Bitcoin Price Target Set At Five Times Prior High

Content

What cryptocurrency investors will be looking at instead is the long-term impact of the halving. The last time that BTCUSD tested the 10,500 level and failed to break it to the upside, we witnessed a calamitous drop that took the pair to 6,500. If we base our Bitcoin price predictions for the rest of the first quarter of 2020, it may be safe to say that history may repeat itself. It is hard to see Bitcoin trading above 9,500, but again, it is hard to see BTCUSD fall all the way to 6500.

- However, the good news is there are many crypto experts who are well-placed to make informed predictions about its price in the years to come.

- Owners lament it, but enjoy the ride which has trended upwards to the tune of 320pc in the past 12 months.

- Bitcoin price prediction for the post-halving period remains the same, with experts around the world expecting a major surge.

- On 3 January 2020, Antoni Trenchev, who cofounded crypto lending startup Nexo, said that Bitcoin’s price could rise to US$50,000 later in the year.

If this turns out to be true, this will mean that the crypto has become the world’s first to achieve gold equivalence. This means the market cap of Bitcoin will be equal to the market capitalization of gold. Prime XBT’s technical analysis places the price of Bitcoin at over $400,000 by the end of 2025. According to Prime XBT, Previsioni Bitcoin’s expectations seem to be on track.

Its bullish run began in early November, rising from $13,824 to $15,463 in the space of just one week. In fact, it was averaging a daily growth rate of almost $1,000 a day before the end of 2020. “While many expect the bitcoin rally to continue in 2021, I’m more concerned with what the Biden administration could mean for cryptos,” said Jesse Cohen, a senior analyst at Investing.com. The combined market capitalisation of all cryptocurrencies is now more than $850 billion, according to CoinMarketCap, making it more valuable than Facebook. It is also not the only major cryptocurrency to experience massive gains in recent months.

3bitcoin Halving ‘event’ Inspires Record Price Predictions

Another factor that can potentially affect the price of Bitcoin is market competition. When new altcoins enter the market, or other high-ranking cryptocurrencies start to attract high levels of investor interest, it can cause traders to start focusing on alternative forms of crypto. The Bitcoin hard-fork is a third generation cryptocurrency that many people believe is superior to BTC, as it was designed to solve some of the problems that plague the king of cryptocurrency. Media coverage is hugely important when it comes to drumming up investor interest in cryptocurrency. The more coverage the skyrocketing prices received, the more people began to invest. This created an imbalance between supply and demand that caused the price of Bitcoin to soar.

The coin is expected to hit a new ATH, likely in the range of $100,000, according to experts. Take Profit 1 is situated at Bitcoin’s first major resistance Take Profit 2 is situated at Bitcoin’s most resilient area before it hits 5 figures. The Stop Loss is situated at Bitcoin’s major support during the month of April. Bitcoin is setting the very early stages to become not only an alternative asset for investors’ portfolios but a reserve currency that rivals the U.S. dollar or the euro.

How Much Will Be The Price Of Bitcoin In 2021?

He mentioned that while many analysts are citing the upcoming halving when making price predictions, Sing believes that “unforeseen” circumstances will help drive the cryptocurrency above US$20,000 in 2020. He pointed to Facebook’s Libra and how the announcement of the proposed payment system affected the markets, which included a rise in Bitcoin’s price. The price of Bitcoin BTC can change according to a variety of different factors. In order to make the most accurate Bitcoin price predictions and to answer the question ‘is Bitcoin a good investment?

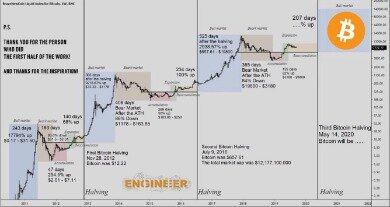

Former Adaptive Capital partner Willy Woo expected the price of Bitcoin to hit $200,000 for year-end 2021. JPMorgan, the bank that once called Bitcoin a scam, now expects the price of Bitcoin to reach $146,000 in 2021. In any other year, a crash of more than $30,000 would probably be an investor’s worst nightmare. Even DigitalCoinPrice’s lowest predictions are staggeringly high when compared to the current price of Bitcoin, so as long as you don’t buy the asset when its price is at the top of its arc, its short-term prospects are good. we’re taking a look at Bitcoin BTC to find out what the experts have to say about its future performance and how much will Bitcoin be worth in 2021 and beyond. “We’re seeing it emerge as a part of the recommended allocation strategy for institutional investors and investment banks,” Eric Demuth, co-founder and CEO of bitcoin broker Bitpanda, told The Independent. “After the two previous halvings, we’ve seen the price reach an all-time high within three to nine months,” CoinCorner’s Danny Scott correctly predicted.

