Bitcoin Mining Difficulty Drops 9% To January Levels

Content

Nikolas Papas has been in the finance industry for over fifteen years in roles spanning across Europe and USA and has acquired in-depth knowledge and experience within many aspects of the financial markets. Nikolas has worked for some of Europe’s leading brokers, as an equity analyst, and a trader managing accounts for both private and corporate investors. The amount of tax we claim will be 25% of the total value of your donations in that tax year. Furthermore, if you are a higher taxpayer, you are also entitled to claim the difference between the basic rate which we will claim and the amount of tax you have actually paid. For further details on how you can do this, please contact your tax office.

Because of this the pool has been highly trusted since its earliest days. Beyond that is a short discussion regarding the recent addition of ASIC Litecoin mining hardware, and what that can mean for Litecoin miners. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. The malicious scripts are installed on computers — spanning the personal to the enterprise levels — that run bitcoin mining software disguised as legitimate programmes. In 2017, the Pirate Bay was caught generating revenue by secretly using the central processing unit power of millions of visitors to mine cryptocurrency Monero. It was their alternative to the ad overlays that reduced the user experience of accessing pirated content.

Who created Bitcoin?

Bitcoin / Founders

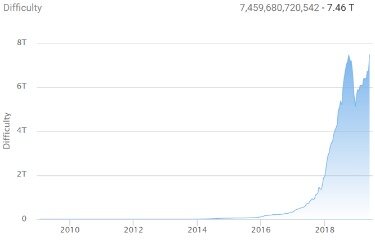

If the price of bitcoin decreases, some hashpower will be removed from the network. This lowers the difficulty until the cost of mining again approaches the price. As a result of Bitcoin reward halving, there is a significant impact on the mining industry. Following the first and second halving, the hash rate decreased, but recovered quickly. Throughout 2018, when the price of Bitcoin was falling, a number of miners decided to leave the practice as well as a few mining pools closing down. This highlights the effect the changing price of Bitcoin has on the industry. However, with this being said, there seems to be a wider acceptance of Bitcoin today.

Frontiers In Blockchain

Alternatively, however, if you buy $1000 in ETH today you end up with 0.55 ETH. At current rates, it will only take ~6 months to mine that much ETH with a 3080. If instead of buying a RTX graphic card to mine Ethenum, someone had simply spent the money on Ethenum coins, the return could actually be higher. Given the above pricing and profitability, there’s a balance between time to break even and daily potential profits. We’ve considered the options and come up with this list of the best mining GPUs for Ethereum (right now — things could change rapidly based on pricing and availability). If you’ve looked for a new graphics card lately, the current going prices probably caused at least a raised eyebrow, maybe even two or three!

Leveraging results about congestion games, we establish conditions for the existence of pure Nash equilibria and provide efficient algorithms for finding such equilibria. We account for multiple system models, varying according to the way that mining resources are allocated and shared and according to the granularity at which mining puzzle complexity is adjusted. When constraints on resources are included, the resulting game is a constrained resource allocation game for which we characterize a normalized Nash equilibrium. Ultimately, we know many gamers and PC enthusiasts are upset at the lack of availability for graphics cards , but we cover all aspects of PC hardware — not just gaming. We’ve looked at GPU mining many times over the years, including back in 2011, 2014, and 2017. Those are all times when the price of Bitcoin shot up, driving interest and demand.

Pi To Btc

The change occurs every four years, reducing the rate at which new Bitcoin is released into circulation and steadily reduces the total supply of new Bitcoin until all 21 million are released. said it was “well prepared” for a Bitcoin halving which took place last month after the group was left with a “healthy mining margin” post-halving. The value of cryptoassets can go down as well as up and you can lose your entire investment.

We’ve filtered out the ‘fake’ postings as much as possible, but really we’re mostly interested in the overall pricing trends. As you can see, the trend is up on every single GPU (out of the 30 we’ve looked at) during the past 90 days, with some models roughly doubling in price.

Bitcoin: Experts Discuss Changes In volatile Cryptocurrency

Even budget GPUs are impacted, as they’re still profitable. Note that the power figures for all GPUs are before taking PSU efficiency into account. For pure graphics card power, you should divide the numbers in the table by your PSU’s efficiency rating (e.g., RTX 3080 measured 234W, and with a 90% efficient PSU it would actually use 260W).

