Crypto Market Briefly Surpasses $1 Trillion As Adoption Keeps Growing

Content

Individuals can purchase XRP coins directly from a crypto marketplace. They will then be fully exposed to the fluctuations of the coins and the extreme volatility that goes with it. Despite its practicality, crypto currencies, including XRP are subject to very high volatility. An example of this was in 2017 when XRP jumped 54,900% from $0.006 in March 2017 to $3.30 in December of that same year. Ripple XRP has a practical use for businesses who perform international transactions. Some traders feel that this aspect will keep XRP in demand and increase its value over time while others feel that people convert into, and then out of, XRP too quickly for it to hold value.

The ETP has seen its assets under management increase to surpass $5 million since launch, and had has a performance of “nearly 60%” since launch. Ether , the second-largest cryptocurrency by market capitalization, moved from $780 to $1,300, a value close to its near $1,400 all-time high, before dropping along with BTC. Together with the clean energy industry and global finance decision-makers, we can unite to position blockchain as the most sustainable path forward in creating a green digital financial future. The XRP Ledger’s native digital asset XRP was specifically chosen to power RippleNet’s On-Demand Liquidity service for its immutable green aspects and its payment scalability. With independent researchers suggesting that XRP transactions could grow by more than 1000% by 2025, this has massive implications for energy savings and the carbon footprint reduction of blockchain-driven finance. Examining long-term sustainability of money is one way we can contribute.

Crypto Market Watch: Can Xrp Retake The No 2 Spot From Ethereum Sooner Than Expected?

The impact of the charges escalated quickly, with several cryptocurrency exchanges dumping the digital asset off their list of tradable assets. In December, one of the major cryptocurrency exchanges, Coinbase, announced it would suspend XRP trading on its platform. The pre-determined final date for their decision is reportedly January 19, 2021. Coinbase said that regardless of the harsh measures, the trading suspension of XRP pairs will not affect customers’ access to their XRP wallets.

Especially when it comes to cross-border omittance services, the token seems to excel. /PRNewswire/ –Coil, a platform dedicated to reimagining monetization on the web for creators and their fans, today announced a 1 billion XRP grant from Ripple’s Xpring. Ripple allows users to transfer funds in the form of cryptocurrencies or traditional fiat currencies.

Ripple Price History

Ajay Lalwani, 31, a reporter for a local television station and an Urdu language newspaper, was shot multiple times while having his hair cut at a barber shop Thursday, said Ashiq Mirani, the area police chief. Furious British gamers and lawmakers are training their sights on “scalpers” who are buying up coveted PS5 and Xbox consoles and selling them online at vastly inflated prices.

Crypto experts believe that XRP could see significant adoption in 2024. Some experts have predicted that if XRP adoption occurs at expected levels, we could see the cryptocurrency go on a bull run, and Ripple’s price could rise even further. The Ripple team has quite a few projects that will see the light of day in 2023. The network is also set to partner with more financial institutions and hopes to see considerable mainstream adoption in 2023. This could push the price of XRP higher than it has ever been, with experts predicting that by 2023 the currency could reach $3. Moody’s has also stated that Ripple has a lot of plans in the offing.

Factors That Could Influence Xrp Price In 2020

If enough people need XRP and trade it regularly, the rules of supply and demand may push the valuation of each coin higher. XRP, while limited to the Ripple Labs network, has multiple use cases such as with smart contracts, international money transfers, in-app purchases, and more. Having in built-in uses and easy adoption makes for XRP to be potentially more desirable to a larger audience, should use cases continue to grow. To increase the value of each coin, a small amount of XRP is destroyed with each transaction.

Ripple’s price saw movement in March 2017 when the coin jumped to $0.03. This jump in price was fueled by the news of Ripple partnering with the Bank of Tokyo.

Most currencies today aren’t environmentally friendly, with the production and movement of money contributing to pollution, deforestation and a large carbon footprint. The blockchain and digital asset industry will play a critical role in building a sustainable future for global finance. We, as an industry, need to come together to dramatically reduce our collective environmental impact as broad adoption takes hold. Ripple is hoping to tempt banks to jump onto its enterprise blockchain network by dangling a rebate, in the form of its XRP digital asset, to early commercial adopters.

The platform supports creators, including writers and journalists, video creators, podcasters, streamers, musicians, photographers, and artists. Xpring is Ripple’s initiative to develop infrastructure and collaborate with innovative blockchain projects to increase the adoption of XRP. On-Demand liquidity lets RippleNet users leverage XRP to bridge currencies. This ensures that payments are done quickly and are sent/received in the local currency. XRP is ideal for cross-border payments as it is quicker, cheaper, and more scalable than other digital assets. XRP, like any other asset, faces volatility in its price due to the prevailing market conditions.

2030 will see Ripple register significant growth, thanks to increased adoption and greater use cases. XRP’s long term price prediction states that the currency might reach $17 by 2030.

Ripple Blockchain Network Hits 100

This means that there is continuously less XRP available as time goes on. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various Cryptocurrencies but has no bias in his writing.

