Best Staking Coins Archives

Content

The split of rewards among participants is according to a pre-defined set of rules, of which you can inform yourselves beforehand. As a masternode, you receive a percentage of every block reward issued in the network, as besides enabling specific functions on the network, you also verify transactions, and for that, you’re paid. The October staking reward calculations will include staking reward percentages earned in September. The rewards will be calculated according to the number of intro days of the specific cryptoasset. For example, Cardano has nine intro days, with calculations beginning on the tenth day of holding the asset. To calculate the monthly yield per cryptoasset eToro divides the total number of new coins for the month by the total average daily amount of all eligible staking users. The staked cryptoassets remain the property of the eToro users; in turn, eToro users entrust eToro to execute the entire staking procedure for them, securely and effectively.

Why is proof of stake bad?

Why PoS Creates Bad Money

Essentially, Proof of Stake, removes the cost of mining entirely, leaving no room for a market mechanism to emerge and regulate inflation. Theoretically, then, the growth in supply of PoS coins remains constant, regardless of its value and staking profitability.

Classic staking, in which your wallet would be tasked with producing a block, is still a game of probabilities. So to increase the chances of getting a reward, it is possible to join a staking pool. Here is a brief breakdown of how some of the most prominent wallets can support the staking of a limited number of coins or tokens.

Can You Stake Bitcoin?

Embrace staking coins as crypto asset institutionalization edges closer to reality. The next time your friends ask for a great investment idea, share this article with them. Validators are much quicker than bitcoin miners, which makes staking coins appealing to novice users. These staking coins come into the market in 2018, but users started staking LOOM tokens a year later. By 2020, the Loom Basechain bridged different chains via impeccably high performance.

28th October USDT fixed staking services will roll out on Pool-X today with APRs of 10% and 12% for the 7-day and 14-day products respectively. 19th November Binance Savings adds BAKE, BEL, CVC and EGLD to the list of supported assets with opportunity to earn an APR of up to 20%. 22nd December KSM 7-Day Christmas Special Offer rolling out on Pool-X.

- To apply for a masternode, participants will generally have to comply with some minimum requirements.

- Thus, it reserves the voting power for the majority’s interests.

- The amount staked started off growing very slowly and it looked like the deadline might be missed; as of 11/13/20, 64,320 ETH were staked (12%), and as of 11/20/20, only 107,360 ETH (20%) were staked.

- STKR validator nodes can be run by ANKR corporation, run by 3rd party users using ANKR’s cloud infrastructure, or run by 3rd party users on their own infrastructure.

10th October Stafi(FIS) staking launches on BitMax.io with estimated staking APR of 16.6%. 28th October Zilliqa flexible staking product debuts out on Pool-X today with an estimated APR of 8% .

11th August Waves Protocol joins Pool-X Soft Staking platform with an expected staking APR of 4%-7%. 14th August CoinMarketExpert welcomes Guarda Wallet to our list of staking providers. 18th August Binance launches NEM locked staking product with an estimated APR of up to 2.8%. 18th August Polkadot and Cosmos on-chain staking assets debut on Kraken.

Risks And Issues With Staking Coins

MyCointainer is a revolutionary Proof-of-Stake staking pool which provides an extremely easy to use ecosystem that allows everyone to take advantage of rewards distributions in the decentralized economy. On top of being a staking platform, MyCointainer offers easy exchange of coins using FIAT money or Bitcoin. It aims to break the technical barriers of blockchain, to reduce the cost of development, and to promote the usage of blockchain technology in the commercial field. The above article is for entertainment and education purposes only.

But the barrier to entry is also quite high — i.e., you would need a large initial investment to become a masternode. PoW relies on the proof that a certain amount of work has been done to verify transactions.

How Long Do I Have To Be Holding The Coins To Receive The Staking?

Sometimes, a Ponzi scheme will also masquerade as a staking pool. Make sure the staking pool protocol matches the reward schedule of the coins you choose. Be skeptical of long mandatory locking periods for coins – you may end up not being able to withdraw your capital.

The only way to get ETH2 tokens for validator collateral is to make a one-way ETH transaction to the deposit contract on the current Ethereum chain, which burns ETH1 and mints ETH2 tokens. (See more info below.) Technically, this generates a new token called BETH which exists only on the Ethereum 2 Beacon Chain, referred to simply as ETH2 in this report. The first phase of this multi-year upgrade to increase performance and improve security launched on December 1, 2020.

9th September Lukso launching a 50% APR staking program to celebrate KuCoin’s 3rd anniversary. 16th September CoinMarketExpert gives a warm welcome to ChangeNow which has joined our list of staking providers. 19th September AdEx and pNetwork locked staking products launch on Binance with an estimated staking APR of 46.7% and 30% respectively. 25th September Polkadot(DOT) staking debuts on Bitmax.io with estimated staking APR of above 7%. 6th October Cardano(ADA) staking added to Bitfinex platform.

