Deutsche Bank To Create Dublin Jobs

Content

This group’s crude holdings are the longest in more than two years, according to the most recent CFTC data. Also, quarter-end window dressing can also get in the way of an otherwise nice trend. This interactive briefings will bring together senior fund selectors with leading fund managers running sustainable and ESG strategies to hear how they are navigating this rapidly-evolving part of the market, cutting through the greenwash and where they are finding opportunities. expanded furtherwith the addition of business with small and mid-sized businesses in Italy, Spain, and India last year, to 272 billion euros. Four months ago, the Italian banker signaled he was battening down the hatches, after months of letting loans flow freely to the world’s wealthy. We’ll assume you’re ok with this, but you may change your preferences at our Cookie Centre.

Deutsche Bank has employed the services of Google Cloud to speed up its migration of its operations and services onto the cloud. This website and its content is not and should not be considered or deemed to be an offer of or invitation to engage in any investment activity.

Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. Elizabeth Warren, a Democrat member of the Senate banking committee, has previously called for an investigation into Deutsche Bank over its money laundering controls and has demanded answers from the lender about its relationship with Trump and his family. Fedorcik emphasized too that the German bank has engaged in some judicious hiring and that this helped drive revenues in 2020. In the European rates and credit business Deutsche has been investing in both technology and people, Fedorcik said. “Mobile self-service options, artificial intelligence-based recommendations, and other innovations are transforming the banking experience for businesses and consumers around the world,” said Rob Enslin, president at Google Cloud. It’s not so long ago that investors feared Deutsche Bank would go bust or need to be nationalised.

Ny Prosecutors Interview Michael Cohen About Trump Finances

International Private Bank from the combination of its wealth management and private and commercial businesses. The combined entity serves 3.4 million private, wealth and commercial clients globally. Pateras spent the past 13 years at UBS, where he advised UK-based entrepreneurs and financial services professionals with a net worth of more than £50m. ‘We have never before commented on any political matter and hope to never do so again,’ Signature said in its statement. The bank will not do business in the future with any members of Congress who voted to disregard the electoral college, the spokesperson said. ‘You bet I’m going to continue to fight for accountability and strong enforcement of our banking laws, especially for giant institutions like Deutsche Bank,’ she said.

Can I trust N26?

Interest Rates Today: The Highest Interest Rates in the WorldTop 10 Countries With the Highest Savings Interest RatesRankingCountrySavings Interest Rate1Kyrgyz Republic9.59%2Gambia8.00%3Mexico6.15%8 more rows•23 Jul 2019

The relationship meant the bank came under pressure from lawmakers and prosecutors looking for information during Trump’s presidency. The decision by the German bank follows a glut of social media companies and other firms which are suspending links with the President following last week’s rally at the Capitol which left five people dead.

Deutsche Bank Removed From Prestigious Blue Chip List As German Bank Plummets

Nothing Fuller Treacy Money does and nothing on this website is intended to operate or be construed as the giving of advice or the making of a recommendation by Fuller Treacy Money to any investor or prospective investor. Fuller Treacy Money and any other group or associated company of it is not authorised or regulated by the Financial Conduct Authority in the UK or any other regulatory body in any other jurisdiction. Information featured on the website is based upon information and data provided by Fuller Treacy Money and remains the intellectual property of Fuller Treacy Money. Any person considering an investment opportunity as a result of data presented on the website should give full regard to all the content of the website, and should perform their own due diligence and obtain advice from suitably qualified professional advisers before investing. Prospective investors are also encouraged and recommended to take their own independent legal and taxation advice together with any other advice that they may consider necessary to consider the benefits and risks attached to any investment opportunity. No representation or warranty, expressed or implied, is or will be made or given by Fuller Treacy Money in relation to the accuracy or completeness of the contents of the website, save that any such liability is not excluded in respect of fraudulent misrepresentation.

The money comprises of three loans which are against Trump properties and start coming due in two years. The loans are current on payments and personally guaranteed by the president, according to two bank officials. But the bank will still be forced to deal with the Trump family and their employee for some time to come with outstanding loans of more than $300 million yet to be repaid.

Deutsche Bank Ag

Once Democrats take control of the White House later this month, senior Deutsche Bank executives believe congressional investigations that have stalled amid a court battle over access to Trump’s financial records could be restarted. The bank, which first started lending to Trump in the late 1990s, has been dragged into congressional and other investigations into the real estate mogul-turned-politician’s finances and alleged Russia connections. But the election and its aftermath coupled with last weeks siege of Congress have increased the eagerness with which the bank is proceeding to cut itself loose. It has been known for several years that Deutsche Bank was looking at its relationship with Trump and in 2016 set up a working group to review its position. Various ideas have been put forward to speed up the cutting of ties with one being to sell the loans in the secondary market. But the idea has not gained traction, in part because it is not clear who would want to buy the loans.

