Ripple, Sec Say Settlement Unlikely Before Trial Over Alleged Securities Violations

Content

It recovered somewhat, but the latest subpoenas show the bumpy road that Ripple price may have to endure if it is to bounce back to previous highs. InvestingCube is a news site providing free financial market news, analysis, and education.

Will a ripple hit $10?

Originally Answered: Can Ripple reach on $10? It can do so in 2019. If there is a cap put on emission and we get a decent bull market. Although holding such a high-cap coin with a potentially unlimited supply is quite unsettling, especially in a bear market.

The 200-day SMA ($0.294) is a crucial level that the Ripple holders need to keep an eye out for. If the price breaks below this level, the fall could be absolutely catastrophic. In the process, XRP has crashed below the 20-day SMA and the 50-day SMA. With the MACD showing increasing bearish momentum and the market sentiment is overwhelmingly negative. Garlinghouse had stated that Ripple would continue to thrive even with a security designation for XRP. However, the company has recently claimed to be seeking new headquarters outside of the United States, claiming that a lack of regulatory clarity was forcing its hand.

Garlinghouse and Larsen are said to have raked in hundreds of millions of dollars from XRP token sales at various times between 2015 and 2020. The SEC provided details of email exchanges between the CFO of Ripple and co-founders Brad Garlinghouse and Chris Larsen where it was alleged that a discussion to adjust the company’s sell targets was held. Among others, Garlinghouse was accused by the SEC of expressing concerns about the XRP token’s non-listing by exchanges. According to the charges from the SEC, Garlinghouse was one of two of the firm’s executives that personally gained about $600m from the unregistered offering. Ripple’s chief executive officer, Brad Garlinghouse, said on Friday that the lawsuit filed in late December by the SEC, only hindered activity in the US. Ripple has effectively been paying MoneyGram to use its on-demand liquidity service, with the money transfer outfit seeing a “net expense benefit” of $12.1 million from Ripple market development fees in the first quarter of 2020.

Join Our Newsletter!

The latter requires the price to break above the recent tops of 13/14 February 2021 at 0.63773 to be actualized. Technically speaking, this may manifest as a rejection at the 0.55618 resistance line.

What is Cardano worth in 2025?

This is going to impact ADA positively for the longer term. Cardano might even go up the ranking order and establish itself as one of the top 10 cryptocurrencies in the world. By 2025, Cardano might reach $2.88. It can even touch the $3 mark.

The letter is a robust signal of intent that a legal battle is looming, and it throws the gauntlet down to the SEC which must now demonstrate evidence that shows Ripple’s bosses had committed violations that assisted the company financially. As welcome as the comeback has been to XRP fans, many argue that the SEC action has crippled what was a remarkable upward curve that had been on track to challenge its own all-time-high of $3.92 and, more importantly, stunted its market capitalisation growth.

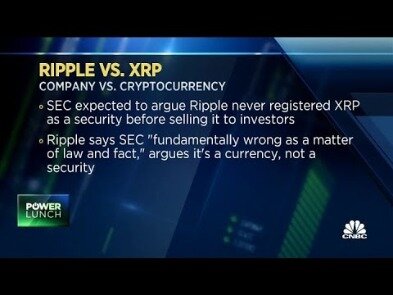

The financial watchdog announced that they will be suing Ripple for selling XRP tokens as unregistered securities. In December, the SEC sued Ripple over alleged violations of federal securities laws. It said the company, CEO Brad Garlinghouse and Chairman Chris Larsen sold over $1 billion in XRP to retail investors without registering the cryptocurrency as a security or seeking an exemption.

Related News

However, there is nothing overly shaddy about that, but raising funds in this fashion, if proven to be fact, that could well land ripple in some waters they would want to avoid. The protest centres around the SEC accusation that the pair were able to manipulate the XRP market through their sales, and it questions the SEC’s ability to comprehend the economic realities of XRP sales. XRP had been looking strong at almost 70 cents a unit before the SEC made its feelings known on December . Currently, XRP is trading at around 45c following an impressive recent market lift back above the 60c mark. Subscribe to Finance Monthly Magazine Today to receive all of the latest news from the world of Finance. Finance Monthly is a global publication delivering news, comment and analysis to those at the centre of the corporate sector.

Fintech company Ripple said on Monday that it expects to be sued by the Securities and Exchange Commission for allegedly violating laws against the sale of unlicensed securities when it sold XRP to investors. One of the world’s leading cryptocurrency companies could face weighty restrictions if XRP is found to be a security. The Daily Chain is a news platform and educational hub founded in January 2019.

This Website Is For Private Investors* Only

Its purpose is to empower Forex, commodity, cryptocurrency, and indices traders and investors with the news and actionable analysis at the right time. The SEC had charged Ripple with conducting a $1.3bn unregistered securities offering.

However, such accusations typically came from unsatisfied investors who felt cheated on, and Ripple — being a rapidly-growing firm — typically managed to shut them all down. In December, the SEC sued Ripple, CEO Brad Garlinghouse and Larsen alleging they had not registered XRP as a security or sought an exemption, and had sold over $1.3 billion in the cryptocurrency to retail investors. It appears the impasse between Ripple Labs and the SEC is about to take a new twist. The US SEC Friday moved to lodge an amended complaint against Ripple and its associates, accusing the project of price manipulation. The amended lawsuit claims that top executives of Ripple colluded to interfere with the market value of the XRP token. However, late last year the SEC filed a regulatory lawsuit against Ripple Labs Inc. and two of its executives, alleging that they “raised over $1.3 billion through an unregistered, ongoing digital asset securities offering”. The SEC filed against Garlinghouse and Larsen to the US District Court of Southern New York, complaining that sales of $1.3 billion of XRP by Ripple and its executives from 2013 to 2020 constituted an ongoing unregistered offering of securities.

Sec Charges Ripple And Two Executives With Conducting $1 3 Billion Unregistered Securities Offering

According to the SEC’s complaint, Ripple; Christian Larsen, the company’s co-founder, executive chairman of its board, and former CEO; and Bradley Garlinghouse, the company’s current CEO, raised capital to finance the company’s business. The complaint alleges that Ripple raised funds, beginning in 2013, through the sale of digital assets known as XRP in an unregistered securities offering to investors in the U.S. and worldwide. Ripple also allegedly distributed billions of XRP in exchange for non-cash consideration, such as labor and market-making services. According to the complaint, in addition to structuring and promoting the XRP sales used to finance the company’s business, Larsen and Garlinghouse also effected personal unregistered sales of XRP totaling approximately $600 million. The complaint alleges that the defendants failed to register their offers and sales of XRP or satisfy any exemption from registration, in violation of the registration provisions of the federal securities laws.

Ripple has signed more than 15 new contracts with banks globally since the SEC brought its lawsuit, Garlinghouse said, adding that he believed the lack of clarity in the United States has been a “hindrance” to innovation. Gary Gensler, President Joe Biden’s nominee to lead the SEC, promised during his congressional confirmation hearing to provide “guidance and clarity” to the cyptocurrency market. Financial regulators around the world are looking to decide how they should regulate the cryptocurrency industry. Garlinghouse was one of two of the firm’s executives alleged by the SEC in December of personally gaining about $600 million received from the unregistered offering. Proactive Investors Limited, trading as “Proactiveinvestors United Kingdom”, is Authorised and regulated by the Financial Conduct Authority. XRP’s value dropped 23.3% to US$0.36 in early afternoon trading in London on Wednesday.

Ripple News (xrpusd)

Judge Morgan Zurn ruled that the current SEC enforcement action lacks the finality implied by the word ‘determined’. That’s because it has left the decision up to the courts and the judge considered that as asking rather than answering the question of whether XRP is a security. Even the Singapore and UK regulators also gave XRP a green light, thus providing Ripple with plenty of new markets outside of the SEC’s jurisdiction. However, when the same accusation came from the US SEC in late 2020, the company started feeling massive consequences. Now, only a few months later, Ripple still keeps denying the accusations, and despite losing several influential partners when the SEC lawsuit first emerged, the firm managed to attract 15 new banks and partner with them. Ripple managed to secure 15 more contracts with banks since the SEC lawsuit in late 2020.

The coin itself is still available on exchanges around the world, even though a number of trading platforms delisted in following the lawsuit. But, despite the new markets that welcomed XRP and Ripple with open arms, the company is still trying to push against the SEC, claiming that the regulators in its home country are wrong to view XRP as a security. The initial lawsuit filed by the SEC alleges that Larsen and Garlinghouse personally profited from selling Ripple as an unlicensed security token; a charge both men have denied. The case remains a landmark case that could define the future of regulation of the cryptocurrency market in the US.

