What Is Bitcoin And Why Is The Price Going Up? 2021

Content

“If you actually abstract away from the substance of the regulation, what is a positive sign regardless, is that regulators are spending time and effort and brainpower on this,” Sokolin says. Bitcoin and crypto are being domesticated and given a new sheen of legitimacy. This comes straight after major fintech companies like PayPal and Robinhood made it easier to purchase bitcoin, and on the heels of a breakneck regulation drive, chiefly in the US. It’s clear that big money is becoming increasingly interested in Bitcoin, cryptocurrency and blockchain as an asset in its own right, as well as because of the transformative potential of the technology.

And, of course, some believe that the cryptocurrency’s future can be seen in its past, when it boomed in 2017 and subsequently went bust shortly afterwards. Incredibly, the $2.4billion it has seen invested in the last 12 months across all its funds, which also invest in other cryptocurrencies like ethereum was more than double what it had received in the previous six years. This has largely been due to three connected ‘c’s’, coronavirus, central banks and currencies. ‘Bitcoin’s price has tripled since the start of the year and I have to wonder whether any of that would have happened in the absence of coronavirus’, Goodman said. Instead, ‘it finally got the seal of approval as an investment from many of the biggest investors in the world and the biggest Wall Street banks’, Glen Goodman, an analyst and author of The Crypto Trader, said.

After Its Price Tripled In Less Than A Year Will Bitcoin Continue To Boom In 2021 Or The Bubble Burst Again?

You can end the agreement at any time by letting us know through the Revolut app, by writing to us at our head office, or by emailing us at If we don’t meet our obligations under these terms and conditions, we will not be responsible for any loss that we couldn’t have thought you’d suffer at the time we entered into the agreement with you. Sometimes we’ll suspend use of our crypto service so that we can make technical changes, add new features , make sure it runs smoothly or improve its security. We’ll try to give you notice before we do this, although we might not be able to do so in an emergency. We’ll also try to limit any suspension so it lasts as short a period as possible. We’ll do as much as reasonably possible to make sure that our crypto services are not interrupted, are secure and virus-free, and are accessible at a reasonable speed. We are not responsible for collecting these from you, for making any payments on your behalf, or for providing any reports relating to tax.

- Second, the cryptocurrency marketplace is a target for fraud, so extra caution is needed.

- Virtual currencies are not regulated, so if something does go wrong you will not be able to claim compensation.

- However, the more established Bitcoin and other cryptocurrencies become in the future, the more retailers and businesses will be willing to accept it as a legitimate currency.

- These speculative bubbles have appeared several times in Bitcoin and in my view, this is what we are seeing this year.

- He has previously warned that cryptocurrency investors should be prepared to “lose all their money”.

Our content addresses what we believe are the key issues in helping make your money go further. However, the nature of it being virtual means that difficulties can part you from your money very easily. Some businesses in the US, Canada, Australia, and the EU have started moving towards accepting Bitcoin – but there is a long way to go yet before it competes with our current form of currency. “And I’m even toying with the idea of selling my gold to buy bitcoin, more Bitcoin.”

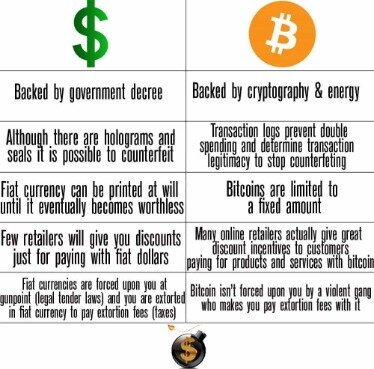

The cryptocurrency’s value had been on the rise all year, party due to a big investment from Tesla and increased interest off the back of the GameStop stock frenzy. A successive all-time high valuation gives additional credence to bitcoin as a digital asset, Sztorc said. Establishing value is a fairly difficult task when you are dealing with a cryptocurrency. Traditional currencies derive their value from being the only accepted legal tender currently circulating within an economy to engage in commerce in the UK, you need to deal in pounds sterling. Likewise, commodities are often based on their industrial value, or, in the case of gold, their properties and desirability.

