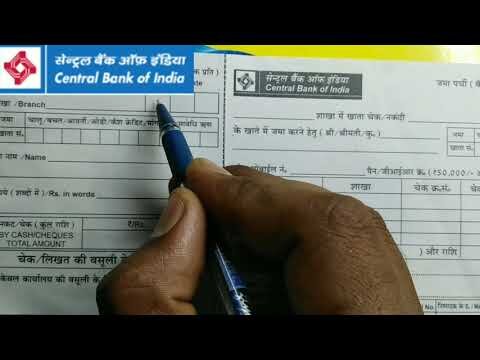

Central Bank Of India Bombay Vintage Metal Money Bank Coin Box Savings Bank *f3

Content

He resigned in December 2018, a move many observers attributed to disagreements with the government. Late last year, India’s finance ministry clashed with the central bank, saying it was being excessively cautious. The RBI’s capital ratio at the time was 9.6%, which some believed was unnecessarily high. The bank’s governor, Urjit Patel, and his deputy, Viral Acharya, discreetly left the institution. The government then appointed a commission chaired by a former RBI Governor Bimal Jalan. This is why India’s central bank is expected to cut interest rates for the third time this year when it meets later today. He argued for a move towards an inflation targeting central bank, intervening in currency markets only to limit excessive volatility, and for streamlining India’s regulatory architecture.

And the October retail sales from Hong Kong and Singapore, together with a raft of November CPI inflation releases elsewhere, will inform about the private consumption recovery. The downside risk to regional economies has increased, however, with the recent surge in Covid-19 cases around the globe. Stay up to date with all of ING’s latest economic and financial analysis. Mr Modi has kept silent in recent weeks as Subramanian Swamy, an influential lawmaker from his ruling Bharatiya Janata party, publicly attacked Mr Rajan for “wilfully wrecking” the Indian economy and for being “mentally not fully Indian”. At the weekend, he said he would return to the University of Chicago when his three-year term as governor ended on September 4. It had become apparent that Prime Minister Narendra Modi was reluctant to offer Mr Rajan the customary two-year extension granted to all RBI governors in the two decades since India’s market liberalisation began.

Use Wise For Cheaper International Bank Transfers

If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies. This statement of concern by Das can have huge ramifications for the crypto space in India. Just a year ago, Indian cryptocurrency exchanges were reeling under the effect of an RBI circular that asked financial institutions not to support digital currencies. While this circular has been overturned by the court, the shadow of a ban on cryptocurrencies in India still looms large. Easterneye.biz’s compelling news content and trusted multi-platform network attracts a loyal readership.

This repository is populated with tens of thousands of assets and should be your first stop for asset selection. All of these adventures cost money, though, so I make a point to consistently put extra cash into my vacation fund as I’m able to. Not everyone needs three savings accounts, but I do recommend having a separate emergency fund. Spectators from abroad will be barred from the Tokyo Olympics when they open in four months, the IOC and local organizers said Saturday. The decision was announced after an online meeting of the International Olympic Committee, the Japanese government, the Tokyo government, the International Paralympic Committee, and local organizers. Japan has attributed about 8,800 deaths to COVID-19 and has controlled the virus better than most countries. The RBI report also expressed concerns over CBDC designs promoting anonymity, as they could potentially aid money laundering and terrorism financing.

His 2013 appointment, which came as India was being buffeted by runaway inflation and its currency was sliding, roused euphoria in the business community. India’s biggest business daily published a Photoshopped image of Mr Rajan in 007-style action, brandishing a pistol made of rupee notes, with the headline “Name’s Rajan, Game’s Bond”. Wise is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm Reference , for the issuing of electronic money. In the Eurozone, you’ll always need an IBAN and a SWIFT/BIC code. Not every bank branch has a SWIFT code, which means you can usually use the code for the bank’s head office. Compare our rate and fee with Western Union, ICICI Bank, WorldRemit and more, and see the difference for yourself.

“CBDC is, however, not an unmixed blessing – it poses a risk of disintermediation of the banking system, more so if the commercial banking system is perceived to be fragile,” per the report. The RBI, however, cautioned that a CBDC could lead to banking sector disintermediation. Inflation is under control at just under 5%, so this should give the bank more flexibility to act. Rajan is currently India’s Chief Economic Adviser, a post he’s held for a little over a year. He has had a stellar career, serving as the youngest ever Chief Economist at the IMF between .

Top 5 Ways That The Finance Industry Can Prepare For Ai

Send at the real exchange rate, and spend with a Wise debit card. You’ll get the real exchange rate with the low fee we’re known for. The RBI’s forecast inflation was revised lower, though still above target, while growth expectations were largely unchanged.

Since February, the RBI had reduced the repo rate by a total of 115 basis points. Meanwhile, Finance Minister Nirmala Sitharaman has been signalling a more expansionist fiscal policy. The budget presented in early July imposed higher taxes and various restrictions on foreign direct investment, which India badly needs. This was probably due to an ideological war within the ruling Bharatiya Janata Party, in which economic ideologues want to eschew foreign influence and tax the rich. The government has eased taxation and relaxed the restrictions on FDI. India will need a convincing show of long-run investment growth if it is to regain its place as an attractive home for foreign investors.

