Can Ecuadors Digital Currency Save Its Economy?

Content

Libra, aim to use sovereign digital currencies to promote commercial digital currencies in order to reap the benefits of “coinage rights”. If this commercial cryptocurrency enters the circulation along with China’s digital currency, it will bring chaos to the current monetary system, just like the digital counterfeit currency. Therefore, the clean-up of various commercial “cryptocurrencies” is the premise for the further promotion of digital currency. The idea of a state-administered, cryptographically secured digital currency has been around almost as long as Bitcoin itself (see, for instance, the Royal Canadian Mint’s MintChip project), and recently, the idea has become somewhat more credible.

It is likely that UK laws will need to be updated to reflect the use of cryptocurrencies in the UK as they grow and become increasingly popular. Yes – The Financial Conduct Authority has a pro-cryptocurrency stance and wants the regulatory framework to be supportive of the cryptocurrency. Bolivia, Kyrgyzstan and Ecuador have banned the use of cryptocurrencies totally. If you’re abroad and you need emergency help from the UK government, contact the nearest British embassy, consulate or high commission. In light of extensive restrictions on mobility announced on 16 March 2020, British Embassy personnel are mainly working remotely, and are in contact with the Ecuadorean authorities to support British nationals in these exceptional circumstances. From 4am on 15 January, visitors who have been in or transited through Ecuador in the previous 10 days cannot enter England. British and Irish nationals, and third country nationals with residence rights in the UK arriving in England from Ecuador will be required to quarantine in a hotel.

Move Over Bitcoin, These Countries Are Creating Their Own Digital Currencies

Individual accounts are held with the BCE directly, and the BCE purchases airtime from the country’s mobile network providers and guarantees the low costs of using the system, ensuring its accessibility. The BCE also deals directly with a variety of retailers and financial institutions, including dozens of local cooperatives, to credit and debit accounts; these institutions thus serve as ‘macro-agents’ and cash-in/cash-out points. The project is, in short, the world’s first publically mandated and operated mobile money system. Large amounts of physical cash leave the country illegally, and according to a Global Financial Integrity report, Ecuador registered $1.9 billion in illicit financial outflows in 2012. The Economist Intelligence Unit showed Venezuelan groups create fake companies in Ecuador, declare non-existent exports, and then bring US dollars into the dollar starved Venezuelan market — where they are worth far more on the black market. While Ecuador’s new system has no clear ban on international transactions, the fact that users have to be citizens, and sending and receiving money requires Ecuadoran cell service, effectively eliminates the possibility of international illegal digital cash flows.

The report focused on principles for how digital currencies would coexist with cash and other types of payments, what would be required so adoption would do no harm to financial stability, and which features would increase financial innovation and efficiency. Some smaller nations, such as Sweden and Thailand, are staging their own digital currency trials, and the Bahamas recently launched the first national CBDC. There is no common definition of a CBDC as the term refers to a range of possible designs and policy choices and combines several areas including computer science, cryptography, payments systems, banking, monetary policy and financial stability. What they generally have in common is they are digital currencies issued by central banks that function as national currencies . They are a direct replacement for paper money, with the exact same value and issuance policies. CBDCs are state-sanctioned and governed by the monetary authority and regulatory law.

Some company treasurers are already making early moves in response to changing dynamics. Firms ranging from tech players like MicroStrategy to insurer MassMutual are increasing their holdings of crypto currencies—seeing the potential for rising portfolio value, for a hedge against inflation or for cryptocurrency options to support consumer purchases. The trading infrastructure is maturing quickly, prompted by regulatory actions.

Bitcoin Banned In Ecuador Until New State

DCEP could further lubricate domestic and, over time, global commerce for Chinese companies. Broad uptake could raise the RMB’s profile in world money markets against the dollar and the euro. There are a number of other potent, parallel trends that will continue driving the demand for digital payments and, by extension, digital currencies.

