How To Spot An Investment Scam

Content

Cryptocurrencies are virtual peer-to-peer currencies that are decentralised. This means the currency only exists online and is not controlled by a bank, treasury or country – you can’t get physical notes or coins from the bank. The scammer pretends they’re representing a legitimate and trusted investment group, but they’re lying. Investment scams are getting harder to spot but there are some telltale signs to help protect your hard-earned money. Brightblue is a specialist marketing ROI consultancy. Our experience ranges from consulting to market mix modelling to global media budget setting and optimisation. We take a clear, dynamic and commercial approach to ensure results are used to maximum effect.

Let’s say that you opened a position on BTC with $200,000 and the price jumped 100%. You as a trader would make $200,000 in profit but return the $100,000 you took from the exchange, plus around $10,000-$50,000 as commission for using the leverage. This is a very technical explanation, but let me try and break it down into pieces.

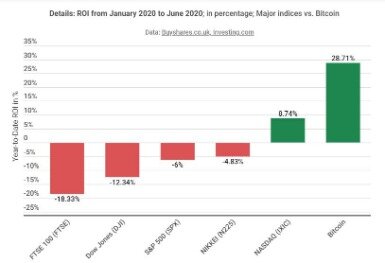

Return of investment refers to a financial metric that is mostly used to determine the probability of gaining a profit from an investment. The ROI which is expressed in percentages compares the gain or loss from an investment relative to its cost. This metric is important as it helps in evaluating the potential return from a stand-alone investment. NIKKEI’s returns stood at -4.83% followed by S&P 500 with a Return of Investment at -6%. On the other hand, Dow Jones had the fourth highest returns at -12.34%. The NASDAQ index had the highest Return of Investment at 96.77% with 4,958.47 points five years ago while on June 26th this year, it stood at 9,757.22 points. The S&P 500 had the second-highest ROI at 46.23% with 2,057.64 points five years ago, while in 2020 it stood at 3,009.05 points.

How Is Investing In Blockchain Companies Different From Traditional Investments?

This refers to the ending value of your bitcoin investment as of the Closing Date. This is the measure of loss or gain generated by your bitcoin investment when made on the Starting Date and sold or traded on the Closing Date. This refers to the date when a bitcoin investment was made. Analyst Justinas Baltrusaitis says Bitcoin’s return on investment from 2015 to 2020 puts the digital asset ahead of many traditional markets.

The increasing popularity in cryptocurrency has seen more traders inject new money into the digital currency market. For the last decade, investing in cryptocurrency, particularly bitcoin, has outperformed highly profitable markets, including bonds and stocks. However, investing in bitcoin can be quite intimidating, especially when you are new in the market and cannot keep track of your investment. While some individuals are intimidated by the technicality of bitcoin investment, most investors are making great returns on their investment.

They work by sharing processing across different systems to allow the computing to be done. However, there are also some disadvantages to blockchain technology.

Why Is Now The Best Time To Invest In Crypto Mining?

Gold is one of the most stable traditional investments, but the ROI is less than spectacular. You can expect an 11% annual return on average, or even less. Note that the content on this site should not be considered investment advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Is Bitcoin a bubble?

Bitcoin and other cryptocurrencies have been identified as speculative bubbles by several laureates of the Nobel Memorial Prize in Economic Sciences, central bankers, and investors. In November of 2020, Bitcoin again surpassed its previous all time high of over $19,000.

Here at Easy Crypto Hunter we offer only the most premium and powerful hardware on the market. If you’re entering into the world’s fastest moving industry, you want a Lamborghini, not a Ford Focus. Our hardware is made up of ultra premium components which give investors the highest performance, flexibility and asset value retention. Each bit of hardware is rigorously tested before reaching you and also comes fully PAT tested and with all of your relevant mining accounts set up. Each bit of hardware isrigorously tested before reaching you and also comes fully PAT tested and with all of your relevant mining accounts set up.

Cryptocurrency: Investing, Trading And Mining Cryptocurrency

Lost in all the noise of the past few years, which many refer to as “crypto winter”, is how professionalized the industry became during that time. Even Mr. Dimon’s own company, JPMorgan, is investing in Bitcoin, offering banking services to crypto companies such as Coinbase, and even building their own cryptocurrency. Any innovation or technological change to bitcoin will have an impact on its rates. For example, the integration of Bitcoin with PayPal services has had an influential impact on the demand for bitcoin, resulting in changes in the prices of the cryptocurrency. Bitcoin is very volatile, which is why any form of attention in the news will affect its rates. Negative news on the cryptocurrency, for example, has had a negative impact on the prices of bitcoin. However, some negative news has been known to popularise the digital currency.

