Compare The Top Spread Betting Companies For 2021

Content

An intelligent platform to power your trading every step of the way. Trading at times when there is a low market participation, such as when the trading week has just opened or when a market is about to close. Harness the market intelligence you need to build your trading strategies. No matter your experience level, download our free trading guides and develop your skills.

Let me share some of our students’ most recent feedback about our courses. We have been around for more than 16 years and we taught more than 300 thousand people globally. We have many successful clients that have managed to make profit when they followed the rules. I’m sure you understand we have costs to cover in order to fulfill your Forex education programme, including ensuring our best traders and mentors are available for you to speak to across the 3 days. We wish you all the best in your forex trading journey and always remember we’re here to help and guide you. Here at Learn to Trade, we make sure that all of our students understand how FOREX trading works so that they are properly guided and can skillfully trade. We look forward to seeing you in more of our classes and we wish you all the best!

Even though the Trade Interceptor software might be a bit simple compared to other competitors, the available features are well structured and balanced, making it neither too complicated nor too simple. This essential and useful interface has brought about a lot of positive user experience from clients. The platform has no web version, leaving the mobile option as the only alternative to the Interceptor desktop. The commissions and fees paid on ThinkMarkets vary depending on the account type you choose when you sign up. This broker can be classified as having fees that are much more than the industry average. I wonder if the broker gets anything from losses as if they just merely collect deposits.

- As a smaller broker, personal service is high on their priority list .

- ThinkMarkets was founded in 2010 by Nauman Anees, following years of experience in financial services.

- The broker offers negative balance protection to stop clients from losing more than their deposits.

- However, it is not listed on the stock exchange, nor is its financial information available to the public.

- Our comprehensive content is geared towards investors of all levels or people just beginning their trading journey.

This was possible because the brokers found new ways to make money from the activity of their clients. One of the most important factors to look out for when choosing an FX broker in the UK is overall trading costs. Regulators in the developed markets have altered the margin conditions that brokers they regulate can offer. This sparked a race among brokers to offer smaller and smaller spreads to attract clients. They give traders access to a wide variety of instruments in several markets like currencies, indices and commodities. For traders interested in cryptocurrencies like Bitcoin, ThinkMarkets offers cryptocurrency CFDs. Hi Simon, the webinar will teach you about the financial markets and trading, along with easy and proven strategies that are used and proven by our top-class coaches.

Clients also benefit from close to 200 free cloud-based notifications. Direct chart trading is also available, along with standard risk management tools and multiple order types. As with most brokers, margin requirements do vary depending on the trader, accounts and instruments.

Metatrader 4

In addition to the already mentioned, award-winning ThinkTrader, ThinkMarkets also supports MT4, in several versions. The trading product range and the client service of the brokerage is worthy of attention as well. In addition to the outstanding insurance, the broker is proud of the trading conditions it features. Certainly, there are some complaints too, but they hardly dent the image of the brokerage. Such complaints have generally been aimed at the perceived quality of the broker’s customer support department, and at the withdrawal process – deemed way too slow here and there. Given the overall serious nature of the operation, it is not the least bit surprising that traders seem to love it. Most of the trader feedback available through portals like Forex Peace Army and TrustPilot is positive.

Established in 1992, Saxo Bank is a Danish investment bank that provides international investors access to trading over 30,000 products covering CFDs, forex, equities, options, futures, and bonds. With its headquarters in Copenhagen and clients in over 180 countries, Saxo Bank is privately held, manages more than USD15 billion in AUM, and processes over one million transactions every day. Saxo provides its clients with an excellent all-around trading experience. Saxo offers two platforms, SaxoTraderGO (web-based) and SaxoTraderPRO (desktop-based). For our testing, we focused on SaxoTraderGO, the more widely used platform of the two. Most investors will pay £8 per trade and €10 per month in custody fees at Saxo Markets, which makes Saxo one of the most expensive options in the UK. Traders will have to ask themselves whether the trading platform, a wide range of investments, and research justify the extra cost.

Trade up today – join thousands of traders who choose a mobile-first broker. 73,9% of retail investor accounts lose money when trading CFDs with this provider. 72% of retail investor accounts lose money when trading CFDs with this provider.

Saxo Markets offers UK residents an excellent share dealing experience by combining the brilliant SaxoTraderGO trading platform with over 30,000 international products to trade across 36 global exchanges. The one downside of Saxo Markets is the pricing, which is substantially higher than most UK competitors. Spread Co doesn’t have the financial power of some of the bigger players to invest in tools and research products, so they play to their strengths.