If we limit our analysis to the last period after the end of 2017, we obtain a mean ratio of 0.3% and D1, D10 deciles with values equal to 0.1 and 0.4%. Regional share of hash rate and electricity prices were not available for USA or Russia so similar adjustments weren’t possible. Due to these other factors and the lack of historic data on electricity prices in several other countries around the world, the majority of this paper will focus on energy pricing using the Brent Crude oil index. A comparison of ratio between the cost of mining and Bitcoin transaction volume is presented in Figure 6 to show the standardized oil prices as a measure of energy cost yield similar results to using regional electricity prices. In this paper, we test if this is indeed the case for the Bitcoin proof of work. For this purpose we are looking across the entire period of existence of Bitcoin, estimating the mining costs and comparing them with the value transferred through the network.

The hash rate began to stabilise at the beginning of 2019, suggesting an optimistic market. BTC’s key features is its hard-capped finite supply at 21 million bitcoin. This distinguishes the flagship cryptocurrency from traditional fiat currency, making it by nature a deflationary currency. Instead bitcoin is sustained by a network of miners who are compensated in block rewards, making crypto calculators a crucial tool. It uses the PPS payment model and was founded back in by three engineers. So, unlike Slush or Antpool, Bitfury cannot be joined if you run mining hardware at home. As Bitcoin mining is somewhat centralized, mining companies have claimed the vast majority of network hash power.

We estimate in this paper that this hashing activity currently corresponds to an energy cost of around 1 million USD per day and around a billion USD over the past year. In turn, this corresponds a per transaction costs as high as 13 USD in January 2020. This cost is not borne by either the sender nor the receiver in a transaction but rather by the miners. While a billion a year burned in hashing is definitely a large amount of money that could be seen as a waste of resources, the Bitcoin proof of work is a necessary process for such an anonymous permission-less network to function. It is indeed required to validate transactions and obtain community consensus to secure the system from attacks.

Media devices such as smart TVs, cable boxes, and DVRs are an increasing target of illicit mining power. Cybercriminals exploit known vulnerabilities to steal the processing power of these devices to mine for cryptocurrencies. At a minimum, illicit cybermining is a drain on organisational resources, resulting in increased computing workload, the theft of expensive cloud computing resources, and even the risk of physical damage to IT and OT infrastructures. This is not just a problem for those who visit torrent sites. Earlier this year, hackers targeted more than 400,000 computers to install bitcoin mining malware.

In this paper, we focus on the competition between miners while addressing the two questions above. We model the competition between miners, who have to choose which ESP to use and which blockchains to mine, as a non-cooperative game.

Therefore, the mining pools assume the role of players as considered in this work. Alternatively, the players are the end users, who contract mining pool services. In the first case, we consider competition among mining pools, at the macro level, and in the latter case, we consider the micro-competition among end-users. The analysis in this section implies that players have less incentives to invest in blockchain mining when constraints are more stringent . Indeed, as V decreases, i.e., as constraints are more stringent, shadow prices γ★ grow and the investments in blockchain mining, reflected by y★, decrease (see equation ). We further discuss general aspects related to the blockchain ecosystem in section 8.

The lines are best-fits with exponential growth laws in the corresponding sub-periods. Doubling times are respectively 33 days, during mid 2010 to mid 2011; 261 days, during mid 2011 to early 2013; 38 days during early 2013 to early 2015; 198 days, during early 2015 to early 2020. Estimate of the lower bound for the energy consumption of the most efficient Bitcoin mining hardware, measured in J/Th. Geographic distribution of the share of hash rate on the Bitcoin network, 2019–2020. pi is the industrial electricity price in region i, converted to USD/kWh based on the average exchange rate. Sometimes forks occur in the blockchain when two blocks containing different transactions are attached to the same block.

When the bitcoin price falls, the miners’ bitcoin income offers less purchasing power to cover ongoing electricity costs. As a result, the miners with the highest production cost will no longer be profitable and will be forced to stop mining . This is almost exactly analogous to normal commodity production cost curves. In addition, Bitcoin reward halving is a contributor to the fluctuating price of the cryptocurrency. Bitcoin has a fixed amount of 21 million, unlike fiat money which can be inflated by the centralised authority. It is intended that when 210,000 blocks are generated, the reward from Bitcoin mining will half.

That rising value, coupled with increased competition and a depleting supply of bitcoins, is the perfect recipe for a serious cybersecurity problem. To say the value of bitcoin is “volatile,” is an understatement.

Life seemed merely a succession of bills and worrying about how to pay them. One late night while surfing the internet, curiosity got the best of him and he started researching Bitcoin and cryptocurrency. His long hours of research paid off and he was able to discover a method of making money that would change his life. He was finally able to make a substantial amount of money while having enough free time to enjoy it. Setting up a proper mining rig with multiple ASIC miners can cost thousands. Additionally, some calculators do not factor in upfront costs such as the price of your mining equipment moving. Mining difficulty – it gets harder to mine Bitcoin as more miners join the network, in order to manage inflation.

- These are formidable changes to a scale never observed in financial systems or in human activity in general.

