Could Bitcoin Reach The Price Of $100k In 2021

Content

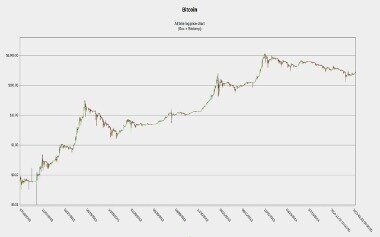

Considering the demand by institutional investors and the way the market is developing, it is possible for Bitcoin to reach the above figures. Central banks have been looking at applying DLT to manage the money system — but they are not looking at bitcoin, they seek control of whatever cryptocurrency is used. Bitcoin’s value has began to rise again after a chaotic last couple of weeks. The cryptocurrency was valued at £25,000 on January 5 before rising to a price of £30,000 on January 7.

- No news or research item is a personal recommendation to deal or invest in any particular company or product, nor does Valuethemarkets.com or Digitonic Ltd endorse any investment or product.

- Please allow additional time if international delivery is subject to customs processing.

- This price movement creates the impossible task in which BTC is expected to act as “the new gold” while exhibiting a lack of correlation.

- The dollar remains the world’s reserve currency and is the benchmark for global trade, though its value has softened in the past year.

These cookies allow Google and the advertiser to determine that you clicked the ad and later visited the advertiser’s site. Conversion cookies are not used by Google for personalized ad targeting and persist for a limited time only. It’s generally set in the googleadservices.com domain or the google.com domain . Some of our other cookies may be used to measure conversion events as well. For example, DoubleClick and Google Analytics cookies may also be used for this purpose. It covers the latest reported cases, regulatory announcements and corporate developments in the cryptocurrency sector.

Bitcoin’s Volatile History In Pictures

The process starts with the blockchain, where all Bitcoin transactions are recorded. Each time a trade is made through a cryptocurrency trading platform, the transaction details are broadcast to Bitcoin miners. The miners compete to mine crypto, but they’re also there to help dependently verify and record every transaction made. The first real mention and concept of a so-called cryptocurrency was published in 1998.

The company’s announcement of a new digital “warehouse” for bitcoin deposits and withdrawals came just hours after the billion-dollar transaction. The single transaction of 94,504 bitcoins represents around 0.5 per cent of all bitcoins currently in existence, and it has left analysts confused by who made it and for what purpose. Bitcoin’s price has risen dramatically, reaching an all-time high at $41,941 on January 08, 2021, as big companies have invested large sums of money.

Can Bitcoin Hit $1million?

Last month saw the announcement that PayPal will begin supporting bitcoin transactions – which may change all that. Meanwhile, 17 per cent said they have got involved as they don’t trust the financial system and the same amount did as part of a long-term savings plan, such as a pension. A quarter have bought in as a part of a wider investment portfolio, while a similar number said they did as they feared missing the boat. It ranges from food and drink and retail, to financial services and travel. It does point out, however, that those who did borrow money purchased small amounts – half bought less than £120 worth.

The mining arms race has driven up the price of equipment while pushing down the chances of success. Bitcoin mining is the process that creates the cryptocurrency and it is resource-intensive, to control the number of Bitcoins in circulation. What’s more, all the information concerning the Bitcoin money supply itself is readily available on the blockchain for anybody to verify and use in real-time. By cryptographically encrypting the data, it can be trusted entirely. The blockchain network gives cryptocurrency payments several advantages over traditional payments. Bitcoin transactions are secure, irreversible, and do not contain sensitive personal information. A common misunderstanding is that Nakamoto is Bitcoin’s core architect, and as a result, this individual controls the network.

“In my line of work you see people do disastrous things if you don’t understand how leverage works, which is the use of borrowed money to take on greater risk.” “It’s an enormous wall of money — just the pipes aren’t there to allow people to do it yet, and that’s coming. But it’s on everybody’s radar screen, and there’s a lot of smart people working on it.” BITCOIN will rise to a value of $1million (£738,000), an expert tells Express.co.uk, as Elon Musk and Tesla spark cryptocurrency surge. You will have no right to complain to the Financial Ombudsman Services or to seek compensation from the Financial Services Compensation Scheme.

The Winklevosses Have Launched Their Bitcoin Exchange In The Uk

“There’s the scarcity associated with it, I think we are at the tip of the iceberg of people’s acceptance of it. “I think there’s a lot of different ways companies are trying to capitalise on this, I would say don’t underestimate the market euphoria.” “It gets you in the news, it makes you seem like you are a technologically oriented company, and there’s certainly demand for Bitcoin out there because of market euphoria right now. David Sacco, an expert in cryptocurrencies from the University of New Haven, told Express.co.uk that the Tesla-inspired surge will continue as more companies will follow the lead of Elon Musk. When you subscribe we will use the information you provide to send you these newsletters.

If the currency we all use is bitcoin, money probably won’t be created by borrowing. But before I explain the logic, I need to first talk about Isaac Newton and then go into a little about bitcoin’s nature. I won’t go into detail describing bitcoin — I am assuming that if the cryptocurrency interests you, then you will do your own research — but I will outline a few salient points. The content of this site is intended to be used, and must only be used for information purposes only. It is very important to do your own analysis before making any investment based on your personal circumstances.

However, the increasing cost of mining equipment is eating away at potential returns. It’s estimated that today there are more than 1 million Bitcoin miners in operation, all competing for that next block to add to the chain every 10 minutes. This has sparked a bit of a Bitcoin arms race where companies worldwide are spending more and more money to develop faster chips and faster mining equipment.

Can Bitcoin reach 50k?

It is possible for bitcoin to reach the moon. $50,000 in 2021 is an achievable feat. Bitcoin can reach 50k sooner than later, in fact in few months.

Research coin wallets, the digital vaults where cryptocurrency is held, and consider security carefully. It is highly likely that the number of people involved in cryptocurrencies has surged during lockdown, thanks to stock market volatility, savings rates collapsing and having extra cash. In general, cryptocurrency holders expect to hold onto it for long periods of time – again, highlighting that most are now buying and leaving it, in the hope for long-term growth. According to the study, 47 per cent of people have never used cryptocurrency for anything. Nearly half of people said they bought crypto as a gamble that could make or lose money. Nevertheless, the lack of such knowledge among some presents potential consumer harm – 11 per cent of current and previous cryptocurrency owners thought their money was protected.

However, a significant proportion doubted that bitcoin or any other cryptocurrency could significantly disrupt the traditional financial system. The lot of 30,000 bitcoins was worth around $632 per bitcoin at the time, meaning his investment is now worth more than 10-times as much. Prominent bitcoin advocate Tim Draper has renewed his claim that the cryptocurrency will continue to see huge gains following its recent price surge. Online auctions are also another quagmire, O’Rorke says, as sellers could potentially leverage fake accounts to tamper with the bidding process. “If you have ten accounts, you can artificially increase the price of NFT,” he says. “This kind of practice exists actually also on eBay, on all these kinds of services. Such a large amount of bitcoin has the potential to crash the cryptocurrency market if it is cashed in for fiat currency.

Jamie Burke, founder and CEO of blockchain investment firm Outlier Ventures, and an NFT enthusiast, is one of those keen about their newfound role as digital arts supporters. Burke says that he was initially turned off by the early, “self-referential” cryptocurrency-focused artworks – strewn with Bitcoin signs and pixelated memes. But when he got more interested in the space, in summer 2020, he was “blown away” by the new artists. Billionaire entrepreneur Elon Musk sparked a Bitcoin frenzy this week after his company Tesla bought $1.5billion’s (£1.1billion) worth of the cryptocurrency. In a stock market filing, Tesla said it has “updated its investment policy” and is therefore looking to invest in “reserve assets” such as digital currencies, gold bullion or gold exchange-traded funds. The shock move drove the value of Bitcoin up to record highs after a turbulent month in January.

That is why central banks try to expand the money supply by creating low-interest rates. They figure that low-interest rates will encourage more borrowing, boosting the money supply. Supporters of bitcoin believe that one day it will be the currency we use by default. Supporters of bitcoin typically love how a central authority does not control it — the crowd manages it.

“Four in 10 Britons are ore sceptical , saying they do not think cryptocurrencies will ever be as common as cash or card,” the research stated. One in five of those surveyed said they thought bitcoin would be “as common as cash or card” in the future as a payment method. In an interview earlier this year, he called bitcoin “one of the greatest technological advances that humanity has ever seen”, and predicted it would used as a routine form of payment within the next three years. Beyond investing, Mr Draper believes bitcoin has the potential to replace mainstream forms of currency due to its technological and economical benefits compared to fiat.

Big sell offs in the past have resulted in flash crashes, with bitcoin losing almost $1,000 from its value in the space of just 24 hours in September 2018 as a result of a major trade. However, it should be mentioned that no one can know precisely what the price of Bitcoin may reach in the future, although the above BTC predictions come from credible financial analysts.

Speaking at the Salt Conference in Las Vegas, Mr Draper once again outlined his belief that bitcoin can keep growing in value and reach well beyond its $20,000 peak that it reached in December 2017. Bitcoin has since experienced a remarkable price recovery, rising from below $4,000 at the start of 2019 to today’s price of $8,100. The product gained over 20,000 users for a beta version of the app with no marketing, after being rated as the number one Crunchbase Bitcoin start-up globally. UK-based fiat and crypto payments network Bottlepay has raised £11 million in a seed funding round backed by British fund manager Alan Howard, present and former Goldman Sachs partners, FinTech Collective and Nydig.

All investments can fall as well as rise in value so you could lose some or all of your investment. But with the price of Bitcoin increasing almost daily, the potential payoff is growing higher as well.

The price of bitcoin soared from $1,000 a coin in early 2017 to $20,000 by the end of the year. A further 700,000 people have also held crypto at some point, or 5.35 per cent of Britons – up 2.35 percentage points on a year earlier.

And although not entirely sticking at $12,500, the price of around $11,500 seems to hold up. Bitcoin are so dull and boring that $1.1Bn worth of BTC has now been “wrapped” so they can run over and play DeFi games.

His assumptions are based on a number of factors including the global amount of millionaires, a $260 trillion stock and derivative market, and Bitcoin’s intrinsically scarce supply schedule. Donovan Mitchell scored eight of his 31 points in the final minute and a half to lead the Utah Jazz to a victory over the Toronto Raptors on Friday night. Pascal Siakam’s 3-point shot at the final horn spun around and out for the Raptors, who have lost seven straight.

That year, investors worldwide started to buy up the cryptocurrency, and institutional investors followed suit. Since then, a whole network and infrastructure has started to build around Bitcoin and other cryptocurrencies. A time of market stress could lead to people being locked in and unable to trade. The price can move by 20 per cent in one day and you could easily lose half of your cash in a far quicker time that investing in the stock market.