Icm Capital Trade Forex, Cfds & Commodities

Content

To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here. IC Markets is one of a handful of brokers that offer the cTrader platform developed for traders looking for a STP/ECN solution. For a list of forex brokers that offer the cTrader platform, check out our comparison of cTrader brokers. IC Markets is an Australian based ECN forex broker that is regulated by the ASIC. Traders have access to a wide variety of instruments in several markets like currencies, while commodity traders are offered a range of energies, metals and agriculturals. This is just a story fabricated by the regulatory bodies claiming that these brokers do segregate clients money. If a broker knows that it is going to go bankrupt, what can stop the broker from thrusting their hands into the clients fund to stabilize things?

Additionally, it offers high leverage and a wide array of financial instruments that traders can trade. However, as a UK based trader, it is disappointing that they don’t have offices here or are UK FCA regulated.

This figure applies to all its account types; cTrader account, Raw Spread account, and Standard account. Just like its trading fees, IC Markets’ non-trading fees are rather low. To start with, it does not charge its clients any inactivity fee . Marcus founded BrokerNotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. IC Markets offers over different instruments to trade, including over 60 currency pairs. We’ve summarised all of the different types of instruments offered by IC Markets below, along with the instruments offered by IG and XTB for comparison. Like most brokers, IC Markets takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

Both regulators seem to have similar strict requirements regarding client money. My main concern is losing all my funds due to a broker going bankrupt for some reason and then not being able see my money. I have read to many horror stories online with other brokers going broke and then the traders are forced to take action and go to court to try and get some of their money back. As prolific traders, we’re well placed to provide informed reviews on dozens of brokers. Today I’d like to offer you my honest review of Blueberry Markets. While researching, calculate the fees involved in relation to the amount of money you will realistically be trading with. Demo accounts which allow you to trade without using real money should help you with this.

Is Ic Markets Safe?

Three different account types are provided for the traders that are custom made to fulfill all the needs of traders. These accounts include “Standard,” “True ECN,” or a cTrader ECN” account, for traders to choose from. No regulations on trading, including the facility to place orders between the spread that is perfect for scalping and high-frequency traders. The first forex rebate providers were Chinese and catered to Chinese clients. In 2006 the company ‘FX Rebates’ arrived on the scene out of the USA, offering forex rebates to a global clientele.

Based on the reviews, both seem to have similar spreads, both are Australian related broker and hold an ASIC regulation. I certainly do disagree that unregulated brokers are better than regulated ones. As traders we have won the price war by screwing down brokers margins . This was a time when the spreads ranged anywhere from 0.1 to 2 pips on the EURUSD. If you’re trading multiple times per day, that spread really starts to eat into your profits.

A good side of the fact is that its trading fees are low and there is no extra fee for withdrawal. You can also find other options and reviews of thebest forex brokersor glance through our list ofbest CFD brokersthat our editorial team has reviewed this month, alongside other online brokers. A highly informative educational section is available for the traders to benefit from over which in-house research, video tutorials, and lecture-based articles are published.

The maximum trade requirements vary depending on the trader and the instrument. As IC Markets offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades. IC Markets offers their traders a wide variety of deposit options in 10 different currencies. These include AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, and CHF. IC Markets provides their traders with 3 different account types tailored made to accommodate each trader’s needs. Traders can choose from a “Standard”, “True ECN”, or a “cTrader ECN” account. The accounts have their differences, but basically all offer the same features.

They do so through the MetaTrader and cTrader respective apps offering your choice of platform on both Android and iOS. Again, the software is light and easy to run in all cases, and offers much the same experience as desktop trading with few of the details or functions lost with trading on the move. IC Markets utilizes the WebTrader from MetaTrader, and the cTrader Web Platform to provide for online, in browser trading platforms. Both are closely linked to their desktop variants and provide for the same great range of features and functionality for a seamless online forex trading experience. Considering desktop platforms first, IC Markets makes available all of the top choices in the field. All are highly respected in the forex trading sector and have been around for many years. There are also 31 drawing tools available through the brokers platforms which are of course well-known for being highly customizable.

Blueberry Markets Review

For instance, the spreads on its cTrader and MetaTrader can reduce to 0.0 pips. As for the commissions, different account types have different rates as shown in the figure below. IC Markets is one of the few brokers that offer both of the MetaTrader platforms; MT4 and MT5.

Both Standard, and the Raw Spread accounts can be converted to the IC Markets Islamic account on request. You will notice from above that IC Markets operates worldwide under a few different entities. Regardless of this, each of these operations prioritizes trader security and the protection of your funds. Of course, one of the most important factors when choosing a top forex broker to deal with, is security.