As of November the total number of XRP coins are down to 99.99 Billion, infusing speculation into the long-term and short-term price of this digital coin. This coin is used as a store of value recognized amongst its hundreds of global gateways, allowing people to convert money from local currency, to XRP, and back at any time. This established global customer base gives XRP active use cases that traders can look to for relevancy. Ripple XRP is the currency accepted across Ripple’s platforms, including their global money transfer system, Ripple Net. This week, bitcoin hit another milestone, as a total of $10 trillion in value changed hands through the Bitcoin network since it was launched back in 2009. About $7.5 billion were moved since 2018 after its price surged to nearly $20,000 in late 2017. It adds that while derivatives surged to a new all-time high, they rose 8.6% compared to November.

The official report promises platform’s users who have XRP balances that they will keep receiving support and access to their XRP assets to send after the halt of trading. Still, the network will not support receiving any further XRP in the Exchange anymore. “One thing I have learnt is that crypto is unpredictable and not to speculate on price. Iversen acknowledges that no one knows for sure where the crypto market is headed. “Where other cryptos are shunning banks, these are the customer base for Ripple.

- Thanks to Bitcoin’s rally in 2017, cryptocurrencies like Ripple also rallied.

- The markets are affected by many internal and external pressures that can spur a sudden breakout or landslide.

- It however, has filed frivolous action claiming the cryptocurrency, XRP, which has already been deemed a currency by FinCEN, to be a security.

- It reached a peak of almost three and a half dollars in early January before settling back as the crypto bubble deflated.

The 5.7 magnitude quake with an epicentre around 60 kms southeast of San Marcos, a two-hour drive from Acapulco, sent tremors through the stadium for about 30 seconds with Koepfer serving in the opening game of the second set. It’s certainly going to be interesting to see how the year unfolds. But if you do have faith in the token and the bullish XRP predictions, now could be the time to stock up. XRP may not have been declared as a security, but it has also not had the case overthrown.

Ripple has stated that it plans to create a payment system that banks can use to transfer funds internationally and domestically. Ripple has announced partnerships with several banks and financial institutions like JP Morgan, HSBC Holdings, Banco Santander, Mizuho Financial Group, and MoneyGram. HSBC Bank Limited also joined the Ripple network in August 2020. The currency stayed between $0.52 and $0.69 until 22nd December 2020, after which it dropped to $0.26. Ripple could not go past the $0.32 mark until 30th January 2021, when the currency’s value rose to $0.50. Ripple’s price kept fluctuating for most of 2017 before going on an upward trajectory, in line with the growth of Bitcoin. Thanks to Bitcoin’s rally in 2017, cryptocurrencies like Ripple also rallied.

Despite this, banks and many financial institutions all over the world have been sceptical on adopting the token and as a result, it hasn’t performed well over the course of 2020. Xpringis Ripple’s initiative to develop infrastructure and collaborate with innovative blockchain projects to increase the adoption of XRP. Our objective is to create a robust community of developers, entrepreneurs and companies who are transforming industries using technologies such as Interledger and XRP Ledger. , former CTO of Ripple, to build a better business model for the web. Coil’s platform is designed to make it easy for creators to monetize their content across the internet. As subscribing fans enjoy content, Coil uses an open API called Web Monetization to stream micropayments to creators in real time.

Can XRP reach $20?

XRP could reach as high as $20 by 2020, they said, as XRP claims it has the greatest capacity of all other cryptos. Ripple coin news, the second-largest traffic-based news website, estimates that the coming years will surface as a smooth time for Ripple after a complex trend.

It however, has filed frivolous action claiming the cryptocurrency, XRP, which has already been deemed a currency by FinCEN, to be a security. Due to this action, the 40 billion dollar market for the currency is rapidly failing as companies scramble to maintain compliance. The XRP token from the San Francisco-based blockchain consortium ripple is considered by many to be the best well-established cryptocurrency for banking institutions. With Ripple tying up with more financial institutions and banks globally, it is bound to see an increase in adoption and use cases. This is significant as it could push the price of XRP higher. As per our analysis and the Ripple price prediction, XRP could be pushing the $5 mark in 2024.

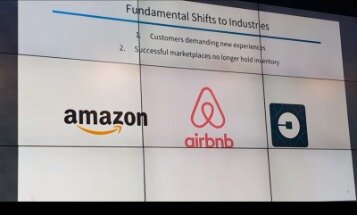

Bitcoin’s price rise is seemingly being supported by growing corporate adoption. The hedge fund investment firm founded by Anthony Scaramucci, Skybridge Capital, has confirmed the launch of its new bitcoin fund and revealed its exposure to the flagship cryptocurrency has now reached $310 million. This week the total market capitalization of all cryptocurrencies briefly surpassed the $1 trillion mark for the first time ever, with bitcoin leading the charge. At the time BTC was trading above $37,000 and had a market capitalization of $690 billion, representing about 69% of the crypto market’s value. With the adoption of innovative financial technologies like cryptocurrency and blockchain, we must prioritize sustainability in parallel with this push toward digitization. The Securities and Exchange Commission is tasked to protect investors in US Securities.