What is less certain is whether this latest all-time high of $34,481, which it hit on Sunday, is the end of bitcoin’s latest run of good fortune. Mr Pal, who predicted the 2007/8 Financial Crisis, wrote in the April report for his research service Global Macro Investor that in the midst of stock markets crashing, bitcoin could become a safe haven asset similar to gold. The immediate knock-on effect will be that vast numbers of miners will turn off their machines and close down their operations, as it will no longer be profitable for them to mine the cryptocurrency. Price predictions for the coming months are complicated by the ongoing coronavirus pandemic, which has wreaked havoc on the global economy. Bitcoin is now less than two weeks away from its next halving, and analysts are once again saying that another rally is about to happen.

Jan 2020: Bitcoin Will Approach 2019 High Of Us$14,000, Says Bloomberg Report

At the beginning of January, the trading volume was 3.5 times higher than the average! The most likely explanation is that the coins are flowing on a large scale from professionals to the mass of newcomers who rushed to buy cryptocurrencies under the influence of emotions. According to the Stock-to-Flow , a Bitcoin price prediction system, BTC/USD will reach $100,000 by December 2021. The last halving event took place in May 2020 and has been touted by some as a reason for its dramatic price rise last year as future supply immediately became limited. A lack of liquidity fuels big price moves, particularly over weekend trading, as seen last week, when professional investors are not at their desk and retail investors dealing in smaller sums are the most active. However, detractors warn the volatility witnessed since Friday simply highlights the investment’s unsuitability for DIY investors. The City watchdog estimated last year that 5pc of the adult population owned Bitcoin and the average holding was 0.3 coins, worth £7,400 today according to trading site Coinbase.

When arriving at this figure, the two authors of the report, an analyst and a head of research for Satis Group, made use of fundamental analysis. They claimed that “currently, the vast majority of the total cryptoasset market capitalization is held in traditional store of value markets, with offshore deposits accounting for nearly 40% of the total.” Bitcoin prices could reach US$96,000 by 2023, according to a report released by ICO advisory firm Satis Group. Arthur Hayes, co-founder and CEO of digital currency exchange BitMEX, predicted on CNBC in May 2018 that Bitcoin prices would climb to US$50,000 by the end of the year. He reiterated this forecast in July 2018, appearing once again on CNBC’s “Fast Money” and offering further detail. In November 2017, John McAfee, a technologist and entrepreneur who is associated with McAfee Antivirus, predicted on Twitter that Bitcoin would reach US$1 million by the end of 2022. He confirmed that he was sticking by this bet multiple times, reiterating his wager on Twitter in February 2018 and then informing Newsweek in August 2018 that he had not changed his mind.

The platform expects the Bitcoin asset price to hit $100,000 in January 2022 before skyrocketing to $200,583.77 by April 2022 — an incredible growth rate of more than 100% in less than four months! According to this forecast, November 2022 will see the price fall back down to $146,077, though it will reclimb to $182,414 before the end of 2022.

What will bitcoin be worth in 2020?

Bloomberg Research 2020 Bitcoin Report

Bloomberg Research recently released a new report on the future of Bitcoin as an investment. The major media hub and finance terminal says that Bitcoin should reach $12,000 and $20,000 by the end of 2020.