Please ensure that you have undergone sufficient preparation and risk management before use. FX919 only provides the legal URL of the platform published by the regulatory website. ASIC’s role is to enforce and regulate company and financial services laws to protect Australian consumers, investors and creditors. ASIC’s authority and scope were determined by the Australian Securities and Investments Commission Act, 2001. Plus500 requires a minimum deposit of £100 if using a credit or debit card, and £500 if using bank transfer. There is no minimum deposit required but Pepperstone recommends a minimum of £500.

Td Ameritrade, Robinhood, Vanguard, Resolve Trading Glitches

The type of trader you are will have a significant influence on the best broker for you, so be sure to assess how well what it offers fits with your trading style. Look at the average spreads each broker offers to find one that works best for you.

Trading with large amounts of money brings with it the ability to open positions with larger lot sizes. This makes it highly imperative to reduce trade costs as much as possible so you can maximize gains. 75.50% of retail investor accounts lose money when trading CFDs with this provider. ThinkMarkets trading hours follow standard opening and closing times of respective markets.

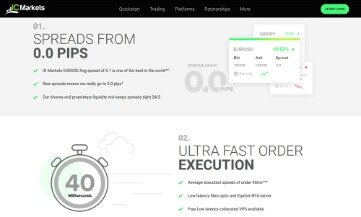

The firm offers market competitive spreads which vary from country to country and are determined through the exceptional trading infrastructure. These spreads are built through top-tier liquidity and have proven advantageous to investors. ThinkMarkets realizes the importance of leverage when it comes to trading and for this reason the firm provides more than one leverage option.

If your strategy is focused on the carry trade, where you intend to hold positions over time to profit from interest rate differentials, you’ll want to look at a broker’s rollover pricing and swap rates. A good broker should be easily contactable, handle problems efficiently and offer trustworthy trading guidance. Check out customer reviews of each potential broker on your list to see how they stack up.

ThinkMarkets is one of the few brokers that offer both of the MetaTrader platforms; MT4 and MT5. To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here. The combination of downloadable platforms for both Mac and Windows allows traders to trade with their device of choice. As you can see, ThinkMarkets’s minimum spread for trading EUR/USD is 0.5 pips – which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with ThinkMarkets vs. similar brokers.

As a market maker, ThinkMarkets may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades. To open a live account, you’ll need a minimum deposit of at least €0. Alternatively, ThinkMarkets offers a demo account that you can use to practice and familiarise yourself with their platform. Our team is strongly committed to deliver the best possible experience to our clients. With an innovative set of tools with ThinkTrader to impeccable client support, we are ready to meet the needs of our most demanding customers.

Is Thinkmarkets Safe?

Should you have any questions, do not hesitate to contact our support teams via email, chat or phone. I actually did the course in London for £2400 and what a waste of money that was! The course is basically aimed at selling a more ‘advanced’ course to you.

All they looked at was the ‘capital i had to invest’ and pounced on that. You are disappointed that you have lost money, and rightly so, anyone would be upset to lose any sum of money whether to trading or any new initiative. It is highly unlikely for every trade to be successful, but as you continue learning you will ensure your risk is managed and will be able to accept that this is part of trading. The Thinkmarkets offers five digits rating on whole its platforms of trading. One may use some style of trading, including scalping and hedging. For traders new to markets or asset classes, Saxo provides 20 interactive courses through its educational portal, Saxo Academy.

Finally, we’ve listed some of the popular funding methods that ThinkMarkets offers its traders below. Like most brokers, ThinkMarkets takes a fee from the spread, which is the difference between the buy and sell price of an instrument. We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster.

We list the world’s top regulated and authorised brokers suitable for a global audience. Monthly cash back Payments are credited and sent automatically by the 12 of the month following the month rebates are earned in. Spread or commission reduction The trader actually receives reduced commissions and/or spreads. Paid direct to brokerage account Cashback is credited directly to the trader’s brokerage account, typically between 1-7 days after the trade is closed. This is another exciting options offered by some of our top brokers.

The award-winning mobile program offers thousands of markets, in-app chat support, plus a breadth of analysis tools and technical indicators. With the ThinkZero spread account, there is a 3.5 commission per side of 100,000.

We are happy to hear you have had a positive experience while using our services. We are firmly committed to delivering a stellar customer experience for our thousands of clients worldwide and with our support teams standing ready to receive any feedback you might have 24/5.

What Deposit And Withdrawal Methods Thinkmarkets Supports?

There are so many things to pay, I end up getting almost nothing. I have been requesting it but they will always block it with terms and conditions. Was never told of the terms and later on surprised that I am unable to withdraw my profit. With cloud-based alerts and triggers, you receive updates in real-time even when you’re offline. Forex.Academy is a free news and research website, offering educational information to those who are interested in Forex trading.