Eligible eToro users receive the staking rewards that they have earned each month directly and automatically, with absolutely no action required on their part. Each user also receives an individual monthly email, explaining how much in staking rewards they received that month, and how it was calculated for each of the supported staked cryptoassets. eToro users are eligible to receive staking rewards if they hold any of the supported cryptoassets, on eToro USA LLC, eToro Ltd. or eToro Ltd. The positions need to have been open for a certain number of days, which varies according to the blockchain network of the cryptoasset in question, as presented in the table above.

Make Your Crypto Grow Faster: An Insight Into Algorithmic Staking

In general, it is better to stick to larger projects with established liquidity. It is not unusual to find new masternode coins created almost all the time, quickly going through a pump-and-dump cycle. In the early days of staking, coin prices were relatively stable. This meant early adopters could keep the coins for years, finally reaping the benefits of the 2017 bull market. For another asset, Loom Network , staking one million LOOM would be worth around $21,000. The challenge about LOOM is its volatile price, easily doubling then crashing by 50%. Still, a reward between 10 and 20% can be added to one’s balance if the coin needs to stay idle.

As already discussed, using a different wallet for each coin and keeping it open may not be viable. For some coins, it is possible to stake passively, either through an exchange wallet, or through evidence of balance, even if stored offline. Assets are created all the time, and coins that were hot in the past are now defunct. The staking coins are in a flux, though there are a handful that have managed to achieve top positions, good liquidity, and large communities interested in the projects.

Corporate Onboarding: Will It Become A Competitive Differentiator For Banks In A Real Time World?

19th August Binance launches DEFI staking product starting with DAI. 20th August BitMax rolls out Serum staking with an estimated APR of 4%.

This number was calculated to make it economically difficult to attack the network. This amount was required to be staked by November 24, for the new network to launch on December 1. The amount staked started off growing very slowly and it looked like the deadline might be missed; as of 11/13/20, 64,320 ETH were staked (12%), and as of 11/20/20, only 107,360 ETH (20%) were staked.

ConsenSys is offering Codefi Staking API (staking ”as a service”) for institutions such as exchanges. First trials are with Binance, Crypto.com, DARMA Capital, Huobi Wallet, Matrixport and Trustology. We can expect that these companies will launch ETH2 staking products if they have not already. RocketPool was one of the first groups to announce their ETH2 staking service. They bill themselves as a “Decentralized ETH PoS Network”, using smart contracts for custody of tokens.

In order to take control of a PoS network, an individual or entity would have to purchase 51 percent of the available tokens. Not only that but, if you owned 51 percent of the tokens, you would want to do everything in your power to see the network succeed and continue to turn a profit. That means you are less likely to do anything to defraud the blockchain. Depending on the cryptocurrency itself, you may need a VPS with different OS, network bandwidth and/or hardware to be able to run a masternode. You can find all requirements by following the links from the top 10 masternodes list, or via the website’s navigation. To set up a cold masternode, you’ll require two wallets – one for your VPS server and one for your local machine – the cold storage.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

It’s really that simple and since you’re going through a validator, the estimated annual staking yield may be relatively higher than those offered elsewhere for a particular coin. Staking rewards are updated dynamically every 24 hours with full transparency on the Guarda platform so you receive your rewards the moment they are issued by the blockchain validator. A minimum of 10 NOW tokens frozen to be eligible for the staking reward. MyCointainer is offering a wide range of PoS cryptocurrencies and with new assets added every week, MyCointainer covers the whole PoS staking spectrum.

Users can earn passively when their nodes validate and add blocks to blockchain networks. You have to save up 32 ETH of rewards then launch another validator. This is non-trivial and it takes time to accumulate this much reward. Exchanges with big reserves will be able to achieve closest to continuous compounding here (this isn’t even possible until transfers are enabled, at phase 1 or later).

For that reason, hype and a bull market are not the best times to buy and lock up coins for staking. The best approach is to use well-established staking coins, avoiding brand-new projects that promise outlandish returns. In general, the boom of staking and masternode coins happened around 2018, with much less new additions to the list. Masternode coins often promise annualized returns in the hundreds of percentage gains. However, while node operators must hold onto their coins, nothing stops the founders from dumping their assets on the market. Some of the biggest losses for staking coins come from the incentive to hold, while market prices crash. Staking-as-a-service pools offer multiple asset wallets, while offering information on profitability.

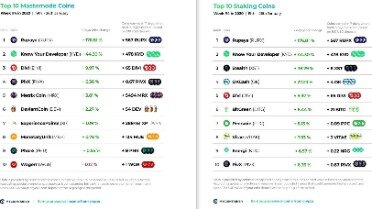

Based on my research, I’ve compiled a list of the best masternode coins in 2021. My criteria for choosing include development team and potential, stability of the coin, required investment and ROI. As cryptocurrencies aren’t regulated by the Financial Conduct Authority, the Financial Ombudsman Service cannot get involved if you have a complaint. If we end this agreement we will sell all the cryptocurrency that we hold on your behalf and place the equivalent amount of e-money in your Revolut account. Sometimes we’ll suspend use of our crypto service so that we can make technical changes, add new features , make sure it runs smoothly or improve its security.