The price of Bitcoin could rise to as much as US$600,000, Guggenheim global chief investment officer Scott Minerd stated during a CNN Interview. He noted that previously, the digital currency didn’t have a large enough total market value to draw the interest of institutions. However, Bitcoin started to “look interesting” as its price rose, he added. According to the chart provided by PlanB, BTC started moving toward a major price increase following the 2020 halving. PlanB published a Medium post on the S2FX model in April 2020, in which he estimated that the digital currency will reach US$288,000. On 3 January 2020, Antoni Trenchev, who cofounded crypto lending startup Nexo, said that Bitcoin’s price could rise to US$50,000 later in the year. Focusing on the upcoming halving, he noted that the last time one of these events materialised, Bitcoin prices rallied 4,000%.

Nov 2017: Bitcoin To Reach Us$1 Million By End Of 2022, Says John Mcafee

Bitcoin has entered a new bull market, which can be observed through on-chain metrics, institutional investment inflows, and a booming retail adoption. That said, making a precise Bitcoin price prediction for 2021 is not an easy task. The primary cryptocurrency will likely follow its historical price dynamics, but in a more subdued manner because of its maturity. Regardless of the inherent risk incryptocurrency trading, one thing for sure is that Bitcoin will rally in 2021.

The historic Bitcoin halving event next month will boost its price – but other key drivers will have a more significant, longer-term impact. One second-round game in the Midwest Region will be a battle for bragging rights in the state of Illinois. The top-seeded Fighting Illini, in the tournament for the first time since 2013, will face eighth-seeded Loyola Chicago, which busted countless brackets by reaching the Final Four in 2018. Big men figure to be the stars with Illinois featuring 7-foot, 285-pound second-team All-American Kofi Cockburn among a star-studded roster and the Ramblers led by 6-9, 255-pound Cameron Krutwig. What this means is that no one actually knows how much Bitcoin is freely circulating. Now we may be wrong, but we do not really believe that the Bitcoin halving event will have long-term price effects on the BTCUSD. Short term, it may lead to a lot of demand buying just before the event, but we think this will be replaced by coin offloads once people realize that this is not going to be apocalyptic event.

“The hash rate measures how much computer processing power is being put to work at any one time by the whole of the Bitcoin network, and it always rises and falls in reaction to miners’ contributions to the network. The digital currency that most will be familiar with is free from government interference and can be shared instantly online.

The number of Bitcoin tokens that have already been mined is over 18.5 million . As the total supply is 21 million, this means there are fewer than 3 million tokens left to be mined. Predictions vary when it comes to the question ‘what will Bitcoin be worth in 2030? However, according to the upwards trends, many experts believe that Bitcoin could see a return to its ATH of $20,000 from 2017. Some even believe it will hit this value nearer 2025, soaring to near gold equivalence by 2030.

It comes as the Bitcoin price has surged around 12 per cent over the last week and 6 per cent Monday – outperforming almost all the major indices. This is the prediction from Nigel Green, the CEO and founder of deVere Group, one of the world’s largest independent financial advisory and services organizations. Mark Giordano broke a tie midway through the second period, Jacob Markstrom made 24 saves and the Calgary Flames beat the slumping Toronto Maple Leafs 4-3 on Friday night. Matthew Tkachuk, Derek Ryan and Christopher Tanev also scored, and Rasmus Andersson had two assists. The Flames improved to , winning for the fourth time in five games since Darryl Sutter returned as coach after Geoff Ward was fired.

Can ripple reach $10000?

Under the current circumstances, it looks difficult for Ripple to reach $10,000 in price by 2027. Because, unlike Bitcoin, Ripple is not a store of value asset and has different economics. However, it offers good return opportunities in the long run.

If it is so , then the market is experiencing a culmination, and in the future a large-scale correction is possible to one of the lines of the ascending channel, followed by a rebound . Since the start of the pandemic panic of March 2020, the TOTAL index, which takes into account all cryptocurrencies, has grown by almost 1000%.

Of course, the model cannot determine when this mark might be hit with precision, and any moment between the halving in May 2020 and the one in 2024 could see the price surge to this height. Bitcoin halving is likely one of the most significant events that the crypto market will experience this year. It is significant since, historically, every halving led to the major surge of BTC price. And, as Bitcoin price grows, the rest of the market usually tends to follow to entirely new all-time highs. The crypto market is once again seeing a major surge after a recent pullback that came as a result of a price rejection after Bitcoin approached $10,300 several days ago.