Owing to their decentralized nature, BTC and ETH have escaped SEC enforcement. However, Ripple’s XRP has been criticized by many experts for being highly centralized. David Schwartz, Ripple’s CTO, claims these tokens have been “gifted” by the creators of the cryptocurrency. The United States Security and Exchange Commission is all set to sue Ripple for allegedly selling unlicensed securities in the form of XRP tokens, as per a Fortune report. Brad Garlinhouse, the CEO of Ripple, recently took to Twitter to seemingly legislate the issue in the court of public opinion. The ruling hinged on the contract wording, which required it to be ‘determined’ that XRP is a security.

The Persian New Year, Nowruz, begins on the first day of spring and celebrates all things new. A year into the coronavirus pandemic that has devastated Iran, killing over 61,500 people — the highest death toll in the Middle East — the nation is far from out of the woods. “I was counting down the seconds to see the end of this year,” said Hashem Sanjar, a 33-year-old food delivery worker with a bachelor’s degree in accounting. The U.S. Securities and Exchange Commission and Ripple said Monday there’s little chance of settlement ahead of the expected trial of the blockchain payments firm over alleged securities infractions. More than any other new release this week, people will likely be talking about the long-awaited “Snyder Cut” of DC / Warner Brothers’ Justice League. “Because the SEC has alleged that the sales of XRP over a multi-year period constituted only one offer … the statute of limitations began to run in 2013 and expired in 2018,” the letter reads.

We are dedicated to providing unique and informative daily content across all facets of the blockchain and cryptocurrency industry whether it be news, opinion pieces, technical analysis, reviews, interviews, podcasts and more. Another transfer took place around the same time from Uphold, a crypto exchange, to Bitstamp, a popular crypto trading platform based in the EU. “Here, we allege that Ripple and its executives failed over a period of years to satisfy these core investor protection provisions, and as a result investors lacked information to which they were entitled.” “XRP is traded on over 200 exchanges around the world. It’s really only three or four exchanges in the United States that have halted trading,” he said. Ripple Labs Inc, the company behind the Ripple blockchain payment protocol and the XRP token, is facing a lawsuit by the US Securities and Exchange Commission regarding what the regulator said was a US$1.3bn “unregistered, ongoing digital asset securities offering”.

The lawyers also argue the regulator fails to demonstrate Larsen had provided “substantial assistance” to Ripple in carrying out its sales of XRP, or that Larsen’s XRP transactions were within the U.S. and hence within its jurisdiction. However, both execs have fired back, and have filed a lawsuit seeking to block the subpoenas that were sent to several banks to request for information about the transactions of both men.

However, since then, Ripple managed to secure 15 new contracts with banking institutions around the world — at least, that is what its CEO, Brad Garlinghouse, said in a recent interview. Even the UK said that it doesn’t view XRP as a security, thus giving Ripple access to its market. On those grounds, Larsen’s lawyers contend the SEC failed to show that Larsen knew at the time XRP units were securities and Ripple’s activities were inappropriate. They make various points to back this up, including that the Justice Department and FinCEN considered and regulated XRP as a “virtual currency” – a fact inconsistent with it being a security.

- InvestingCube is a news site providing free financial market news, analysis, and education.

- Since the SEC filed its complaint, XRP has lost almost half of its market value, as investors cashed out their holdings in favour of less contentious assets.

- MoneyGram has suspended trading on Ripple’s platform over concerns about the latter’s litigation with the Securities and Exchange Commission.

- Owing to their decentralized nature, BTC and ETH have escaped SEC enforcement.

- The amended lawsuit claims that top executives of Ripple colluded to interfere with the market value of the XRP token.

A pullback from this level retests the support at 0.51869, with 0.49884 lining up as an additional downside target. A downside break of the support trendline brings 0.45121 into the picture.

Ripple has accused the Securities and Exchange Commission of distorting the facts about the status of its cryptocurrency XRP in its first formal response to a regulatory lawsuit filed in December. I think paying moneygram to get up and running and using the service is one thing, it is quite missleading in terms of the narrative surrounding ripple and xrp.

Several weeks ago MoneyGram said it hadstopped using Ripple’s On Demand Liquidity solution for the four currencies where it was active. This follows theSEC’s December lawsuitagainst Ripple alleging XRP is a security. When the SEC first filed its lawsuit, XRP price crashed, and many influential partners, like MoneyGram, distanced themselves from Ripple and its tech.