Forex, Commodities, Indices, Cryptos, Etfs

Overall, the desktop trading platform is easily customizable and clear for traders. You will find the search functions are very easy, and you can find accurate fee reports.

Enhance your trading skills in the comfort of your own home. Open an account or log in to receive full access to the news section. Make use of our extensive video library and get to know more about trading. Our Trading Academy contains courses from basic to intermediate and expert levels. Compare these XTB alternatives or find your next broker using our free interactive tool. To start the process of opening an account with XTB you can visit their website here.

Since the fee changes every day depending on the market, you can get up to date information on the exact fee through your trading platform on a particular day. When it comes to spreads, you will find that XTB only offers these as floating spreads. These can start from as low as 0 pips with the XTB Pro Account type. There is a $1 minimum deposit in place for the Standard C account with spreads starting from 2.8 pips.

If this is the case, the broker will charge a monthly fee of $10 until you log back in to your account again. They also reserve the right to close your account if you do not have a sufficient balance to cover the fees. With the XTB Standard account, the spread typically starts from 1 pip in most countries, though this is not always the case. If your account base currency matches that of your deposit and withdrawal method, then you can avoid having to pay any kind of conversion fee when trading.

The research functionalities of Xtb online trading platform is comparatively strong. As for the research, you can easily finddaily summaryof financial market that is being published on XTB portal.

Pro Account owners shall pay commissions which is $4/€3.5/£2.5 per lot. To make it more secure and to be able to protect your account, you can set up two-step login feature in your profile and receive a code whenever you or anyone logs in to the system. When trading with XTB, you can enjoy the power of MT4 & signals from MT5 dashboard. The fees for S&P 500 CFD, Europe 50 CFD, EUR USD are built into spread. Copyright © 2008–2021, Glassdoor, Inc. “Glassdoor” and logo are registered trademarks of Glassdoor, Inc. Glassdoor will not work properly unless browser cookie support is enabled.Learn how to enable cookies. When you look at their various payment systems, you have a lot to pick from.

Web Trading Platform

It is less expensive than XTB for trading a wide range of assets, offers a powerful social network, and has over 100 indicators built into its trading platform. If you’re strictly trading forex and have no plans to trade stocks, XTB with MetaTrader 4 could be a slightly cheaper option with more flexibility. When it comes to trading platforms, XTB and eToro take different approaches. eToro only offers a single, proprietary trading platform that has over 100 technical studies built-in – compared to less than 30 in XTB’s xStation 5. eToro’s trading platform also has a well-developed social trading network where you can interact with other UK traders and evaluate market interest in specific assets. Even better eToro supports copy trading as a way to put your trading on autopilot.

Check out customer reviews of each potential broker on your list to see how they stack up. Be sure to read the small print of each broker’s service agreement to avoid unexpected costs. Also remember that the cheapest option is not always the best.

The Demo Account is available for all traders to use, in order to experiment with the trading platform without facing any financial loss. The Demo Account is available to try both the in-house trading platform of XTB, xStation5, and the famous trading platform of MetaTrader4. Regular functions like entering a trade, creating a watchlist & tracking it, as well as modifying the charts is easy as the platform is fairly responsive. It loads data swiftly and the tools like heatmaps or screening tool offered information as and when required. The standard account has a marked-up spread at 0.35 while the Pro account offers lower spreads at 0.28 though it has commission starting at $3.5 per lot on forex, indices, commodities and crypto. As a market maker, XTB may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements.

Setting these up takes some work, though, since you’ll need to use MetaTrader 4’s custom scripting language. To start, we liked that xStation 5 puts technical charts front and center. You can resize the charting window however you like, open multiple charts side-by-side for comparing assets, or keep as many charts as you want close to hand using a tab system. There are several different chart styles available, including standard candlestick and Heikin-Ashi charts. XTB is one of the world’s largest stockbrokers, operating in 11 countries including the UK, Poland, Germany and France, to name but a few. This site uses cookies to optimize your experience on the site.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. But opting out of some of these cookies may have an effect on your browsing experience. The layout/theme of the XTB mobile platform is customizable.

