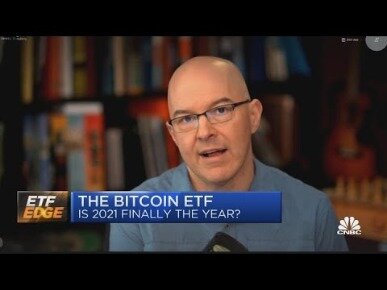

IRS funding cuts are hamstringing the agency, allowing billions of dollars to “slip through its fingers,” warns a news report. Regulators in the U.S. have yet to approve a bitcoin ETF, though investor and Galaxy Digital founder Mike Novogratz told Yahoo Finance that it is likely to happen within the year, given Canada’s approvals and the inefficient premiums observed in bitcoin trusts.

Harvest Portfolio said the fund will invest “in equity securities of issuers exposed, directly or indirectly to the development and implementation of blockchain and distributed ledger technologies”. When you subscribe we will use the information you provide to send you these newsletters. Sometimes they’ll include recommendations for other related newsletters or services we offer. Our Privacy Notice explains more about how we use your data, and your rights. It is important that you understand that with investments, your capital is at risk. It is your responsibility to ensure that you make an informed decision about whether or not to invest with us.

This further underlines the point that while many of the companies in the index are developing blockchain uses, their prices are driven by other factors. So it is clear that the ETF certainly has plenty of bitcoin and cryptocurrency exposure.

World’s First Bitcoin Etf Soars Past $500 Million In Assets Under Management

A number of other companies, including Valkyrie and WisdomTree, have filed for bitcoin ETFs in recent months, after several applications were rejected in late 2019 and early 2020. Grayscale, a subsidiary of CoinDesk’s parent firm Digital Currency Group, recently posted a number of job listings for ETF specialists as well.

New bitcoin units are created by solving cryptographic challenges, known as mining, and require large amounts of energy and computing capacity. The capacity of bitcoins is considered limited by the algorithm used in bitcoin. This measure is designed to motivate companies to invest in new plant and machinery. It will create a significant boost to consumption over the next year by pulling forward any such investment from the future. It’s one of a range of measures in today’s budget aimed at promoting economic growth even as the government look at what will be required to deal with the massive rise in debt resulting from the pandemic.

- Fuller Treacy Money and any other group or associated company of it is not authorised or regulated by the Financial Conduct Authority in the UK or any other regulatory body in any other jurisdiction.

- The Purpose Investments bitcoin ETF now has more than $590 million in assets under management after launching just one week ago.

- “The U.S. is not the only market where demand is high for a bitcoin ETF.

- Recent ETF approvals in Canada may also hint an ETF is on its way in the U.S.

- IRS funding cuts are hamstringing the agency, allowing billions of dollars to “slip through its fingers,” warns a news report.

- Proactive Investors Limited, trading as “Proactiveinvestors United Kingdom”, is Authorised and regulated by the Financial Conduct Authority.

It cut the management fee on its Bitcoin ETF from 1.00% to 0.75%, just one week after the product launched on TSX, in a move designed to drum up investor interest. EBIT has lagged the Purpose Bitcoin ETF (BTCC.U CN) – the first bitcoin ETF to list on TSX – in terms of net inflows, trading activity, and assets under management despite launching just one day later. The disparity in success between the two funds highlights the benefits of being first to market for market-access products and could lead to an intensification of efforts by those seeking to launch the first bitcoin ETF in the US.

Ci Launches Low

No representation or warranty, expressed or implied, is or will be made or given by Fuller Treacy Money in relation to the accuracy or completeness of the contents of the website, save that any such liability is not excluded in respect of fraudulent misrepresentation. Less than a month after the first Bitcoin exchange-traded fund debuted in Canada, a Toronto-based asset manager is looking to convert its cryptocurrency trust to the format. Ninepoint Partners LP plans to ask holders of its $266 million (C$335 million) Bitcoin Trust (BITC.U) to approve its conversion from a closed-end investment fund into an ETF, according to a statement Wednesday. Experts said it followed a surge in businesses looking to expand into blockchain funds over concerns bitcoin does not “have as many legs in viability”. Cryptocurrency markets can be extremely volatile with cryptos vulnerable to speculation, regulatory shifts, and dramatic events pertaining to the major cryptocurrency exchanges, up to and including closure. Saxo’s Bitcoin and Ethereum ETN offerings allow traders indirect exposure to the two largest cryptocurrencies by market capitalisation while retaining the security of a conventional exchange-listed product.

“The U.S. is not the only market where demand is high for a bitcoin ETF. At Global Advisors, we see this and are aggressively pursuing the listing of other professional-caliber, bitcoin investment products. Needless to say, having an experienced ETF industry veteran on our team will accelerate success and ensure we bring the most professional products to market,” says Daniel Masters, Co-Founder and Chief Investment Officer of Global Advisors. Kssis joins XBT Provider as demand for bitcoin-based financial products, especially ETFs, is at all-time highs. Global Advisors sees underserved demand in key markets globally and intends to capture it with a series of products slated for 2017 and 2018.

All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Investors should consider whether to make alternative investments in luxury items or equity investments in the companies that make them. Although the US Federal Reserve’s recent announcement indicates it’s more focused on unemployment and economic recovery, investors shouldn’t ignore inflation.

