Bitcoin Is A Pyramid Scheme, Economist Says

Content

- Russia’s Infamous Fraudster, Sergey Mavrodi, Has Pulled Off A Masterpiece Of A Scam Using Bitcoin And A Veneer Of Marxism

- Brits Lose £2,500,000 To cryptocurrency Pyramid Scheme

- Investment Scams In Focus: Cryptocurrency Scams

- Bitcoin Is A Pyramid Scheme, Economist Says

- Diane Abbott Expresses Concern Over Bitcoin gigantic Ponzi Scheme

They pay a celebrity to endorse their “initial coin offering” through his or her social media channels. The founders take receipt of the money and extract their copious “expenses”. What we now call “Ponzi schemes” have the same basic features.

Users can also accept BitCoin as a donation using the Facebook App ‘BitCoin’. The content of this site is journalism and personal opinion. Nothing contained on this site is, or should be construed as providing or offering, investment, legal, accounting, tax or other advice. Do not act on any opinion expressed here without consulting a qualified professional. Also, if AAPL went to 1c/share, the business does something so it’d be worth buying.

Be wary of any scheme offering to help money from your pension before you’re 55. You may never see your money again, and get hit with a hefty tax bill. Before a new cryptocurrency is launched on an exchange, you will be able to buy cryptocurrency coins or tokens as part of an Initial Coin Offering . This is usually what’s known as a pump-and-dump – when a price becomes inflated at launch, and then rapidly crashes.

Russia’s Infamous Fraudster, Sergey Mavrodi, Has Pulled Off A Masterpiece Of A Scam Using Bitcoin And A Veneer Of Marxism

After an attempt at a political career, mainly “to get parliamentary immunity” from prosecution, Mavrodi vanished. In 2003, he was finally caught and served three years in prison, where he wrote several books. A fictional rendering of the MMM story, PiraMMMida, even became a “modest Russian movie hit”. By 2011, Mavrodi was back in business with a new scheme, MMM-2011, that ran as a kind of social network making it harder for prosecutors to move against him. “It’s not Mavrodi’s problem if people are willing to trade money for a non-currency and then send it to each other in exchange for another non-currency.” When it goes bust as it surely must he can “just start a new one”.

- In August this year, the City of London police ended a two-year investigation into OneCoin.

- The global version of the MMM site offers monthly returns of 100% (the more “modest” China scheme a mere 30%).

- I am guessing since there will only be 21 million Bitcoins and and payouts drop in half every four years.

- She told people she had invented a cryptocurrency to rival Bitcoin, and persuaded them to invest billions.

- This article does not constitute specific advice and investors should bear in mind that capital invested is not guaranteed.

A multinational operation has broken up an online investment fraud scheme that promised attractive returns on Bitcoin, gold and diamonds. The FinCEN files consist of over 2,500 files sent to the Financial Crimes Enforcement Network, a bureau of the United States Department of the Treasury that investigates financial crimes such as money laundering. Banks are required to send reports to the bureau if they suspect a client may be behaving suspiciously, but this is not necessarily evidence of wrongdoing. But no one, certainly not economists, knows for certain what the future holds. Perhaps cryptocurrencies will one day take on these features. Perhaps the fact that the volume of a cryptocurrency is limited and they cannot be created by governments will prove to be as transformative as the hype-merchants claim. Perhaps the anonymity they allow will prove to be what most people really want.

They’d read, with envy, the stories of people striking gold with Bitcoin and thought OneCoin was a second chance. Many were struck by the personality and persuasiveness of the “visionary” Dr Ruja. Investors might not have understood the technology, but they could see her talking to huge audiences, or at the Economist conference.

Brits Lose £2,500,000 To cryptocurrency Pyramid Scheme

Daniel is one of thousands of Ugandans who’ve bought into Dr Ruja’s fake cryptocurrency – and the OneCoin financial documents leaked to the BBC reveal that as time went on, investors like him became increasingly important to OneCoin. Over the next hour or so she listened carefully to people talking enthusiastically about this exciting new cryptocurrency – how it could transform her fortunes. All of them were “very up-tempo, full of beans, full of passion”, she remembers.

For several months, a French journalist called Maxime Grimbert tried to unpick OneCoin’s corporate workings, collecting as many company names and bank account details as he could. I show his results to Bullough, who immediately notices how many British companies there are. “British companies are the companies of choice,” he comments. The problem, he explains, is that following the money isn’t as easy as it sounds, because criminals structure their companies and bank accounts in such a way that their assets seem to disappear. “They still exist”, he says, in his garden near the village of Hay-on-Wye.

When Georgia and I visited Sofia a month later, Dr Ruja’s personal mansion appeared to be locked up and empty, but the OneCoin office gave every appearance of being a busy workplace. On 6 March 2019 Konstantin Ignatov was at Los Angeles International airport, waiting to fly back to Bulgaria after some OneCoin meetings in the US. Just as he was boarding his flight home, he was pounced on by FBI agents, arrested ,and charged with fraud in connection with OneCoin. Around the same time, the US authorities charged Dr Ruja in absentia for wire fraud, security fraud and money laundering.

Investment Scams In Focus: Cryptocurrency Scams

What really drives its price, according to investment manager Fidelity, is simply human interest in Bitcoin. The upward price effect is amplified when interest rates go lower. The opportunity cost of owning gold, which pays no income, decreases as yields fall on rival “safe” investments such as bonds and cash saving accounts. Understanding why people buy gold is critical to understanding why people buy Bitcoin. Gold is considered a hedge against inflation as its supply is more or less fixed, whereas governments can print more money.

A cryptocurrency start-up from Bulgaria was looking for a chief technical officer. Bjercke would get an apartment and a car – and an attractive annual salary of about £250,000. For its fans this is a revolutionary new form of currency, with the potential to sideline the banks and national currencies, and provide banking for anyone with a mobile phone. And if you get in early, there’s the chance to make a fortune. The reason so many people are excited by Bitcoin is that it solves that problem.

Many are wracked with guilt after persuading their loved ones to invest in Lyfcoin, mistakenly thinking they would be able to double their money in as little as five months. “It’ll be interesting to observe whether the relationship between those cashouts and Bitcoin’s price continues.

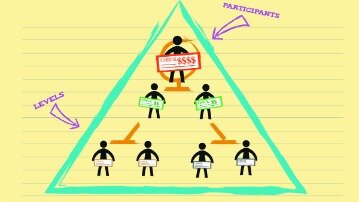

This means that more money has to come into the system — new people have to join the scheme. This is obvious to everyone “investing” — they have to recruit. With Facebook about to launch its own coin in 2020, there is more investment in the eco-structure of cryptocurrency than any known Ponzi scheme. The question is whether to jump on board now in the hope of gaining the most benefits, or wait to test the waters.

The manager of the database could go in and change it at will. But towards the end of the year Jen McAdam was contacted by a stranger on the internet.

Too bad many so many people don’t like to report their earnings of profits from cyrpto on their tax returns. Can’t wait for the audits to come 3 years from now, with incurring penalties which drive people into bankruptcy.

The SEC issued an investor alert warning investors about the dangers of potential investment scams involving virtual currencies promoted through the Internet. Even the miners are not guaranteed a return on investment and the false rising cost theory is very Scam O Rama. cent in electricity to compute and validate the transaction for which the miner was paid 25 Bitcoins while the last Bitcoin will cost an infinite number of dollars to mine in electricity and never pay out anything. I am guessing since there will only be 21 million Bitcoins and and payouts drop in half every four years. I fear the last blockchain will include compute the value of pi until it repeats. Otherwise who will be left to verify transactions when there would be no more Bitcoin to mine? Therefore, trust is involved and Bitcoin undermines its own credibility without blockchain verification at minimum.

Bitcoin Is A Pyramid Scheme, Economist Says

Fears have emerged that Bitcoin and other digital currencies could become the capital of choice for jihadist groups, money launderers and other offenders keen to stay below the radar. Even if you are willing or able to commit the time and resources to a complex investigation, the likelihood of recovering your money is much lower than in real world. They focus on smaller transactions and scams varying from Ponzi schemes, unregulated or fake brokers, fraudulent crypto-currency exchange platforms, to hack attacks on legitimate exchanges and crypto wallet providers. According to a report by US-based CipherTrace, last year was overrun by dozens of smaller-scale crypto hacks and scams. While certainly not a hard and fast rule, it may be difficult to justify the expense of an investigation to recover those assets for investment losses under USD $5million. Stuck at home for long periods over the last year due to the pandemic, not only do our behaviours change, but so too can our perception of risk.

Bitcoin is the most famous cryptocurrency, but there are more than 1,500 cryptocurrencies including other well-known ones such as Ethereum and Litecoin. The scammer pretends they’re representing a legitimate and trusted investment group, but they’re lying. Investment scams are getting harder to spot but there are some telltale signs to help protect your hard-earned money. This article does not constitute specific advice and investors should bear in mind that capital invested is not guaranteed.

it’s Tim Swanson – who’s done a ton of bitcoin and blockchain stuff – explaining in small words to bitcoiners that they’re not achieving an independent economy in the foreseeable future. Something about cryptocurrencies attracts, not just starry-eyed naïfs, but the sort of starry-eyed naïf who thinks that Ponzis, chain letters and other blatantly fraudulent financial schemes are actually a good idea. The problem with calling Bitcoin a “Ponzi scheme” or “pyramid scheme” is that a Ponzi conventionally has a mastermind at the top, making the money.

Diane Abbott Expresses Concern Over Bitcoin gigantic Ponzi Scheme

But it seems it’s not just the promise of riches that keeps people believing. After Jen McAdam invested into OneCoin she was constantly told she was part of the OneCoin “family”. She was entered into a Whatsapp group, with its own “leader” who disseminated information from the headquarters in Sofia. And McAdam’s leader prepared her carefully for conversations with OneCoin sceptics.

“This is supposed to mean that you can no longer use a British company to hide behind,” he says, as he scrolls down the page. “Oh, hey presto, they haven’t filed a person with significant control. That’s illegal… That is an anonymous shell company, as anonymous as anything that you can buy anywhere in the Seychelles or Nevis or the Marshall Islands or Vanuatu.”