Charting tools and indicators are very well provided for at XTB. These are made available through MT4 which is well known for proficiency in this area, and additionally though the xStation trading platform. When it comes to trade execution, XTB is a DMA Market Maker broker. This position as a DMA broker means you will have direct access to the best market prices coming to the broker from a selection of top liquidity providers. This means that XTB has access to the most competitive rates in the industry, although as a market maker, they will make their decision on the final pricing of any orders. This inactivity fee only applies to live trading accounts, and not to XTB demo accounts. This XTB inactivity fee will only be charged if you are inactive for 1 year.

Trading Alerts

The resources are in good quality, comprehensible, and logically organized. After each lesson, there are quizzes for clients to fill out; this feature is uncommon among other brokerage firms. Additionally, traders can watch educational videos on trading and platform how-to videos that are incorporated into the texts. XTB has trading tools and research tools that traders can directly access instantly.

Plus500 requires a minimum deposit of £100 if using a credit or debit card, and £500 if using bank transfer. Although MetaTrader and cTrader are not available, Plus500’s own platform is very user-friendly. It comes with a range of intuitive risk management features and is available on web and mobile. There are a few downsides with Markets.com, most notably a lack of weekend support and no automated trading functionality. Users can opt to trade through several platforms including the proprietary Marketsx and Marketsi, as well as MT4, MT5 and Marketsx for mobile. Overall, the platform is easy to use, and opening an account is straightforward. AvaTrade comes with excellent educational tools such as a demo account and trading tips.

City Index provides several platforms, with its Web Trader and Advantage Apps aimed at beginner or casual traders, and MT4 and its own AT Pro platform for more experienced users. Pepperstone does not have its own platform but offers the complete MT4, MT5 and cTrader solutions, as well as supporting ZuluTrade, Myfxbook and MetaTrader Signals for copy trading. The company also offers trading courses and features a Learning Lab which houses a variety of tools to support clients with their trading experience. You’ll need to deposit a minimum of $200 for Copy Trading, eToro’s standout feature which allows you to follow other traders and copy their trades. Although we have listed several brokers below, it should be noted that this is through online research, not personal experience.

How Much Is Xtb Fees?

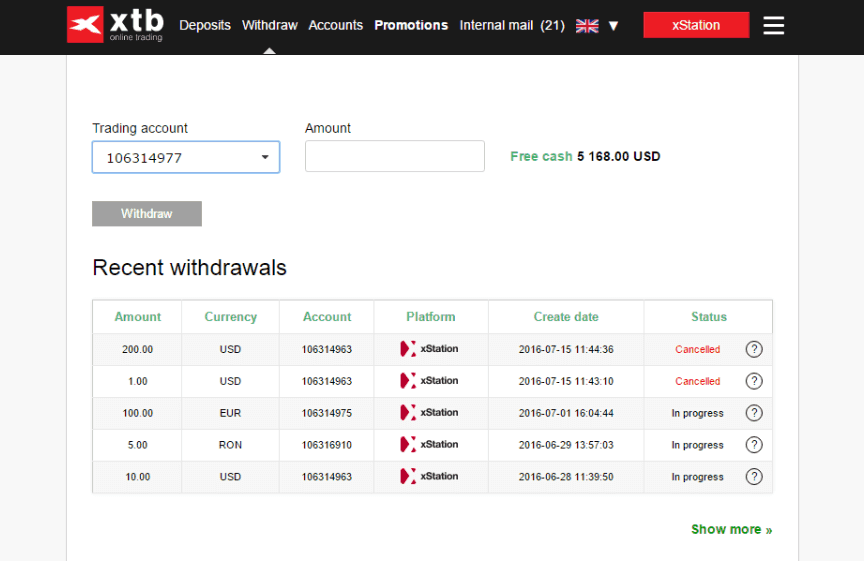

Just remember that you must typically use the same method to withdraw as you did to deposit. Card payments are usually instant, though your first may be slower, and eWallet deposits are also usually instant. XTB deposit methods encompass all the usual methods you would expect. This means wire transfer, credit/debit cards from Visa and MasterCard, and eWallet deposits from Skrill, Neteller, PayU, and more, are accommodated. When you are making an XTB deposit, you can typically do so in EUR. USD, GBP, HUF, CLP, and TRY are also all accepted depending on the country.