Year Bitcoin Chart

Morningstar.co.uk contains data, news and research on shares and funds, unique commentary and independent Morningstar research on a broad range of investment products, and portfolio and asset allocation tools to help make better investing decisions. It is sub-advised by Galaxy Digital Capital Management, the asset management arm of Galaxy Digital, a financial services firm dedicated to the digital asset and blockchain technology sector. The fund will leverage Galaxy Digital’s cryptocurrency trading capabilities to execute the purchase and sale of bitcoin. Its competitor and second ETF to gain approval, the Evolve bitcoin ETF cut its management fee to 0.75% on Wednesday. Both differ from closed-end trusts in that they directly purchase bitcoin and hold it in cold storage without the risk of trading at large premiums to the value of the ETF’s underlying bitcoin holdings. From an ease-of-use perspective, that allows investors to gain more direct exposure without worrying about buying and selling crypto directly through a wallet on an exchange like Coinbase. That’s particularly important for institutional funds that might not be able to go that route.

Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The value of your investments, and the income derived from them, may go down as well as up. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

One of the most well-known cryptocurrencies is Bitcoin, while other prominent cryptos include Ethereum, Ripple, Litecoin, and Monero. Cryptocurrencies were traditionally using specialised exchanges, but as the crypto market grows, financial insitutions have taken steps to permit the exchange of securities that track cryptocurrency movements.

Zack Guzman is an anchor for Yahoo Finance Live as well as a senior writer covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Coinbase’s initial filing revealed institutional trading volume totaled just $28 billion in 2018.

Plant Health Care Raises $10m For Regulatory Approval For Products In Europe ..

Historically, the SEC has rejected every bitcoin ETF application, including VanEck’s past efforts, citing the potential for market manipulation and a host of other concerns. “A lot of people have wanted to get exposure to bitcoin but they haven’t really wanted to go through the hoops of opening up their own accounts or their own wallet to do so or trading some of the other closed-end funds,” he said. “Having the ETF option I think has always been the holy grail out there and we’re happy to have it trading and we’re seeing some of the results of that pent-up demand.” “The concept of blockchain is very attractive to investors right now, and while the idea is still very novel, the research shows that this is a technology that could potentially save billions of dollars in cost, and that is very attractive.” Cryptocurrencies are digital currencies based on blockchain technology. A blockchain is a digital ledger whose entries are secured using cryptography. These ledgers, or lists of records, are used to determine the creation of cryptocurrency units as well as to store data regarding transfers and purchases.

The diversification principles of the regulatory investment fund framework do not allow to launch a UCITS fund with only one constituent. Due to this fact, bitcoin is mainly available as an exchange-traded note in European countries.

Data shows that the last 200 days of XVG transaction history “just vanished” over the block reorganization. Financial and investing advice firm “The Motley Fool” has also revealed it decided to invest $5 million in Bitcoin and explained the move was made as it believes the cryptocurrency “will store value more effectively than gold over the long term”. Prospective issuers of bitcoin ETFs will be watching with interest.

“I am excited to join the team at XBT Provider and Global Advisors at this critical maturity moment in professional bitcoin. We are witnessing peak demand for exchange traded bitcoin products like those XBT Provider issues and I am invigorated by the opportunity to help shape the future of the industry,” says Kssis. Purpose Bitcoin ETF is the first direct custody bitcoin ETF in the world. It’s designed to provide investors with exposure to the leading cryptocurrency by investing directly in physically settled bitcoin. This week was marked by the launch of North America’s first-ever Bitcoin exchange-traded fund on the Toronto Stock Exchange. The low price tag demonstrates how issuers are willing to slash fees in a bid to capture market share in the nascent digital-asset space. According to prospectus documents, BTCX had originally been slated to launch with a management fee of 1.00%.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. In the interview for ETF TV, Seif breaks down the types of clients who contributed to the impressive $421m AUM in the first two days of trading, as well as discussing where he thinks the fund could go next. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Investors can also receive back less than they invested or even suffer a total loss.

What are the disadvantages of Bitcoin?

Disadvantages of Bitcoin InvestmentsVolatility. The price of bitcoin is always rippling back and forth.

Threat of online hacking. Hacking is a big threat facing a bitcoin investor.

Little or no regulation. The bitcoin market currently operates with no major regulations.

Limited use.

Wallets can be lost.

In February this year, the ETF surpassed $1billion in assets under management thanks to strong performance and inflows throughout 2020 and into 2021. As the ETF has grown into a leading global investment vehicle, the Canadian ETF market has remained at the forefront of the industry. At year-end 2020, there were 794 ETFs listed that held almost $250 billion in AUM. Verge, it’s worth noting, suffered multiple exploits over the years, so much so the price of XVG was mostly unaffected by the news. While the decentralized finance space has been gaining popularity at an astounding pace, it’s still risky to lock funds in protocols associated with it. Alpha Homora was exploited for $37.5 million last weekend, as hackers managed to code a contract that tricked it into believing it was one of their own. Counterpoint Global, a $150 billion unit of Morgan Stanley Investment Management that has racked up wins in mutual-fund rankings, is exploring whether Bitcoin would be a suitable option for its investors.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. The material is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. It is against this backdrop of huge highs and sudden lows that Som Seif, founder and CEO of Purpose Financial, has launched the world’s first pure-play Bitcoin-focused exchange-traded fund .