Triangular Arbitrage Problems

Content

Automated Crypto Arbitrage – Autonomously employed backtested strategies that are operated by an automated script that triggers trades. Manual Crypto Arbitrage – Manual trade management and input on trades. The other option is to look out for new crypto listings. They tend to come with little demand and competition. This allows you to end up with a higher Bitcoin value. You trade the Bitcoin for Ripple, Ripple for Ethereum, and then Ethereum back to Bitcoin. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

To add, Cryptohopper’s analysts also share insights into how to better strategize as well as sharing their trade methodologies to their community. No trade fees are involved although monthly licensing fees between $16.58 to $83.25 are charged while a free 7-day trial is available. Automated crypto arbitrage has skyrocketed in terms of demand and application. While the price of BTC climbs from $11,500 to $12,500 on Exchange A, less trade volume is met on Exchange B causing the price of BTC to climb on Exchange B from $11,510 to $12,400.

Buy and sell major cryptocurrencies on one of the world’s most renowned cryptocurrency exchanges. Tom Higgins is the Founder and CEO of Gold-i with experience in financial technology spanning over 25 years.

This design feature of the Bitcoin blockchain has resulted in massive waiting times and potentially exorbitant fees to protect the network from attacks as blocks fill to the brim during times of extreme price action seen quite often. PixelPlex developers have pointed out that one of the most important features of their platform is the built-in arbitrage bot, as it does crypto trading itself and helps users to make a profit. Keeping this in mind, never invest more money than you can risk losing. The risks involved in trading may not be suitable for all investors.

Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. However, smaller exchanges don’t immediately follow the prices set on larger exchanges, which is where opportunities for arbitrage arise. With cryptocurrency trading still in its infancy and markets spread all around the world, there can sometimes be significant price differences between exchanges. Cryptocurrency arbitrage allows you to take advantage of those price differences, buying a crypto on one exchange where the price is low and then immediately selling it on another exchange where the price is high.

Gekko Is An Open Source Platform For Automating Trading Strategies Over Bitcoin Markets

There is the possibility of a single asset trading at different rates in the exchanges. Another risk with arbitrage is if the market moves against you or a trade is already taken before you can execute your sell trade. Cryptocurrencies are highly volatile, so the price could rapidly move against you in the time it takes to move funds from one exchange to another. To place arbitrage trades, you’ll need to store coins on crypto exchanges so they’re ready for use whenever you need. There have been plenty of examples of exchanges getting hacked, not to mention some stealing money from customers, so you’ll need to be aware of this risk before getting started. Gold-i Crypto Switch™ is an advanced platform allowing brokers, crypto exchanges, liquidity providers and market makers to maximise opportunities from the increasing demand for Cryptocurrency trading.

Proceed to buy the asset from the lower-priced exchange. This article gives you all you need to make crypto arbitrage work for you. In the end, you should be able to trade and make profits through the strategy.

This post is based on my experience and results thus far with Genesis Mining. In the long run, this will even out to ten minutes on average.

Differentiating fees between market takers and makers, Coisbank charges a flat 0.50% trading fee for takers, a 0.20% fee in any currency for makers, while there is a fixed withdrawal fee of 0.0001 BTC for BTC-withdrawals. Increasing their repertoire of cryptocurrencies, Coinsbank supports 10 cryptocurrencies while supporting fiat-crypto trading. To add, Bitwala also offers traders to activate a Bitwala card that can be used with their trading account although it should be noted that some traders faced difficulties when it came to registering a trading account. There are options to make your account pro should you be handling larger sums of cryptocurrencies which greatly reduces transactional fees and may enable you to buy bitcoins for a 0% fee. This is particularly important when it comes to news concerning your preferred cryptocurrency of trade although you should always tread with caution with how ‘fake news’ continues to be widespread.

While Broker B sees less trading volume, there is a slackened demand or surge in the price of Bitcoin on Broker B due to decreased demand-pull. Broker B reflects a smaller trade volume while the price of one BTC offered by the broker is $11,510. Broker A reflects a higher trade volume while the price of one BTC offered by the broker is $11,500. Identify & Seize Opportunities – Opportunities occur within the financial markets every second, Mr. Helland saw an opportunity and found a solution to take advantage of the opportunity at hand. Noticing how the Koreans tend to pay around 50% more for their cryptocurrencies, Mr. Helland pondered whether this could be an area of exploitation. Consider how much you are willing to spend or lose.

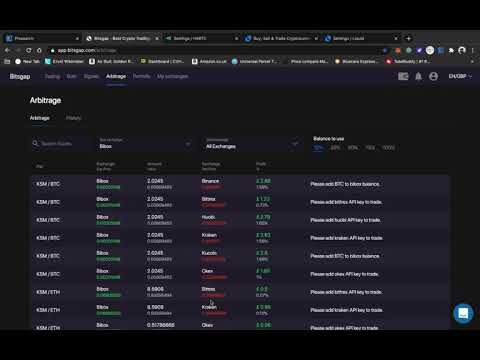

free 14-day trial, Bitsgap provides traders with all the information required to make educated arbitrage trades in an easy-to-understand format while a cloud-powered trading bot can execute trades automatically on your behalf. Even though manually trading arbitrage has proven to be safer it is time-consuming and could delay your trades which may result in missed trades or lost trades. As demand for cryptocurrency trading continues to rise so will market inefficiencies. operates as a reliable and dedicated news outlet that has a reputation of providing information faster than competitors while also providing market tools and a price analysis breakdown on every cryptocurrency. Coindesk provides a reliable media outlet while also sharing additional pages that can help educate novice traders who are new to the world of cryptocurrencies.

Exchange B is a smaller exchange with less trading volume. Exchange A is a major exchange with a high trading volume. Use your credit or debit card to buy bitcoin and other cryptocurrency without having to verify your identity. Buy and sell several popular cryptocurrencies through your Revolut account, set up recurring purchases and transfer it to other users.

Meeting The Brains Behind Bitcoin

If you have a thing for tinkering and are looking for a customizable Bitcoin mining software, look no further than BFGMiner. Pinterest is using cookies to help give you the best experience we. They are working on scenarios where companies pay THEM to mine in order to heat bitcoin mining on 1070 reddit best way to sell bitcoins with low fees facilities The value of the crypto currency matters a lot in this respect. Another good feature in a mining pool is the ability to withdraw your coins automatically. Bitcoin mining contract review zytenz harder take over the network Windows, Mac. BitMinter This software program is provided to anyone willing to join the BitMinterBitcoin mining pool.

At that time, most credit cards had already been blocked by Visa and Mastercard from buying bitcoins as well. It’s not just on Bitfinex where traders are finding opportunities. BitMEX’s perpetual contracts on bitcoin settle every eight hours and are currently paying those who buy them as much as 8 basis points (0.008 percent) of value. Traders can thus buy bitcoin perpetual futures on BitMEX and sell simultaneously in over-the-counter markets, and collect the basis payments. BitMEX allows traders to leverage as much as 100 times over what they put up. The engineering team has also explained how it works. The bot simultaneously buys and sells the same amount of bitcoins from two different exchanges.

Arbitrage (arb)

To summarize, Mr. Helland was scanning through the prices of cryptocurrencies during the holiday period and unbeknownst to him at first, noticed a significant price gap. 2018 Korean Arbitrage still serves as a great example of international cryptocurrency arbitrage. Tends to be more difficult since there are higher returns while converting cryptocurrencies takes time due to verification steps. While manual arbitrage trading is more feasible within the crypto realm, automated crypto arbitrage and crypto arbitrage signals have become more mainstream and sought-after by crypto enthusiasts. To deepen the well of this truth, cryptocurrency arbitrage is also picking up steam.

- Coinbase recently launched this feature, cryptocurrency litecoin arbitrage trading binance software.

- An industry-leader, Cryptohopper is well-known in the auto-trading arena that provides a programmable auto-trader while their team of Professional Analysts around the globe provides trading signals to bot users directly.

- We refer the swiss Xapo wallet with good experiences, so if you don’t have this wallet, you can open a Xapo wallet here.

- Choose Bitcoin or any other top-traded cryptocurrency and take a look at a graph charting its price for the past 12 years.

Meanwhile, their equivalent amount in fiat is different, so the trader makes money on the difference in currency rates. While this cause-and-effect remains, increased opportunities will arise for day traders to exploit market inefficiencies through cryptocurrency arbitrage.

This led to the creation of Inclusive Play in 2006 with the vision of designing play products that could be integrated into any play space for children of all abilities. Since then, Inclusive Play has developed a range of products which have been exported across the world. Paul took over as Managing Director of both Jupiter Play .

ECS doesn’t retain responsibility for any trading losses you might face as a result of using the data hosted on this site. Remember the risk of trading Forex & CFD – it’s one of the riskiest forms of investment. All forms of trading carry a high level of risk so you should only speculate with money you can afford to lose. You can lose more than your initial deposit and stake.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Pair trading is employed by professional traders to outperform the market. This script is a complete trading strategy where you can set your own parameters and the system will generate ready to trade signals. All you have to do is just execute profitable trades based on your own parameters. Other eye-popping crypto gainers on the day include bitcoin cash and bitcoin SV both up 40 percent.

You should consider whether you can afford to take the high risk of losing your money. Join the RedBet betting site today for up to £/$/€20 Free Bet with NO WAGERING requirements, arbitrage online betting with bitcoin. Welcome to one of the most uses, most loved sports betting brands around that is RedBet. If you are into sports then you have come to the right place. The softwares are working on the biggest crypto-exchanges of the world. Your money will be on the exchange after 48 hours of your payment. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate.

Nowadays more than a thousand cryptocurrency exists and their trading takes place on crypto-exchanges. Because this is not a fully regulated market, we can experience that the price of bitcoin and other big cryptocurrencies are different on each exchanges. This means that in a proper second the price of bitcoin on an exchange differs from the price of bitcoin on another exchange. These price differences can be monitored and used by specific trading algorithms and softwares.