- Let Tk be the time it takes for the first miner, across all ESPs, to solve puzzle k.

- Rewards are granted to miners once the contracted ESP solves the corresponding puzzle.

- Genesis Mining offers three different Bitcoin mining cloud contracts.

- Power use isn’t bad either, meaning it’s feasible to potentially run six GPUs off a single PC — though then you’d need PCIe riser cards and other extras that would add to the total cost.

For the purpose of this study, we focus only on the first element, the energy cost of running the Bitcoin mining hardware which is likely to be the key driver and is the only cost that can be estimated with some precision. Certainly a combination of both old and new mining hardware should coexist in the Bitcoin network as long as each machine continue to generate a profit. However, the market share of each hardware and its evolution over time is an unknown. With respect to the purpose of the present estimate of the lower bound of the mining cost, we must stress that the maintenance and the hardware costs must be anyway proportional to the energy consumption costs. By ignoring them we are under-estimating the total mining cost by some factor but, beside this factor, the estimation of the overall behavior of the mining cost should not be significantly affected. Bitcoin is a digital currency launched in 2009 by an anonymous inventor or group of inventors under the alias of Satoshi Nakamoto . It is the largest cryptocurrency in market capitalization with over 100 billion dollars (Chan et al., 2019; Grobys and Sapkota, 2019; Blockchain.com, 2020).

The CONSTRAINED GAME admits an infinite number of equilibria. Nonetheless, as will be shown in the sequel, it admits a unique normalized equilibrium. To prove that claim, we translate global constraints from the CONSTRAINED GAME into local penalties in a simpler version of the GENERAL RELAXED GAME, referred to as the RELAXED GAME. The last condition is referred to as complementarity property. We call the game with utilities given by Lagrangians Lm as the relaxed game or Lagrangian game. Note that in the game above we assume that each player maximizes the probability of being the first to successfully solve the puzzle, Pm, under constraints on the total amount bid by all players.

Even with a potential payoff of $100,000 per block added, those costs are not insignificant. In the UK., depending on electricity rates, the cost to mine a single bitcoin ranges from $15,000 to $20,000. When its value was a couple hundred dollars, bitcoin “mining” wasn’t cost-efficient. It requires a fast internet connection, creates electricity costs through power consumption and cooling, depletes storage space and takes time. When the value of a single bitcoin began to skyrocket, so did the profitability of bitcoin mining — and investment in it. A mining hardware has an energy consumption that can be measured in joules per terahash (J/Th), and has a hashing speed that can be measured in terahashes per second (Th/s).

, recently announced that it will achieve an estimated hash rate capacity of 1.06 Exahash per second (“EH/s”) with the deployment of the newly received 2,002 S19 Pro Antminers. “Exceeding 1 EH/s in hash rate capacity marks a major milestone for the Company,” said Jason Les, CEO of Riot.

Bitcoin price is 1.64% lower at $9,632 as the price stops a three-day winning streak. Bitcoin price rejected for the third time at the $10,000 mark and attracted some sellers that pushed the price in early Asian session down to $9,215. The bullish momentum is intact as at the time of writing BTCUSD managed to bounce form daily lows and now is 2.07% lower at $9,596. BinBotPro is holding their final round of beta testing and is currently looking for people to help out in testing their software. This is the perfect opportunity for anyone looking to get involved in cryptocurrency. Remember, it’s always better to start small if you are a beginner. With the BinBotPro System you can start trades with a minimal amount of money.

In scenario 1, we have a few miners in the system and low puzzle difficulty level. In scenario 2, we have additional miners in the system and increased puzzle difficulty level . Under the coarse grained adjustment of difficulty level, the increase in the number of miners may not immediately reflect in adjustment of difficulty level. In scenario 3, miners still compete in the short term, to determine who will be the next to mine the upcoming block. Paper outline The remainder of this paper is organized as follows. Sections 2, 3 present background on mining competition and the general game framework considered in this paper to characterize such competition. Then, section 4 specializes to the setup wherein there is only one single cryptocurrency, and section 5 accounts for multiple cryptocurrencies.

“I lost my job a year ago and since then have been unable to find a steady paying job, but with BinBotPro I was able to create a passive income stream that put money in my pocket daily.” One of the most popular and interesting methods people use to trade cryptocurrency is through automated trading software. Unlike the stock market, cryptocurrency can be traded 24 hours a day. So traders are able to run trading software from their home computers and profit in their sleep. The phenomenon of running automated software to trade cryptocurrencies and generate money online is not new. Nevertheless, recently these programs have managed to get a lot of attention because they have become far more accurate and profitable. Most people are aware of Bitcoin, but a little known fact is that there are literally thousands of alternative cryptocurrencies out there.