Coincheck Cryptocurrency Hack Victims To Receive Refund

Content

The incident is believed to be the largest case of cryptocurrency theft there has been so far. Via services like ShapeShift, that doesn’t require any personal data to trade cryptos, and exchanging the NEM with more anonymised currencies like Monero, it will be easy for the hackers to cash in. Until such time, we will likely continue to see regulation hotspots, like Gibraltar, push the legislative framework whilst courts across the globe grapple with the complex nature of any dispute. Around 260,000 users of the exchange are believed to have been affected by the hack on Friday, with the thieves targeting the lesser-known NEM coin,BBC Newsreports. The heist at Coincheck involved 523 million tokens from a cryptocurrency known as NEM. While some legal experts revealed they were not too confident in the cryptocurrency-backed loan being legal under Russian loan, others argued in favour of it, saying there are “no restrictions on the circulation of non-payment tokens in our country. In other news, the first cryptocurrency-backed loan issued in Russia has been issued, using the Waves token as collateral.

Exchange operators in Tokyo said the Coincheck hack will likely cause concerns over security to grow among consumers, potentially pressuring the price of cryptocurrencies. NEM fell to $0.78 from $1.01 on Friday but recovered to $0.95 late on Monday afternoon, according to CoinMarketCap. Cryptocurrency related shares mostly rose in Tokyo, with GMO Internet, which offers cryptocurrency exchange services, gaining 5.7 per cent. The FSA has registered 16 cryptocurrency exchanges so far, and another 16 are still awaiting clearance. Partner Elliott Phillips, Professional Support Lawyer Johnny Shearman and Paralegal Melenik Forde discuss the state of the emerging cryptocurrency industry and blockchain, and examine how investors can mitigate their exposure to risk. I do not hold a position in any crypto asset or cryptocurrency or blockchain company. Using unique passwords and two-factor authentication can better protect your cryptocurrency account from hacking.

This event is one of a number of high profile cyber security breaches in recent years. The most infamous in 2014, when digital exchange MTGoxfell victim to a catastrophic breach which saw hackers skim850,000 Bitcoins over an extended period. One of Japan’s largest digital currency exchanges, Coincheck, has fallen victim to a large scale cyberattack. Over 260,000 customers were affected by the hack on Friday January 26, in which £380 million worth of virtual assets were lost. Singapore-based NEM Foundation said it had a tracing system on the NEM blockchain and that it had “a full account” of all of Coincheck’s lost NEM coins.

However, arguably, this is not the most convenient way to manage one’s cryptocurrency wallet and so the debate has started as to how cryptocurrency markets should deal with potential security breaches ahead of time. Coincheck’s losses exceeds those suffered in the attack on the now-defunct Mt. Gox cryptocurrency exchange in 2014, when cyber thieves stole around $460m (£327m) worth ofbitcoin, says The Guardian. On Friday, January 25th, an as-yet determined hacker or hackers compromised the Coincheck exchange and thereafter stole from its hot wallet more than 500 million NEM, one of the top cryptocurrencies by market capitalization. One of Japan’s more popular cryptocurrency exchanges, Coincheck, has just been rocked by what’s already been clarified as the largest hack in the crypto ecosystem’s short history. Bitfinex, one of the largest bitcoin exchanges in the world, saw almost 120,000 bitcoin – about £49m at the time – stolen after its computer systems were breached. With the stolen cryptocurrency worth approximately $526m, the Coincheck heist was the biggest in history. It surpassed the previous record of $470m stolen from the Mt Gox exchange in 2014.

However, comments by Sir Geoffrey Vos, Chancellor of the High Court, highlight the English Court’s desire to be at the forefront of resolving disputes arising out of blockchain technologies. Therefore, commentators anticipate the English Courts, with the agility of the common law system behind them, will deal with disputes swiftly as and when they arise.

Who Are The Richest People In The World?

Hackers used a security loophole to gain access to the Coincheck systems late last year. Coincheck had been storing coins in “hot wallets”, meaning that they were accessible via external, connected networks. Monex plans to add Coincheck as a crypto complement to its existing FX and equities services for retail investors, said Monex chief executive Oki Matsumoto.

- Therefore, commentators anticipate the English Courts, with the agility of the common law system behind them, will deal with disputes swiftly as and when they arise.

- The Hong Kong-based exchange was forced to temporarily stop all trading, deposits and withdrawals, while it investigated how the loss of 119,756 bitcoin occurred.

- Parity is a software developer which produces a web browser allowing users to interact with the Ethereum blockchain network and buy and sell cryptocurrencies including ether.

- Don’t get comfortable between trades and keep any non-trivial sum of crypto on any exchange.