You may have heard of the term distributed ledger technology, that’s what it means. The ledger is called the block chain because as transactions are validated they are bundled up into blocks, which are then added to the end of the ledger. Each block includes a reference to the previous one, linking them all together in a long chain.

How Do I Buy Bitcoin And Why Has The Price Gone Up?

Currencies do fluctuate in price, but they are small changes compared to what we see in cryptocurrencies. Transactions rates and volumes are not fast enough for Bitcoin to work in a wider population and the energy Bitcoin system uses to validate each transaction is huge and growing every transaction.

You can instruct us to buy cryptocurrencies for you using the e-money in your Revolut account. We call our services that allow you to buy, sell, receive or spend cryptocurrency our crypto services. When you buy cryptocurrency through the Revolut app, it will not be protected by the Financial Services Compensation Scheme.

Bitcoins are valuable because people are willing to exchange them for real goods and services, and even cash. You could end up spending more money on electricity for your computer than the Bitcoin would be worth. In order for the Bitcoin system to work, people can make their computer process transactions for everybody. This makes it possible to trace the history of Bitcoins to stop people from spending coins they do not own, making copies or undo-ing transactions. As talk of the currency has gone global, the Bank of Singapore has suggested that the 12-year-old currency could replace gold as its store of value. Elon Musk has told users of an online social media app that he thinks the virtual currency, Bitcoin, is a “good thing.”

Not only does Bitcoin have a limited supply, but there is also the issue of liquidity. A lot Bitcoin is either locked up by large investors, yet to be created or simply lost trapped in a digital wallet or hard drive, because someone has lost their password, never to be recovered. Bitcoin is the largest and most popular cryptocurrency and tends to get most of the limelight. Others include Ripple or Ethereum but literally thousands exist, and they won’t all necessarily behave in the same manner. Dominic Frisby looks at the most common, and explains exactly how to buy bitcoins in the UK. If you want to accept digital currency as a means of payment you must satisfy yourself and us that you can meet your obligations in relation to anti-money launderingand that you are acting in a socially responsible way. There is a history of hacking, theft and other criminal activity associated with digital currencies.

There Is No Reason To Sell What Will Happen To Bitcoin And Ethereum?

Early adopters have already made millions but if institutional investors really are starting to take notice, then recent price rises could just be the beginning. With the prices of cryptocurrencies increasing dramatically over the last few years, scammers are now actively targeting potential investors. However, people have been increasingly buying cryptocurrencies for the purposes of investment, hoping to make a lot of money quickly. Bitcoin is just one type of cryptocurrency, a form of digital asset or money that can be exchanged in a similar way to normal currency.

And if it was kept on a computer connected to the internet, it could be stolen by hackers half way across the world should they find a way of breaking into hard drives, tablets or phones where wallets and passwords are stored. Traditionally buying Bitcoins online has involved either having a connection, or transacting through an online exchange. As operators in a hugely lucrative and barely policed market, it isn’t surprising that over the years many of these have been the focus of scams and hacking attempts. Through these, collectively, billions of dollars’ worth (at today’s prices) of Bitcoins have been swiped. It’s not the only step that Bitcoin and crypto currency seem to have taken towards mainstream acceptance in recent days. “Now we are close to $400 billion and we are talking about a completely different picture. It’s really been a market where the products available haven’t been geared towards institutional investors, but now we are starting to move towards that.

Nakamoto further describes the Bitcoin network as a decentralized payments system, meaning third-party financial intermediaries (i.e. banks or credit unions) are unnecessary when transferring value with Bitcoin. He has repeatedly shown his support to online currencies in recent years and caused major movements in their values due to his own personal wealth and influence.

However, if you’d invested at the start of 2018 and sold at the end of the year on New Year’s Eve, you would have lost 73% of your money as the bitcoin price collapsed. The concept of digital monies such as bitcoin that people send online is not that complicated in itself — after all, transferring money from one online bank account to another is doing exactly that. Cryptocurrencies use blockchain technology — a way of sending data in cyberspace — to do this. But, different from normal currencies like dollars and pounds, cryptocurrencies are “decentralised”, which means they are not regulated by a financial authority, like a government or central banks.

