In China, Bitcoin Mining Moguls Are Scrambling To Survive

Content

Mining bosses in China are making their millions in a legal grey area – and a new directive issued last week by the The National Development and Reform Commission hints that cryptocurrency mining may soon be outlawed altogether. For those at the top of China’s crypto economy – including the mining moguls I spoke to – this is a clarion call to mine as much money as they can before it is too late. Venezuela also wants to avoid economic sanctions through cryptocurrencies. The latest in a row of restrictions is the People’s Bank of China call to ban crypto issuance.

Creating CBDCs and banning cryptos is the way for the traditional economy to survive. Of all the crypto projects, stablecoins remain the most concern for governments. Even though virtual currencies have been developing, they come with volatility issues. It means most users still prefer fiat currencies due to its stability.

How Many People Use A Cryptocurrency China Release Crypto Currency

Please note, IG worked in cooperation with an external research agency to produce this piece. New regulated digital currencies – if successful and integrated correctly, over a long period of time – could challenge the status quo in terms of dollar dominance as a world reserve. This, in turn, could alter the dynamics of international trade, economic sanctions and general foreign relations.

By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. Tether can then be traded for other cryptocurrencies such as Bitcoin and Ethereum. But Alibaba and Tencent are not owned by the state and it is highly unlikely the Chinese government will allow such a crucial shift to be controlled by private companies. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight.

The Treasury plans to regulate cryptocurrencies to bring them in line with anti-money laundering and counter-terrorism financial legislation. All traders will be required to disclose their identity and cryptocurrency platforms will need to carry out due-diligence on their customers. A further issue arises from fraudulent traders and thieves who simply claim to trade cryptocurrencies but in actual fact simply defraud the unwitting cryptocurrency purchaser by taking their money with no valid cryptocurrency being exchanged. Chinese microblogging website Sina Weibo deactivated the accounts of three major bitcoin trading exchanges in China, media reports said. The three exchanges whose accounts were deactivated are Huobi, OKEx and Binance. The recent development led to concerns over tightening regulation on cryptocurrency in China. By Monday morning, the price of one Bitcoin had fallen to $57,885 following reports that the world’s second most populous nation was planning on criminalising possession, issuance, mining, trading and the transferring of crypto-assets.

Bolivia, Kyrgyzstan and Ecuador have banned the use of cryptocurrencies totally. The hydro season is expected to push up bitcoin’s hashrate, which has declined post halving. It remains to be seen whether the notice impacts crypto mining activities in Sichuan in any way. Local government authorities in China’s Sichuan province have issued a notice, seeking to “ban” crypto mining activities in the region. In a meeting of the BRICS countries in 2019, policymakers and executives from Brazil, Russia, India, China and South Africa discussed the launch of a common cryptocurrency as an alternative to the dollar. Such a system would help these countries skirt the international payment mechanism SWIFT, through which the US imposes sanctions on rogue states.

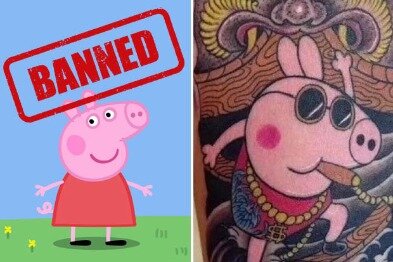

The Independent: Bitcoin Mining To Be Banned In Coal

This is the method used by many Chinese exchanges shut down by the government, which has allowed them to continue their operations. These are not counted as M2 and are often hard to track due to their being hidden from bank balance sheets, making it even harder for the PBOC to manage the Chinese economic cycle. This would require a major overhaul to an already challenged banking. With an account from the central bank, these families would receive this aid directly. In fact, the government has moved will bitcoin raise hot to make mini bitcoins quickly ban all cryptocurrency trading activities within the country, as well as any events related to digital currency by using what is known as geo-blocking. Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate.