Thus, businesses could keep accounts in hard ECUs and trade them cross-border with minimal transaction costs and no foreign exchange risk and tourists could have hard ECU payment cards that they could use across the continent. But each state would continue with its own national currency — you would still be able to use Sterling notes and coins and Sterling-denominated cards — and the cost of replacing them would have been saved. The electronic money system can’t resolve these problems — it is not a tool to prevent other forms of money laundering — but its design may reduce illegal use. Since signup began in December, the BCE has registered over 11,000 accounts, which are limited to Ecuadoran citizens and tied to their national ID numbers. Although adoption remains low , new services are coming online, and by mid-2015 the Central Bank says users will be able to pay utility bills, taxes, and credit card bills from their mobile phones. And … don’t try to back your system with a bank that your users don’t trust with their money. The BCE was the only legal issuer of e-money — cryptocurrency was also disallowed — and the phone company, CNT, was the only legal distribution channel.

backing Money

Similarly, the powers that be must also arrest privacy concerns and security lapses by issuing an updated regulatory framework and ensuring an adequate security infrastructure is in place to protect consumers against any damages – personal or financial. “The most important thing is to bring some financial services to people who would not otherwise have them, because they do not have access to a bank account or credit cards,” says Weisbrot. Although often-volatile crypto currencies such as bitcoin look an appropriate means for comparison when taken at face value, Ecuador’s new currency actually bears little resemblance to its existing digital counterparts.

The suggestion that Ecuador was to become the first country to issue its own cryptocurrency, however, was more than a little misleading. The BCE’s proposal for a centrally integrated mobile payments system had nothing to do with Bitcoin per se. That system looked, instead, more like Kenya’s M-Pesa, to which Ecuadorian officials explicitly compared and contrasted their plan. In the wake of M-Pesa’s dramatic success as a system for providing basic financial services to tens of thousands of Kenyans, its cell phone-based ‘branchless banking’ model has gained traction among development professionals and industry actors around the world. The design of the Ecuadorian mobile payments project drew heavily on this ‘e-money’ paradigm. Ecuadorian officials insist that the primary mission of the project is to expand the reach of formal financial services to un- and under-banked populations and reduce the costs of cash, especially to the poor. In terms of retail digital currency, the popularity of digital currency has more uncertainties.

Apple Pay To Propel Mobile Money Into The Mainstream

Would Bitcoin fulfill its promise to be a digital version of cash—a relatively open, accessible, and, yes, public payment system—or would it end up consolidated and partitioned into closed loops, fenced off from one another, their points of access gated and tolled? From this perspective, the Ecuadorian mobile payments project looks downright progressive. The idea of the hard ECU was to have a pan-European digital currency but still be accepted in all member states. Keith Hart, author of the brilliant “The Memory Bank“, a book about money from an anthropological perspective, wrote that it was a big mistake to replace national currencies with the euro.

- Many citizens remain skeptical of the project, although far more are unaware of it, the Guardian reported.

- For after all, the dollar is itself the result of state fiat—just not Ecuador’s—and there are many who regularly worry about expanding its supply.

- One observer thus proposed that Bitcoin was going through a ‘constitutional crisis’.

Leveraging LMAX Group proven, robust technology and liquidity relationships, LMAX Digital delivers a market-leading solution for physical trading and custodial services for the most liquid crypto currencies – such as BTC , ETH , LTC , BCH and XRP . LMAX Digital is the institutional crypto currency exchange from the LMAX Group, which operates a leading FCA regulated trading venue. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. It is likely that far wider and complexed legislative updates will be required in order to keep up with the ever-expanding and developing world of cryptocurrencies. The anonymity of cryptocurrency trading means that is very difficult for people using the commodity for criminal activity to be traced by anyone if suspicious activity is detected. The benefit of anonymity was made abundantly clear in May 2017 when a third of NHS Trusts were hit with ransomware with the offenders demanding payment in Bitcoin.

The new currency will be convertible into yen on a one-to-one basis in the app and using QR codes to be scanned in stores. Banks will offer the service for free, and be paid in the data they will collect on consumer spending patterns. The People’s Bank of China has been doing trial runs of its own cryptocurrency, says Bloomberg.

The Peoples Bank of China has been testing a cryptocurrency based on blockchain technology, since early 2017. Now is the time to start laying the groundwork for how companies move into the digital currency era.