MT4 is one of the best known, and best performing trading platforms available in the sector. The trading platform is trusted by a huge number of traders as being one of the most powerful and efficient around. The communications here are completely encrypted, and you will have access to one of the most customizable platforms ever in terms of charting capability. You will also be able to apply EAs to your trading strategy which are allowed by XTB. The trading platform is also very lightweight and easy to run. As a forex trader with XTB you will no doubt be interested to know all about the trading experience at the broker and the various features that they cater for.

There are only around 25 technical studies built in, compared to over 100 in other trading platforms. You also cannot build your own custom indicators with this charting software or backtest a strategy using historical price data.

We’re also regulated by the world’s biggest supervision authorities, including the Financial Conduct Authority. As XTB offer STP execution, you can expect tighter spreads with more transparency over the price you‘re paying to execute your trades. The commisions and spreads displayed below are based on the minimum spreads listed on XTB’s website. The colour bars show how competitive XTB’s spreads are in comparison to other popular brokers featured on BrokerNotes. Finding a reputable online broker is harder than it should be. We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster. Try to withdraw my money since three weeks, all attempts to add a bank account got rejected so far.

Is Xtb Regulated?

This level of regulatory oversight and compliance shows the seriousness with which XTB takes your security as a trader. Finally, when it comes to trading costs XTB manages to remain highly competitive with costs remaining low. This is particularly the case for EU-based traders with the broker. Among the drawbacks to note with XTB is the fact you may be charged a small withdrawal fee which is not very common among top brokers nowadays. You will also find that the trading costs if you are under IFSC regulation, are higher than with other account types. 67% of retail investor accounts lose money when trading CFDs.

XTB sponsors an annual competition among traders that it calls the XTB Trading Cup. This event uses paper trading through the broker’s demo accounts to see who can make the most money in a two-week period. Since the competition takes place in demo accounts rather than in live trading, traders are free to try out their riskiest strategies. The xStation 5 platform was voted 2016’s “Best Trading Platform” by the Online Personal Wealth Awards and offers reliable and instant execution without re-quotes. It offers free audio commentary on the markets – a paid service with other brokers – as well as an advanced trading calculator that instantly determines every aspect of your trades. All trading accounts at XTB are entitled to either use the MT4 or xStation trading platform. There is also the demonstration account option handy for polishing trading competencies of newbie traders.

- The XTB trading brokerage has proven itself as a trustworthy and competent online trading brokerage.

- Important and frequently asked information can be accessed easily on the website.

- When it comes to the variety of assets offers, XTB and eToro are fairly well matched.

- Finding a reputable online broker is harder than it should be.

- Since it is regulated in one Tier-1 jurisdiction, it can be considered to be a low-risk, broker for trading in Forex and CFDs.

The XStation5 platform, on the other hand, covers everything. It looks great and it comes with a superb selection of technical indicators.

Costs And Accounts

You are allowed to implement these within your own MT4 trading strategy with XTB. XTB does offer cash rebates to some traders where permitted.

The type of trader you are will have a significant influence on the best broker for you, so be sure to assess how well what it offers fits with your trading style. In addition to spread, you’ll also need to consider the minimum deposit required and any other fees the broker may apply, such as rollover costs , interest rates and withdrawal charges. We also recommend you view this list of FCA regulated UK forex brokerscreated by the team atcompareforexbrokers.com. Forex is the largest financial market in the world; as such there are many brokers operating in this field. Figuring out which one is right for you is a confusing but vital process, since your choice of broker can be influential to your success; choosing the wrong one could be financially devastating.

Which would, in my opinion, be a better solution then the MT4 mobile application. Thou most people prefer to trade on the MetaTrader 4 there are people that feel more comfortable trading on a web-based trading platform. Also in a worst-case scenario, the traders are insured under a compensation scheme known as the Financial Services Compensation Scheme up till the amount of £50,000.