Someone who bought £1,000 worth of the cryptocurrency would have seen that turn into £3,292.16 by the last weekend before Christmas, a return of 229 per cent in less than a year, according to personal finance comparison website Finder. Just a few days laterNew York based banking firm BNY Mellon announcedplans to hold Bitcoin and other cryptocurrencies for its clients. “Price movement may galvanise Bitcoin’s many critics, including those who recently dismissed the leading cryptocurrency as an economic sideshow,” Paolo Ardoino, chief technology officer at cryptocurrency exchange Bitfinex told Forbes. “I would suspect, down the road, that a number of central banks will have digital currency,” he said. The volatile nature of cryptocurrencies makes it almost impossible to know what will happen next.

Third, the boom in open purchases of Bitcoin by institutional investors has pushed the rate up quite strongly, but in addition to large funds, the creation of reserves in Bitcoin by government agencies has begun. On the night of Tuesday, January 5, the price of Bitcoin on the Binance crypto exchange exceeded $32.8 K, now it is $31.2 K. Over the past day, the cryptocurrency has risen in price by 6%, during a week – by almost 20%.

Morrow adds that the danger of investing in Bitcoin is that you have “the potential to lose all your money”. You may have heard Bitcoin being called ‘digital gold’ or ‘cash for the internet,” Blair Halliday, Head of UK at Gemini, a leading platform for buying, selling and storing cryptocurrency. An expert reveals exactly what we need to know about the buzzy cryptocurrency. As cryptocurrencies aren’t regulated by the Financial Conduct Authority, the Financial Ombudsman Service cannot get involved if you have a complaint. If we end this agreement we will sell all the cryptocurrency that we hold on your behalf and place the equivalent amount of e-money in your Revolut account. A fork may seriously change the function, value or even the name of a cryptocurrency.

One consequence of the pandemic has been a lot of government spending, which made it a no-brainer, for many, to put at least some money in bitcoin. Morgan said this week that it could win over gold, and rise to a price of $146,000. Corporates including cloud-based services MicroStrategy, and hallowed insurer MassMutual – besides funds such as former star-crossed Trump aide Anthony Scaramucci’s SkyBridge Capital – have all gone big on bitcoin. The cryptocurrency that started its existence as an anti-establishment tool to avoid government detection and oil the cogs of dark markets is now being embraced by financiers. Hailed by fans as a market-disrupting liberation, and demonised by critics as a dangerous, volatile creation, bitcoin and other cryptocurrencies are never out of the headlines for long. On December 16, 2020, the price of bitcoin hit $20,000 for the first time.

On January 3, 2021, its value soared above $34,000, meaning the cryptocurrency had gained almost $5,000 in the first few days of 2021. Then on February 9, 2021, its value briefly hit a new record high of $48,000 after electric-car maker Tesla revealed that it had bought $1.5bn of the cryptocurrency and pledged to start accepting it as payment for vehicles. More in general, a change in strategy from key institutional investors could certainly lead to corrections. The report also suggests that bigger investors sucked out liquidity from the market, buying bitcoins from traders and keeping them under lock and key – “hodling” them, in crypto-lingo . When these larger investors sold their bitcoin, they usually charged higher prices.

Why Has Bitcoins Price Crashed?

In the short space of time since I wrote it, the price of a Bitcoin has close to doubled, from $9,000 to $17,000. People can track their ownership of Bitcoin by using a cryptocurrency wallet, which is a digital way to exchange payments. He added that many institutional funds will adopt the digital currency as the economy will take a long time to recover from the coronavirus pandemic. While the price of Bitcoin and other cryptocurrencies remain subject to volatility, Halliday says it’s more common to spend cash and invest in Bitcoin – although Elon Musk has said Tesla will now accept it for its cars.

But while investor interest is surging again, regulatory warnings are getting louder. While you would need a truck to drive off with a billion dollars’ worth of gold, and you’d have to physically move it from wherever it is stored, the same value in Bitcoin could fit onto a microSD card, or even a slip of paper.

“Yes, you may have a price decrease if it appears that the apocalypse hedge is worth less, given that the apocalypse is less likely,” he says. But he also reckons that that decrease would not be significant, and that what is happening now is probably “a permanent shift”.