Trading Platforms

Customer service is available via phone, email and live chat, and all queries are answered promptly. Pepperstone requires no minimum deposit and offers low trading fees. The trading platform is native to eToro and has been designed with new traders in mind. If you have other issues regarding accounts, marketing or affiliate issues there are dedicated email addresses for these departments that you can find on the contact page. Should you need help more urgently, they also offer a 24/7 live chat support feature meaning you can get in touch with IC Markets whenever you want, around the clock. Luckily, IC Markets has a huge amount of different client support options, so you never have to be worried about not getting in touch with them.

On the other hand, it offers charting features with decent customization capability. Even though IC Markets is not publicly listed on any stock exchange, the company maintains a good reputation as a low fee trading platform. Their MT4 platform and its availability are on all types of devices. The emails were promptly replied to, at max, it takes a day to get a reply. Their Help Center was able to answer most of the common questions asked.

As a platform, it has all the standard educational resources and research tools. It is regulated by the FCA and listed on the London Stock Exchange. It has excellent education tools, good customer service, a regular news flow and useful search functions. Established in 1999 and owned by Jefferies Financial Group, FXCM is both safe and regulated. This is especially important while you familiarise yourself with the platform.

Educational Services:

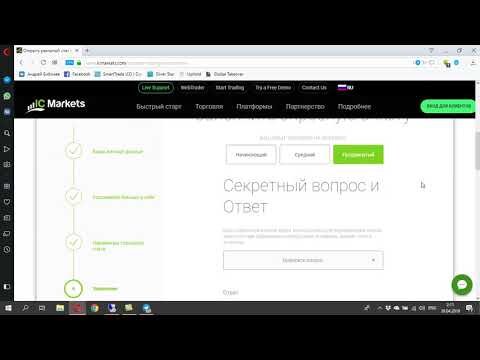

You will be asked to input your personal details including your official name, email address, and phone number. The next and final step in this process is the trading account configuration, after which you can start trading on your demo account. As for the swap rates, they are applied for positions held overnight. One can find these rates at either the company’s cTrader or MetaTrader trading platform. CFDs are leveraged products and can result in the loss of your capital. IC Markets has a BrokerNotes A support rating because IC Markets offer over three languages and email support.live chat support.

For instance, the spreads on its cTrader and MetaTrader start from 0.0 pips. For instance, the EUR/USD has an average spread of 0.1 pips. As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website. IC Markets allows you to execute a minimum trade of 0.01 Lot.

It began trading in 1974 and is one of the biggest CFD brokers in the world. It has good resources, but high forex fees and financing rates. There is no minimum deposit, but the trader needs to have funds available to buy and share. XTB uses its xStation 5 platform, which offers good customisation, search functions and modern design. With over 2,000 stocks, Plus500 is an easy-to-use platform with lots of educational material, a demo account and customer service 24/7.

- It offers MetaTrader 4, MetaTrader 5, and its platform, cTrader.

- I certainly do disagree that unregulated brokers are better than regulated ones.

- IC Markets offers additional trading products such as social trading integration with popular social trading platforms, ZuluTrade, and MyFXbook.

- There are ten base currencies you can choose from as your preferred currency to trade with.

- Quite good and fast customer suport, fixed my problem easily and very kind.

The customer support can be reached by calling the global telephone support hotline, sending an email, or using the live chat. During that part of the week, the support is staffed around the clock. This platform is available for both traditional desktop and mobile touch-screen devices.

If you continue to meet this monthly number of trades, then your free VPS service will continue. In terms of additional products or features that IC Markets offers, this is what we have found.

Its customer service is quick and efficient, and the educational material is considered some of the best. Markets.com was established in 2010 and is regulated by the FCA and ASIC.

What Methods Can I Use To Deposit Funds At Ic Markets?

IC Markets rebates are a portion of the transaction cost that is paid back to the client on each trade, resulting in a lower spread and improved win ratio. For example, if your rebate is 1 pip and the spread is 3 pips, then your net spread is only 2 pips. If you do not have the extra capital that you can afford to lose, you should not trade in the foreign exchange market. IC Markets has a mobile app that is utilized in all its available platforms. The MT4, MT5 and cTrader platforms are accepted in iOS and Android devices.

I once forgot my demo account password and could not find out the reason why. Luckily, there was a Live chat and here is Samantha White who helped me a lot. With quick response, She did a very good job by showing me a lot more useful information. Davano was really helpful his assistance cleared all my concern truly happy with his customer service. We appreciate your feedback as we are consistently working to improve our services. I’ve had duplicated trades a few times and the CS team seemed adamant on blaming me for the error.

Monthly cash back Payments are credited and sent automatically by the 12 of the month following the month rebates are earned in. Spread or commission reduction The trader actually receives reduced commissions and/or spreads. This is an exciting option offered by some of our top brokers. Paid direct to brokerage account Cashback is credited directly to the trader’s brokerage account, typically between 1-7 days after the trade is closed. This is another exciting options offered by some of our top brokers. In the case of the ‘Monthly cash back’ rebate option, monthly payments can be paid via bank wire, Paypal, Skrill, Sticpay, Entropay, China Unionpay, and Neteller.