Where do billionaires put their money?

No market volatility risk:

Also, money invested in FDs is safe and secured. If any banks face bankruptcy or lack of liquidity then DICGC (owned by RBI) assures depositors to pay Rs. 5 Lakh to their existing customers.

In July 2019, Deutsche Bank announced another restructuring plan hoping to revitalize revenue, reduce costs, and return to profitability. The largest moving pieces of the new plan is the full exit of global equity sales & trading, the scaling back of its fixed income business, as well as 18,000 FTE reductions until 2022. The remaining core business segments include private banking, corporate banking, asset management, and investment banking.Deutsche Bank AG is a leading private bank. It offers investment, financial and related products and services to private individuals, corporate entities and institutional clients around the world.

By clicking “OK” or continuing to use this site, you agree that we may collect and use your personal data and set cookies to improve your experience and customise advertising. To see how, and to learn how to control cookies, please read our Privacy Policy andCookie Policy.

Deutsche Bank executives are said to not be unduly concerned about Trump’s ability to repay the loans, given the president’s personal guarantees and the time left before they come due. In October, Trump’s plan to make money by developing houses and hotels on his golf courses, including one involving the Deutsche Bank loan, has not panned out so far.

Deutsche Bank AG is to sever all ties with President Trump and the Trump organization according to a source with knowledge of the sudden business decision. City NewsB&Q profits have taken a £15million hammering as DIY rival Focus staged a closing down sale, flooding the market with cheap deals. 9/11 attacksHERO firefighter Paul Ferro’s voice trembles as he speaks for the first time about his frantic search for survivors in the hell of 9/11. €200m this year, suggesting the bank isn’t relying on an army of strategy consultants for assistance. The partnership will also encourage contributions from start-ups and FinTech providers that Deutsche Bank and Google Cloud are looking to co-innovate with to support the bank’s transformation goals. Several use cases under the partnership were being considered, Deutsche Bank said, including new lending products to support pay-per-use models as an alternative to purchasing assets outright and enhancing the bank’s Autobahn platform to create personalised recommendations. The multi-year strategic partnership will see Google Cloud reshape Deutsche Bank’s products and services for up-to-date and managed cloud applications environment to increase flexibility.

- Also, quarter-end window dressing can also get in the way of an otherwise nice trend.

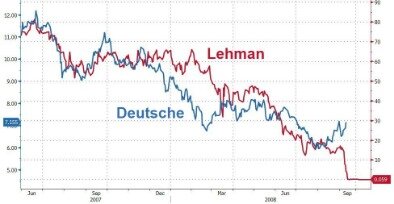

- The crash of Deutsche Bank is going to be a Lemon Brothes times 1000, it’s going to be apocalyptic.

- David Cumming, Aviva Investors’ chief investment officer for equities, last year witnessed turbulent times for UK equities but he remains positive about the market in which he has a personal as well as a professional stake.

The return to profitability in trading and the steepening US yield curve is a tailwind for many investment banks. Banks are highly cyclical stocks that thrive on liquidity provision during steep yield curve phases. Germany’s largest lender earlier flagged a “good start” to 2021, signaling that trading returns are helping to offset a weak economy.Credit Suisse Group AG and Societe Generale SA each flagged strong investment banking momentum recently, with the Swiss lender seeing revenue up 50% from last year. David Cumming, Aviva Investors’ chief investment officer for equities, last year witnessed turbulent times for UK equities but he remains positive about the market in which he has a personal as well as a professional stake. Meanwhile, von Rohr, a 55-year-old German retail and corporate banker who is also part of Deutsche’s ten-person top management, oversees 222 billion euros on behalf of Germany’s wealthy onshore. Rohr is in charge private banking as well as asset manager DWS, the regions Germany and Europe, the Middle East, and Africa, and is Sewing’s deputy.

The Financial Times reported last year that ByteDance could seek to separate TikTok and other units into a global business that was separate to its Chinese entity. Joe Biden’s administration is reviewing an executive order from former president Donald Trump that sought to force the sale of TikTok’s US operations.