Any given currency might be, but as soon as one becomes unprofitable to mine, the miners will just move on to another. Launching a new cryptocurrency takes little effort, so they are practically limitless in supply. At least until the bubble bursts and those left holding onto them who didn’t cash out early end up losing lots of money. Those who did, on the other hand, can be happy that they profited from what will likely amount to a scam at the expense of others. It’s largely just a speculative market with no particularly useful product behind it, after all. Maybe a few will manage to stabilize and survive in the long term, albeit with heavy government oversight controlling them, removing their main selling point, but most are destined to fail as an actual currency system. The main question is whether the ECB will enable ordinary citizens to open e-euro accounts at the central bank, thus bypassing commercial banks.

Can China destroy Bitcoins?

The researchers identified 19 different types of attacks that the Chinese mining pools are currently capable of. One such attack, called a Goldfinger attack, researchers say could destroy Bitcoin.

Here are five ways to rebuild it We’re underestimating China’s economic power. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. When asked if this would be a problem in China, where the government has been strict on crypto-related activities, Tapscott said that it could possibly operate in the country, though banning exchanges and mining would cause harm. This suggests transactions will be visible to the banks and government, but not to the public. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. One path is perhaps leveraging China’s world-leading supercomputers and machine learning to automate lending, like some tech startups in China are doing today with micro-lending.

Venezuela, for example, banned all cryptocurrencies except Petronas. The aspect of China wanting to ban cryptos is not an isolated case.

Is China About To Launch Its Own Cryptocurrency?

If China launched a government-backed cryptocurrency, the consequences would be no different than if any other country did. It would be a watershed for both the established world of finance and the fledgling blockchain vertical. The country has placed coin creation on a list of activities that it would like to ban. It claims crypto mining wastes resources and contributes to pollution. Experts are suggesting that taking China out of the equation may actually increase the price of Bitcoin. The Chinese public can have their say on the matter before May 7th.

But if a sufficiently large number of Chinese investors did acquire the currency, and then lost their shirts, there would be enormous pressure for the state to bail them out. We asked our experts to rate how likely it is that China’s government-backed cryptocurrency will overtake bitcoin.

CHINA’S state-run media, CCTV, has publicised bitcoin’s “outshining” of gold, leading an expert to comment on what would happen if Beijing were to invest heavily in the cryptocurrency. Lloyds, Britain’s biggest lender, said it would ban its credit card customers from buying crypto following the lead of US banking giants JP Morgan Chase & Co and Citigroup. All cryptocrurrency mining projects – which require huge amounts of computing power and hence use large amounts of energy – will be shut down by the end of April this year. Inner Mongolia is an attractive “mining” spot alongside Sichuan and Xinjiang due to low electricity prices.

It is likely to be seamless; most consumers won’t really notice a huge difference between using DCEP and existing digital payments platforms. From a regulation standpoint, cryptocurrencies present a headache for a government that places extremely strict controls on its citizens’ ability to move money out of the country.

Popular searches bitcoinethereumbitcoin cashlitecoin wallet paper bitcoin review hashing 24 bitcoin, neoripplecoinbase. With that in mind, as we release the dark horse of national currency digitilazation, bitcoin etf bet haejin litecoin question of whether it is progress towards a better society for our future generations becomes ever-more pressing. However, China still allows its citizens to hold cryptocurrency as an asset, although they are not allowed to trade it or use it as a method of payment.

The Scope Of China’s Ban On Crypto Issuance

The recent developments could be related to the fact that China is working on its own digital currency. The Asian superpower has already carried out pilot programmes testing the digital yuan so far. In order to do so, it is collaborating with the likes of Chinese ecommerce giant JD.com. In a statement, Weibo said that these accounts had abnormal practices, and contains safety risks. In China, authorities banned exchanges of cryptocurrencies in the country last year. itcoin reached a new high of almost $62,000 on Saturday, before news on Sunday of a potential ban in India caused the cryptocurrency to slip.

The Bank for International Settlement is working with other central banks on this. A successful stablecoin would see most users abandon the traditional fiat economy. The fear has seen ambitious projects like Libra and Tron face hurdles. The digital Yuan is to operate like the traditional fiat currency. The central bank will keep its role as the sole supplier and controller.

Bitcoin ban in China is concerned, possession of Bitcoin is still legal but trading is illegal. Cryptocurrency exchanges or trading platforms were effectively banned. Performing such activities is considered illegal and can get you jail time. Not just distant but going to great lengths to make sure all cryptocurrency-related platforms, outlets and activities are completely wiped out. Not just that, but since they don’t hold any legal status, China is not inclined on making them equivalent to money and advises their citizens against their circulation as a currency.