According to Bloomberg, cyber security experts fear that the regime is using stolen cryptocurrency to fund its nuclear weapons program following United Nations’ sanctions on the state, which saw North Korea’s export revenue plummet in 2017. North Korea is thought to be behind a heist on Asia’s leading cryptocurrency exchange Coincheck last month, in which 58bn yen ($526m) was stolen. MILLIONS of pounds is set to be repaid to investors who used the Tokyo-based cryptocurrency exchange Coincheck Inc. after the company announced it would reimburse those who lost money due to being hacked.

The hacker has not moved any of the funds, the foundation said in a statement posted to the Medium publishing site, adding it would create an automated tagging system within two days to follow the coins and identify any account which receives them. The exchange has since faced investigations from Japan’s Financial Services Agency over security failures and has pledged to reimburse users at a rate of $0.81 per token – which would result in a total pay-out near $420m. Japanesecryptocurrency exchange has accepted a takeover offer worth almost £24m from online brokerage firm Monex Group. NEM is the tenth-largest cryptocurrency based on market value, however in the wake of the breach its value plummeted by 11% over a 24-hour period; and it was not the only cryptocurrency to feel the pinch. World leaders meeting in Davos last week issued fresh warnings about the dangers of cryptocurrencies, with U.S. Treasury Secretary Steven Mnuchin relating Washington’s concern about the money being used for illicit activity. “I have to admit that all cryptocurrencies will now be tainted in their minds, so there may be a mid-term negative impact,” said Genki Oda, president of BitPoint Japan.

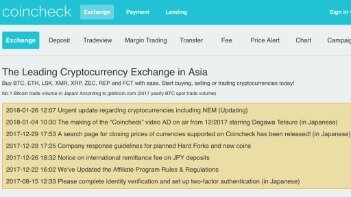

The Hong Kong-based exchange was forced to temporarily stop all trading, deposits and withdrawals, while it investigated how the loss of 119,756 bitcoin occurred. ccording to the Slovenia-based company, the hack was “a highly professional attack with sophisticated social engineering” and that about 4,700 bitcoin, worth about $70m (£52m) at the time, were lost. NiceHash, a website which offers Bitcoin in exchange for customers’ computing power so it can mine other cryptocurrencies, confirmed in December that it had suffered a security breach. The Tokyo-based exchange shut down after admitting 850,000 Bitcoins- worth around £311 million ($480m) at the time – had disappeared from its digital vaults. Details of the hack remained unclear, but the “leading Bitcoin and cryptocurrency exchange in Asia” said it detected the unauthorised access to its system about 3 a.m on Friday. The stolen coins were reportedly kept in a “hot wallet” – a part of the exchange connected to the internet.

Hacked Crypto Exchange Coincheck To Be Acquired

The digital currency news website CoinTelegraph reported that NEM is creating a tagging system to identify the stolen funds. Japan has emerged as a major location for digital currency trading and usage, with more than 10,000 Japan-based businesses accepting cryptocurrencies such as Bitcoin, Ethereum and a range of others. Coincheck is one of Japan’s largest digital currency exchanges, with more than 260,000 traders and currency owners believed to be affected by the security break-in. The funds were seized from a 30-year old doctor who had been arrested in March together with an accomplice for allegedly buying cryptocurrency linked to the hack, violating laws against participating in organized crime in the process. This week cryptocurrency headlines were dominated by security-related advancements, as the Tokyo District Court ordered the first cryptocurrency seizure in the country, seizing cryptoassets associated with the 2018 Coincheck hack.

Taiwanese exchange Cobinhood goes Tether-only after its local banks all cut it off from actual money. Make sure to use your adblock on YouTube — even Google is incompetent to block crypto-mining malware in advertisements.

Coincheck said on Sunday it would return about 90 per cent with internal funds, though it has yet to figure out how or when. The theft highlights the vulnerabilities in trading an asset that global policymakers are struggling to regulate and the broader risks for Japan as it aims to leverage the fintech industry to stimulate economic growth. Russia has launched a humanoid robot into space on a rocket bound for the International Space Station . The robot Fedor will spend 10 days aboard the ISS practising skills such as using tools to fix issues onboard. Russia’s deputy prime minister Dmitry Rogozin has previously shared videos of Fedor handling and shooting guns at a firing range with deadly accuracy. Our UX team designs customer experiences and digital products that your users will love. Investigations are still under way, although recovering the actual stolen coins is an impossible perspective.