And in Ecuador, where the government has been trying to launch a Central Bank digital currency. Any Ecuadorian over the age of 18 can open an account for free and transfer money to other people for free. Bitcoin, which is often compared to Ecuador’s electronic money system, is widely used to buy drugs from online internet marketplaces. Silk Road, the first and biggest such marketplace, was taken down in 2013 and the FBI seized a bitcoin haul to the tune of $33.6 million. The currency has also come under fire for money laundering concerns — in April 2014 one Bitcoin entrepreneur was convicted for facilitating $1 million in illegal payments.

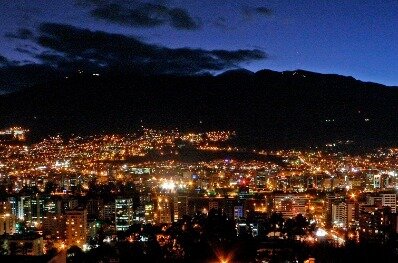

Much of Ecuador’s dollars are tied up in either debt or its dwindling oil and gold reserves, fuelled primarily by state spending, which has increased more than threefold since Correa came to office in 2007. Measures taken so far by the government to reduce the deficit include taking out a $2bn loan and selling the same amount again in debt, using the country’s oil and gold reserves as collateral. The proposed digital currency, however, could reduce the funding gap, provided the country finds an efficient and responsible way of utilising the currency in selected payments.

Remembering their experience with crisis and dollarization, Ecuadorians feared the reintroduction of fiat currency. For fiat, of course, refers to creation by decree—the sovereign power to create value ex nihilo, as if out of nothing. But there is also something odd about worries that, with the mobile payments system in place, the Ecuadorian government will over-issue electronic money, effectively ‘printing’ currency through state fiat.

Which crypto to buy now?

Remember that cryptocurrencies are highly volatile that may not suitable for all investors! Bitcoin (BTC) Current market value: 2030 billion US dollars.

Ethereum (ETH) Market value: $23 billion.

Ripple (XRP) Market value: $13 billion.

Bitcoin Cash (BCH) Market value: more than $5 billion.

Litecoin (LTC)

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. Want more insights on the big issues facing business and society in the year ahead?

That leads to a third contention, that banks’ complex and layered ‘plumbing’ is inflexible, highly complicated and not suited to agility, as well as the completely different technology concept of cryptocurrencies. Ignoring the technology behind cryptocurrencies, as well as the use of them, is not really an option. The banks currently have a complex range of systems to support their traditional businesses as well as the myriad of regulatory and compliance requirements. Cryptocurrency is actually designed to remove intermediaries, which is where banks operate. Cryptocurrencies also introduce a new technology paradigm for storing and exchanging value. This does not lend itself to minor changes or tweaks, or adding another layer on to already complex systems.

This is a good summary of the general response to cryptocurrencies from politicians and regulators. There are however exceptions, and notably some jurisdictions are looking to embrace cryptocurrencies. A very recent example is from Turkey where a former industry minister and the current Deputy Prime Minister are talking about a national ‘digital’ cryptocurrency. Whatever people’s views on cryptocurrencies, I believe that they will not go away so therefore cannot be ignored.

You’ll also receive complimentary access to the March 2021 digital edition of PwC’s strategy+business magazine, featuring the Take on Tomorrowseries, a Q&A with Pfizer’s CEO, and more. In recent months, we have seen the first steps of concerted moves towards CBDCs. This change of attitude is welcome as it complements other private and public initiatives in the world of payments which is innovating at a greater pace than ever. With the current European Parliament’s term running from 2019 to 2024, now is a good time to cast an eye over what is and what will be in terms of financial market regulations. Determined to bring order to its payments infrastructure, SITA called upon Unifiedpost, and its cloud-based PowertoPay corporate payments hub, for help. enabling more efficient cross border payments if the different CBDCs were to be linked together to enable immediate and transparent settlement. The unfolding conflict over Bitcoin’s block size exposes a worry that changing the code will damage Bitcoin’s credibility and undermine trust.