However, its share of the market decreased dramatically from over 87% to just 35% due to the even bigger gains in other currencies. Bitcoin and the market also both finally surpassed their values from 2014, but interestingly only 4 of the top 10 coins would still be in the top 10 in 2018, fewer than in 2016. However, you would have made a profit on every currency except PayCoin, including joke cryptocurrency Dogecoin, which would have yielded a profit of $9,119. However, if you’d stayed invested in all top 10 coins, the total value of your $1,000 investment would have grown to $72,587.55 lead by Stellar Lumens, Ripple and Litecoin. Interestingly, despite the market contraction and price decrease, Ripple increased it’s market cap by just over 200% YoY due to an increasing amount of the currency in circulation.

In fact, providing it becomes globally successful in the future, it will change the way marketers buy media online. This is because it makes purchases cheaper and much more transparent, all the while offering more security. Equally, this will also allow for a production of better quality data that leads to more accurate analysis on online media. For more information on blockchain technology, the pros and cons and more information on what it is more broadly, click here. Blockchain technology is a digital decentralised ledger that records and safely stores transactions – think of a really secure database. Originally it was created to support Bitcoin where all transactions are recorded however, it has since found a new path in the digital advertising world. Essentially it is this technology that underpins cryptocurrencies which can be applied to ad transactions, thus allowing large amounts of data to be transmitted securely.

But, cryptocurrencies also allow you to pay for or sell something anonymously, so they also appeal to scammers and shady online dealers. Bitcoin is the most famous cryptocurrency, but there are more than 1,500 cryptocurrencies including other well-known ones such as Ethereum and Litecoin. For marketing analytics, we see the major benefit to stem from access to more detailed data, both on the channel side and performance side. This will mean that major opportunities will arise in analysing much more detailed impacts and the ability to assess performance across different consumer types. For example, instead of looking a TV’s total ROI, it could be broken down to assess the ROI of copy rotation, day of week, time of day, channel , and so on.

What Is A Bitcoin Investment Calculator?

If you are hosting your mining farm with us, it will be located in our secure facility in Finland. You can keep all or choose to sell your coins in the medium to long term.

Rethink your investment and consider blockchain companies instead. You’ll be fortunate to bring home a 10% ROI in real estate, especially in the wake of COVID-19. Not to mention all the documents, red tape, and improvements and repairs you have to struggle with before you can even sell a property.

Meaning we can mine the coins which generate the best returns for our clients. So rather than investing in Bitcoin mining, Crypto mining has historically generated substantially higher returns.

Here is a step by step guide on how to go about the use of this simple bitcoin investment calculator. This is the date when the investor sells the bitcoins. It is also used to indicate the time when the investor estimates the holding value of their bitcoin investment. Fraudsters now use platforms such as Facebook, Instagram and Twitter to lure people into investing in cryptocurrencies, foreign exchange and binary options. The scammers often have convincing social media profiles or websites with bogus reviews. Quick transaction times is one of the reasons people like cryptocurrencies.

Bringing a human touch to Crypto, we are your one stop shop for all your mining needs. Easy Crypto Hunter is not a financial advisor and cannot guarantee any mining return figures. We can only use the figures we have personally seen from rigs averaged over given time frames. Due to the changing nature of cryptocurrency, we cannot guarantee any future earnings figures. We have no control of the external market, but we’re going to be here every step of the way with you and it’s exciting we’re all on this journey together. we are able to take advantage of this ever changing market.

- While getting into the market in 2015 was better than 2014, things still didn’t exactly look great one year later.

- Bitcoin and the market also both finally surpassed their values from 2014, but interestingly only 4 of the top 10 coins would still be in the top 10 in 2018, fewer than in 2016.

- Easy Crypto Hunter is the UK’s premier GPU mining rig provider.

- Every single currency saw declines over the year, with Ripple performing the least poorly.

Not to be left out are other leading altcoins, such as Ethereum and EOS, which have seen recent spikes in price as well due to rising demand with no end in sight. In layman’s terms, this effectively means that crypto should have been a part of everybody’s investment portfolio over this period of time, regardless of how volatile it may be. A mere 1% allocation to crypto assets over the past few years could have nearly doubled your investment portfolio’s overall, risk-adjusted return.

If you are a financial institution or family office and have technical questions, you may also book a complimentary workshop with Iconic to have your specific questions answered. After a long search we went with KP Engineering for our tall railings and gates. We chose them because of their very informative web site, the favourable reviews, and the way that they dealt with our initial queries. They picked the phone up, they answered e-mails promptly, and were straightforward and helpful. The design process and detailed specification went smoothly even when we modified our initial requirements.