The Massive Coincheck Hack Highlights Why Hardware Wallets, Not Exchanges, Are For Holding

South Korea will this week ban cryptocurrency traders from using anonymous bank accounts to crack down on the criminal use of virtual coins. China, worried about financial risks from such trading, has ordered some exchanges in Beijing to close. In 2014, Tokyo-based Mt. Gox, which once handled 80 per cent of the world’s bitcoin trades, filed for bankruptcy after losing around half a billion dollars worth of bitcoins. More recently, South Korean cryptocurrency exchange Youbit last month shut down and filed for bankruptcy after being hacked twice last year. One simple technique investors can adopt to mitigate their exposure to attack is to store any large sums of cryptocurrency in offline wallets instead of those linked to a particular exchange.

But the regulator does not have any rules banning the use of “hot wallets” by exchanges, nor does it set requirements on how much should be kept in “cold wallets,” an FSA official said at a briefing. First off, it stored all the coins in only one hot wallet – meaning that all the deposit was connected to the Internet. It is of vital importance for a crypto exchange to have part of all the deposited coins in a cold, offline wallet to prevent attacks to occur on such a large scale. As it stands, England and Wales are yet to address blockchain technology under specific legislation.

Ether , the second-largest cryptocurrency by market capitalization, started the week at $425 but quickly moved up to $440, accompanying BTC’s move up. ETH then entered a steady downtrend to $380, a point from which it bounced back to $405 at press time. The cryptocurrency markets are famously volatile and tend to react very badly when governments propose new laws. In the past month, there have been two separate ‘bloodbaths’ in which the price of thousands of cryptocurrencies plummeted. Yesterday, Britain’s Prime Minister and Chancellor of the Exchequer called for new laws and regulations to control cryptocurrency trading. The cryptocurrency’s value dropped from a high of about $11,600 to a low of just over $10,500, while the price of Ripple, Ethereum and hundreds of other cryptocurrencies also nosedived.

For bitcoin transactions to clear, computers compete to find the solution to a computational problem, which NEM developers say makes the rich richer as those who have money can afford more hardware to solve such problems. At the time, this amounted to over $450 million; in today’s market that’s over $9 billion. Despite the response time, the company is confident that they can track the lost assets and offer customers reimbursement.

At press time, the stolen NEM are valued at over 530 million dollars or, likewise, 380 million pounds. That makes this current Coincheck hack larger than the cryptoverse’s previous infamous top dog incident, the 2014 Mt. Gox hack that cost crypto investors over 400 million dollars collectively. Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes.

Local reports detailed the loan was issued by commercial bank Expobank to local entrepreneur Mikhail Uspensky, who is committed to holding onto the WAVES tokens. Meanwhile, the decentralized finance space has continued to grow, as more and more users take advantage of lending and borrowing protocols to both earn interest on their cryptocurrency holdings, and to be rewarded in platforms’ native governance tokens. YouTube has been sued by Ripple, its co-founder Brad Garlinghouse, and by Apple co-founder Steve Wozniak over its failure to stop scammers from impersonating celebrities to promote fake giveaways. YouTube itself denies liability for these cryptocurrency scams, on the grounds of Section 230 of the Communications Decency Act, which serves to protect platform publishers from being liable for third parties.

British Summer Time 2021: When Do The Clocks Change?

You could lose everything if you hold your digital assets on the wrong exchange at the wrong time, and that’s a risk that none of us should be willing to take. If there was ever a time to buy a cryptocurrency hardware wallet, this Coincheck hack should drive home the urgency of the need. Yet it remains unclear what recourse the exchange or any affected users may have short of being able to track where the hackers send or spend the stolen NEM. And it’s also unclear what the wider implications of this hack will be in the short- and long-term.

Japan’s financial regulator says it will inspect all cryptocurrency exchanges in the country if it needs to, after $534m worth of bitcoin alternative NEM was stolen by hackers. Japanese cryptocurrency exchange Coincheck has announced it will refund investors most of 58bn yen (£380m) worth of digital coins stolen by hackers last week. In late 2017, North Korean hackers reportedly infiltrated a cryptocurrency exchange in South Korea, stealing at least £5.25 million worth of digital currencies.

“Cryptocurrencies are becoming an incredibly important asset class, one that we can no longer ignore,” he said. However, the Monex acquisition has been well-received by the broker’s shareholders. Its share price has shot up by a massive 40% since news of the Coincheck deal was first reported earlier this week, adding $330 million to its market capitalisation. Cryptocurrency exchange operators working within the country were required as of April 2017 to register with the Government. When you subscribe we will use the information you provide to send you these newsletters. Sometimes they’ll include recommendations for other related newsletters or services we offer. Two individuals whose trading volumes greatly exceeded others were arrested in March 2020, while the other suspects were charged a later date.