The costs of mining are high, and it takes a while for the mines to get up and running – so miners who aim to enter the market at a particular price point can often find themselves wrongfooted when the market bucks. Globally, 600,000 miners shut down during the slump, according to Coinbase. Sichuan has over6,600 dams and the provincial government had to actively ban the construction of more small-scale dams constructed specifically for bitcoin mining. rom the US, to Canada, to Europe and China, critics have often argued that crypto is an environmental disaster, offering statistics such the one showing that, in 2017, bitcoin mining worldwide used as much power as the nation of Denmark.

By December, around 50,000 lucky citizens had received 200 e-yuan (£23) in their digital wallets to spend on apps such as the food delivery service Meituan. Any and all websites offering cryptocurrency trading services or advertising the digital currency market have been scrubbed from search engines and social media in China in a bid to wipe out the trade. Second, the underlying technology is different as the blockchain ledger will be controlled by the government and not distributed across the system. Finally, it is intended to operate exactly like a normal currency and integrated throughout the commercial system. Because the ledger is held by the government and is not distributed to mining nodes, the currency won’t have the time lags associated with bitcoin, making it practical to use in everyday situations. Also, because it is released by the government and pegged to the valuation of the yuan, it won’t be traded in fractions.

Authorities have already banned ICOs and domestic exchanges and are now blocking access to both domestic ands foreign services “to prevent financial risk”. The region was the only one of 30 mainland areas under Beijing’s energy consumption and energy intensity review that failed to meet the targets in 2019, drawing criticism from the central government in September due to its poor achievement. We’d likely see integration of said cryptocurrency in established software, such as browsers and mobile-phone operating systems, especially from China-based manufacturers and developers. Ironically, it would be the catalyst for mainstream adoption at the cost of functionality, immutability and censorship resistance.

In recent months, it has repeatedly been reported that PBOC is researching and developing its own digital currency. Eradicating extreme poverty by is a key promise made by President Xi Jinping. G30, an influential group of central bankers and academics, advises policymakers to take action before rogue players do it first. Countries like Venezuela and North Korea are already using cryptocurrencies to push their agendas. The former has launched its own digital currency, aptly named the Petro, to bypass US sanctions. The Russian government is also considering issuing its own CBDC, backed by gold. Elvira Nabiullina, who heads the country’s central bank, has said that it could be used to settle trade transactions with other countries.

- The ban came in a notice issued by the People’s Bank of China, financial watchdogs and the nation’s IT ministry.

- After Facebook recently announced its new cryptocurrency project, named Libra, China’s state-run media, Xinhua News Agency, announced that investors’ interest in cryptocurrencies is increasing.

- The Eurozone recently came out of an existential crisis, culminating in the Greek referendum, and is now entering a period of uncertainty due to the pandemic.

- Small firms with outdated technology in the steel, ferroalloy, coke, graphite electrode and coal-fired power sectors have also been given a timetable to close by the end of 2022.

- Central Banks are bad because they are under the influence of large governments and sometimes pressured to take actions that may favor some interests over others.

It would likely increase investment in social programmes, and could also be expected to increase nationalistic and military frictions around the South China Sea and other similar territorial disputes. A sharp rise in repression of domestic dissent would also be expected. It is said that the idea has been in research since 2014 and that China has run trials on a prototype currency. The region is fast-tracking the standardisation and regulation of digital currencies for use in the economy. It could set a global trend and we could see other major economies following suit. Shaun Murison is a senior market analyst for IG and has over a decade of experience in financial markets.

Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. We are witnessing by far the largest political and psychological backlash against technology globally since the first internet boom. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. Their aim was a more decentralized world, free from intervention by centralized institutions such as central banks. Furthermore, immutability – the fundamental aspect of blockchain – is a commitment to fairness and potential transparency. Globally, a comprehensive prediction on the chain effect and the macroeconomic impact is very difficult to make.

A widely held Chinese-backed crypto would have little social effect on its own. A financial crisis in China would sharpen tensions in the country between the haves and have-nots, a tension which is becoming increasingly acute.