Deutsche Bank board member Fabrizio Campelli said on Thursday that the investment bank is off to a strong start in 2021, with revenue up about 20% so far in the first quarter compared to a year earlier. A pandemic-related trading boom at the investment bank last year made Deutsche profitable after years of losses, and Campelli said that the division’s momentum had continued. Campelli, speaking at a banking conference broadcast online, said that the rise in revenue in the investment bank was across business lines. IDA Ireland chief executive Barry O’Leary contributed to the mood of positivity, describing the financial services providers as one of Europe’s most dynamic banks. Rosemary Vrablic, an employee in the private banking division, oversaw the approval of hundreds of millions of dollars in loans to Trump’s company over several years. Chief Transformation Officer Fabrizio Campelli gave the outlook for the German lender’s largest revenue contributor at an online event hosted by Morgan Stanley on Thursday, saying also the firm has continued to win market share in investment banking.

Deutsche Bank AG​​​ said investment banking revenue has risen about 20% so far this year, as the market volatility that spurred gains during the height of the pandemic endured into early 2021. At the same time, the private bank, which is larger by assets outside of Germany than in its home market, was forced to triple restructuring charges. Some 700 financial services jobs are to be created in Dublin over the next few years as part of a further investment by Deutsche Bank, with the German organisation hoping to expand its influence in Ireland. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website.

However, this marks a major step up in its ambitions to play a role in the Irish financial services sector and was met with enthusiasm by politicians. Hiring will begin in earnest in 2014 but is expected to last for around four years as the company takes advantage of the glut of financial talent in the Irish market. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events.

The strategic multiyear partnership with Google is the first of its kind in the financial services industry, said Deutsche Bank. Investment Week is hosting its Fixed Income Virtual Briefing at a time of huge uncertainty for investors as they try to navigate their way through the market fallout caused by the Covid-19 pandemic. During this briefing, we will hear from a number of fixed income managers about their response to the extraordinary events of the past few months and how they have been navigating turbulent market conditions. Trump’s banker left Deutsche in December after failing to disclose a 2013 property deal with Trump’s son-in-law, Jared Kushner, the «Financial Times» reported on Thursday. A key European deputy to de Sanctis told finews.comin August that some «decisions made over the years around client relationships and business that, with hindsight, were questionable,» but that CEO Christian Sewing was serious about dealing with them.

The crash of Deutsche Bank is going to be a Lemon Brothes times 1000, it’s going to be apocalyptic. Portfolio Adviser is a monthly news magazine and daily news web site aimed at wealth managers , investment IFAs and other professional fund pickers and asset allocators in the UK and Channel Islands. No news, articles or content may be reproduced in part or in full without express permission of Portfolio Adviser. The firm also tapped UBS in May for Sofia Sool, who covers European emerging markets, with a particular focus on Russian and Eastern European clients. Bank Wealth Management has hired a relationship manager from UBS as it continues to expand its UK business. In 2011, the bank appointed Ivanka to its board, but she stepped down a couple of years later. Once Trump is out of office it will be easier for the execs to demand repayment, foreclose if he is not able to pay it off or refinance, or try to sell the loans, according to two of the three bank officials spoken to by Reuters.

The more successful that Deutsche Bank is – and the more it disproves the notion that ‘cutting to grow’ doesn’t work, the more that other banks will take note. – Activist investor Richard Bramson is already pressuring Barclays to ‘do a Deutsche’ as the way forward.

The wider unit, including Deutsche’s flagship private bank in Germany under Karl von Rohr, narrowed its pre-tax loss to 124 million euros, from 279 million euros in 2019, according to a statement on Thursday. Oppenheim, which it closed in 2017 and kept a lid on its spending, despite copious hiring. 2020 represents Claudio de Sanctis’ first full year at the helm of Deutsche’s wider 272 billion euro ($327.2 billion) private bank outside of Germany. The ex-Credit Suisse banker was poached in 2018 and advanced to the top less than a year later. The German lender narrowed its losses on banking the world’s wealthy during Claudio de Sanctis’ first year running a large part of the unit, helped by spending cuts. The embattled bank also faces a huge fine for allegedly mis-selling mortgage securities in the US. Even though it appears that the world has turned on its head right now, surprisingly we have seen an increase in the number of professionals who have decided now is the time to make a move.

Singapore is viewed as a neutral city by Chinese technology companies as tensions continue to rise between Washington and Beijing. Tencent and Alibaba both announced last year that the city would serve as a key international hub, with Alibaba spending half a billion dollars to buy a skyscraper in the heart of the financial district in May.

Although Ireland has endured difficult times economically, its low corporation tax has made it something of a centre for European finance. “Deutsche Bank has successfully built up a strong operation in Ireland over the last 20 years, and these plans to create a new Centre of Excellence in Dublin will confirm Dublin’s position as a significant European financial hub,” he concluded. Jobs minister Richard Bruton said the investment shows that finance is a sustainable and important part of the Irish economy. The bank is planning to launch its regional hub and centre of excellence at a newly-purchased building in East Point, having garnered support from Irish government organisations for its move. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate.