The Blockchain Report 2020

Content

As with any emerging technology, challenges and doubts exist around blockchain’s reliability, speed, security and scalability. And there are concerns regarding a lack of standardisation and the potential lack of interoperability with other blockchains. A company creating a blockchain for itself will undoubtedly confront challenges related to internal buy-in, data harmonisation and scale. Still, this company can set and enforce the rules of the blockchain, just as it does with its ERP today. But generally speaking, you don’t realise the greatest return on investment in blockchain if you’re building it just for yourself.

In comparison, Breaker’s Adam Lesh was more interested in how blockchain can be used to manage rights and royalties for independent artists by registering every transaction to the blockchain. As a blockchain entertainment studio, Breaker is developing a media supply chain to empower independent artists – across film, TV, music, eBooks and podcasts – to own, control and monetize their content.

In 2019, total funding to ICOs fell to $371 million vs. $2.8 billion in equity funding to crypto and blockchain companies. Not only did Bitcoin have a very good year (up over 90%), but investors continued to fund companies building crypto infrastructure. Incumbent financial institutions also looked to expand their service offerings in areas such as custody and trading.

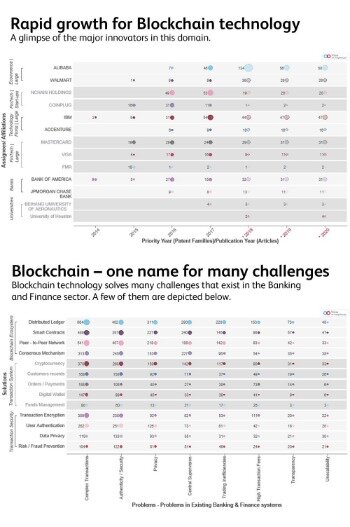

A new age of blockchain is certainly coming and businesses can’t afford to stand still if they want to capitalise on the industry’s imminent future growth. This means PR and marketing professionals have to start developing a communications strategy if they want to be able to cut through the noise and get ahead of the competition. Corporate investment in blockchain hit $1 billion in 2017 and is expected to grow at a compound annual growth rate of 50 percent through to 2021. What’s more, recent McKinsey research identified more than 90 use cases for blockchain business applications across industries, highlighting the technology’s true potential. With more and more business realising the vast potential of the technology beyond cryptocurrencies, the next era of blockchain is fast approaching.

Blockchain And Cryptocurrencies

will prepare and publish for consultation of the regulatory requirements, including the codes and guidelines, before the commencement of the new licensing regime. must not engage in proprietary trading or market-making activities on a proprietary basis, in order to avoid any conflicts of interests. whether the person is of good standing and financial integrity (e.g. not being the subject of any bankruptcy or liquidation proceedings). This alert highlights the proposed licensing regime and the reception by industry players. Add a call-to-action (ask yourself who’s in control of your data/learn more/join the community). The company is a global formation of more than 1,000 technologists, entrepreneurs and developers building the infrastructure, applications, and practices that enable a decentralised world. what to make of cryptocurrencies and blockchains, as The Economist puts it, for example, is now arising more and more.

As a relatively novel technology, blockchain has not undergone the standardization procedures that might lead to widespread adoption of one or two universal technical standards. Currently, several developers are competing for their blockchain standard to come out on top; in the meantime, virtually none of the blockchains or services built on top of them are able to communicate with one another. Decentralized and public blockchains are particularly vulnerable, and developers often have to expend valuable resources to make their services accessible across different blockchains.

CFIUS is an interagency committee of the U.S. government that reviews certain prospective transactions involving a U.S. businesses by a non-U.S. person to determine, and potentially mitigate, the effect of such transactions on the national security of the United States, including by addressing any risks associated with the transfer of technology, sensitive personal data, and other resources outside of the United States. Accordingly, extensive patent due diligence and freedom-to-operate analyses may be advisable. Although the above addresses the U.S. legal requirements, many jurisdictions have similar statutory and regulatory frameworks in place, and the following principles generally apply, and should be considered, for transactions involving foreign virtual money transmitters as well. We note that there may be additional state legal requirements with regard to an MSB’s BSA/AML compliance program. For example, the New York State Department of Financial Services’ so-called Part 504 requirements, which provide for minimum standards for transaction monitoring and filtering programs and an annual compliance certification requirement for money transmitters that are licensed by the NYDFS. Attorney’s Office for the Northern District of California, found that BTC-e, also known as Canton Business Corporation, an Internet-based, Russian-located money transmitter that facilitates the purchase and sale of fiat currency and convertible virtual currency, willfully violated U.S.

The company aims to support the unbanked citizens to get access to competitive credit lines and payday loans. Asia marks notable progress in recent years with the birth of some major global players in the blockchain industry.

Moving forwardAsia is poised to lead the blockchain revolution thanks to its embrace of progressive regula-tory measures and its forward-thinking approach from both sides – oversight authorities and businesses. Apart from the pure value that DLT brings, the side effect of the improved envi-ronment on the continent is the opportunity to lure top-notch professionals like developers, investors and entrepreneurs from Europe and the US. Add to that the fact that as of now, the Asia-Pacific region’s economy is the world’s fastest-growing and the path to a brighter future is paved. MicroMoney is another great example of Asia’s march towards blockchain innovation.

Accelerating Technology Disruption In The Automotive Market

With Bitcoin still in its relative infancy, some jurisdictions have taken steps to integrate Bitcoin into their financial regulatory system, while regulators in Hong Kong have not yet done so. With Bitcoin increasingly having real-world impact on everyday citizens, the question of how Bitcoin regulation should be approached becomes increasingly pressing. A smart contract is a set of promises, agreed between parties and encoded in software, which, when criteria are met, are performed automatically. Smart contracts were written about in the 1990s by Nick Szabo, and have received renewed interest recently as a result of the “blockchain revolution” stemming from the technology underlying Bitcoin.

For example, under some laws, called data export restrictions, personal information may only be exported from one country to another if certain conditions are met. This is a challenge for a global blockchain application in which the data is housed and duplicated all over the world. If the blockchain application is private, the data export requirement can be met by including certain terms in the contract between the participants. Similar laws, called data location laws, require that the “master” copy of data be housed in a particular country, even if it may also be stored elsewhere. This poses another challenge for a blockchain application where there is no one true “master” copy. Unlike IP considerations, using a blockchain in a business model presents novel privacy issues.

This article provides an overview of the efficiencies gained by using this infrastructure for bond issuances, focusing on one case study. Allen & Overy was delighted to have the opportunity to lead a workshop on Initial Coin Offerings at the recent Innovate Finance Global Summit. We had such an engaged audience and covered so much ground that we wanted to share some of the key points more broadly.

There are increasingly coming all sorts of solutions on the market to deploy ZKPs in a broad way. For instance to put mortgage requests on blockchain and, via ZKPs as a sort of notary, automatically grant or reject such a request. ZKPs are much more complex to develop than coding a smart contract without privacy, but for security reasons corporates are expected to shift from developing DApps to developing ZApps.

Our Insights On Blockchain, Cryptocurrencies And Initial Coin Offerings

As we said above, the important thing right now is to pay attention to how this tech evolves and the stages it goes through. Because a lot will happen over the next couple of decades, and those who have been following the trends will be in a better position to take advantage of the new situation. The current prospects for the tech and its integration into the market are already quite attractive. Many companies have been exploring the market in even more detail lately too, and have been doing their best to make the situation more attractive for their users.

- Over the last few years, digital assets did not appear to fall within scope of French law or regulation as they could not be characterised as e.g. currency, electronic money, financial instruments.

- Four years ago, 51% of deals were for US-based companies while only 2% went to China based companies.

- As a result the global blockchain market size is expected to expand from USD 3.0 billion in 2020 to USD 39.7 billion by 2025, at an effective Compound Annual Growth Rate of 67.3% during 2020–2025.

- This may lead to a firm growth in contactless transactions and redesigned financial services.

- Investors purchase the crypto-assets , instead of shares, using either cryptocurrency or fiat currencies such as US dollars.

Because of this, we’ve seen the rise of many integrations of blockchain tech into various aspects of the current market, and this is something that will likely continue in full force as well. Blockchain is already enjoying an established place in many areas of the market, but it will take a while before it’s fully reached its potential. Until then, we’re likely going to see variouscompanies attempting to use it in new and different ways, and not all of those will be successful in the long run. But what truly matters here is that we pay attention to not only the successes, but the failures as well. Identifying the cause for each of those failures is going to be crucial in the long term when it comes to ensuring that we’re using blockchain to its full potential. A final trend we will see in 2021 and beyond is that regulators will intensify their search for stricter and tighter regulation.

Payments Industry Intelligence

However, there are often gaps in record keeping of digital assets that may result in difficulties about determining even threshold considerations, such as the property’s basis. Further, it is often difficult to classify the receipts generated from the holding and selling of digital assets. Typically, attempts to classify such receipts require an analogy to more traditional intangible property. But digital assets do not always have straightforward analogous traditional counterparts. Digital assets may have characteristics of several categories of traditional intangible property, or may have no analogous counterpart at all. For example, for U.S. tax purposes, the Internal Revenue Service has taken the general position that digital assets are treated as property .

An acquirer of a blockchain target may, however, find additional potential risks, including those related to a more pronounced reliance on open source software, and a greater likelihood of a target being subject to patent litigation claims. The following are a sampling of IP rights considerations that should be kept in mind when performing IP due diligence of a blockchain target. A number of U.S. sanctions targets, most notably, Iran, North Korea, Russia, and Venezuela, have attempted to use blockchain technology to either circumvent U.S. sanctions or engage in malign activity that U.S. sanctions target. Even though this case arises out of significant allegations of criminal AML activity, the court’s interpretation of relevant laws appears to suggest a default assumption that money transmission licenses are required to receive and transmit virtual currency.

Again, therefore, to adopt a traditional concept, the smart contract is akin to a Letter of Credit. Niches of risk transfer such as parametric insurances (e.g. crop insurance triggered by pre-determined weather data parameters) or Insurance-Linked Securities have obvious potential. The nature of many contracts, with a variety of parties and obligations being impacted by single triggers, is ripe with potential for distributed ledgers.

Digital transformation, built on the IT cornerstones of cloud, mobile, social and big data is affecting all industries. Depending on the specific implementation, blockchain technologies offer a number of benefits to users including transparency, immutability and process simplification. Use cases for blockchains span areas as diverse as payments, share trading, identity management, voting and supply chain management. “Chain reactions”, two articles from our 2016 Annual review, explain what blockchain, the ‘Computationally Efficient Trust Engine’ is and explore its impact on lawyers. In a new paper Nivaura CEO and Product Architect Dr Avtar Sehra, Allen & Overy debt capital markets partner Phil Smith and Phil Gomes, Senior Vice President of U.S. B2B Digital for communications marketing firm Edelman, explore the dynamics within the market for initial coin offerings . The SEC’s initiatives involve the creation of a new ‘Cyber Unit’ which will work as part of the SEC’s Enforcement Division and the creation of a ‘Retail Strategy Task Force’ which will develop initiatives to identify misconduct that impacts retail investors.

Volatility and uncertainty sparked by COVID-19 has led many corporates to pull back from some of their more long-term DLT-related projects for the time being. These long-term strategic projects, in particular those requiring changes to market structure or regulatory changes, are mostly working to extended timetables now. Budgets for purely experimental and R&D projects – run in isolation from the business- are becoming harder to obtain and have been cut this year. Therefore, both acquirers and targets should consider including their respective IT experts in the due diligence process and make sure they analyze the costs and practical realities related to effectively retrofitting a blockchain-enabled technology into the acquirer’s IT infrastructure. At least at some level, while developers work with operations and finance experts to develop a long term, comprehensive integration plan, maintaining separate operating systems might be the preferable choice. Typically, technology integration is the most challenging and costly element of any blockchain M&A deal. Serial acquirers often have a well-established integration process; however, no two integration programs are exactly alike, and the integration of fast-growing blockchain companies often requires reshaping traditional strategies that allow the target to maintain some autonomy but also actively participate in the integration process.

investment company cannot register with the SEC without obtaining exemptive relief, which the SEC infrequently provides. Although not required by law , many MSBs also establish and implement policies and procedures specifically addressing the identification and verification of beneficial owners of legal entity customers. Coinbase, for example, obtained a broker-dealer license, an alternative trading system license, and a registered investment adviser license through its simultaneously announced acquisitions of Keystone Capital Corp., Venovate Marketplace, Inc., and Digital Wealth LLC in 2018. Similarly, Kraken acquired UK-based Crypto Facilities Ltd, an entity registered with the UK’s Financial Conduct Authority, which allowed Kraken to offer its customers the ability to trade digital asset derivative products beyond the U.S.’s trading‑hour limits and expand its European customer base. As is characteristic in regulated industries, there are a host of registrations, licenses, no-action relief, and other approvals that may need to be obtained prior to expanding operations in new jurisdictions or rolling out a new regulated blockchain-enabled product. Acquisitions by larger players focused on absorbing smaller startups to integrate IP and know‑how into their own platform, known as “bolt-on” or “tuck-in” acquisitions, have become a key part of the playbook in blockchain M&A.

Peer-to-peer platforms where the actual transaction is conducted outside the platform without it coming into possession of any VA at any point in time, are not covered under the above definition of VA Exchange. VA Exchanges that are already regulated as a licensed corporate in the current opt-in regime are also exempted. Dedicated one-on-one briefings with journalists to give them the chance to understand the complexity of blockchain and the role your company/startup wants to play in the ecosystem. Listen to the full podcast to hear more valuable marketing insights from Patrick and find out what it’s like to work at one of the world’s leading blockchain organisations.

For example, smart contracts can manage the supply chain, and ensure ethical sourcing of healthcare products. Equity funding to crypto and blockchain companies overtook Initial Coin Offering funding in 2019 as the ICO boom collapsed under regulatory scrutiny.