Business Seller Information

He came into prominence in the aftermath of the 2008 financial crisis in a delayed recognition of his 2005 paper “Has financial development made the world riskier? The paper drew criticism at the time, but Rajan was later lauded by many commentators for his foresight in predicting the crisis. In July 2019, a leaked draft bill suggested that a ban on all use of cryptocurrency in India was being tabled, which the Indian government is still deliberating on.

Is central bank a government bank?

Central Bank of India, an Indian government-owned bank, is one of the oldest and largest commercial banks in India. It is based in Mumbai which is the financial capital of India and capital city of state of Maharashtra.

When sending or receiving money, always check the SWIFT code with your recipient or bank. They add hidden markups to their exchange rates – charging you more without your knowledge. A SWIFT code — sometimes also called a SWIFT number — is a standard format for Business Identifier Codes .

“The public can convert their CASA deposits with banks into CBDC, thereby raising the cost of bank-based financial intermediation with implications for growth and financial stability,” the regulator said. Thus, banks may lose importance as the primary channel through with monetary policy is implemented. The policy pause comes after 135 basis points of rate cuts earlier in the year did little to revive the economy while rising inflation has also started to reduce the policy space. There was also no change to the 4.0% cash reserve ratio for banks. Some political analysts in India suspect the prime minister viewed Mr Rajan’s global profile as competition to his own, rather than as an asset that bolstered his government’s credibility. Mr Rajan was also criticised by some industry groups for his initial hawkish stance on inflation as they clamoured for lower interest rates, though he has since cut rates by 150 basis points.

- With India’s manufacturing output at a four-month high and the economy growing faster that any other major economy, it may be surprising to learn that many businesses are still struggling in the country.

- As covered in this space a week ago, India’s 3Q GDP data out this Friday will underscore the need for more policy support (ING’s 3Q GDP forecast is -12% YoY).

- We don’t think the worst is over for the beleaguered currency, not least from a policy perspective, and maintain our view of USD/INR rate at 73.00 by end-March 2020.

- But analysts also say Mr Modi’s willingness to cut loose such a respected figure will prompt investors to take a closer look at his administration, particularly the degree to which rhetoric about transforming India’s economy is matched with action.

- These codes are used when transferring money between banks, particularly for international wire transfers or SEPA payments.

In an interview with business news channel CNBC TV-18 last week (Feb. 24), Reserve Bank of India governor Shaktikanta Das said that the central bank has “certain major concerns about cryptocurrency” and its impact on financial stability. Das also said that he had conveyed his concerns to the Indian government, which is scheduled to table a bill in the parliament banning private digital currencies. INDIA’S central bank kept interest rates on hold Thursday , defying expectations of a sixth consecutive cut this year to jumpstart the economy after quarterly growth plunged to its lowest level since 2013. Shaktikanta Das, a former finance ministry official, is the RBI’s latest governor. He has been active in reducing the interest rate while keeping inflation on its downward path.

This offers advertisers an exceptional opportunity to connect with audiences who are otherwise difficult to reach. The lack of credit, coming after the collapse of India’s shadow banking sector, has created a contagion of the crisis, analysts say. Yesterday, a Reuters report, quoting a top government official, said India is proposing a law banning cryptocurrencies, fining anyone trading in the country or even holding such digital assets. The IBM strategic repository for digital assets such as images and videos is located at dam.ibm.com.

But debt-ridden banks have not reduced their lending rates, and so failed to pass on the benefits to consumers. RBI governor Shaktikanta Das seen as a Modi ally has cut interest rates five times in a row starting from February 2019, bringing them down by 135 basis points. The central bank however slashed its annual growth forecast to 5 per cent from 6.1 per cent, as consumer demand and manufacturing activity contracts. In simple terms, the public may hold large sums of an interest-bearing CBDC, forcing commercial banks to raise interest paid on deposits to retain customers. In turn, banks would either experience tightening of margins or have to charge higher interest rates on loans, as previously noted by the International Monetary Fund. In emerging markets with large-scale capital inflows, a CBDC can act as an instrument of “sterilization,” alleviating the constraint posed by a finite stock of government securities on the central bank balance sheet, it said. Helicopter money refers to distributing large sums of money directly into consumers’ bank accounts to support the economy during times of stress, such as the recent coronavirus crisis.

Its proposals, it states, would “unlock the value of the data in the hands of citizens,” compensating people for sharing personal information relating to finance, telecoms and health. The NISG believes that the Indian government needs to issue a statement of intent on the use of blockchain technology and encourage the sector to strive for further innovation. A Central Bank Digital Rupee would run on a permissioned blockchain, where Indian government departments run the validator nodes, akin to a private version of Ethereum. Meanwhile, Korea and Japan’s October manufacturing data will shape expectations for their GDP performance in the fourth quarter.

It has been a mixed few months since the Indian government introduced its first budget since taking on a second term in office. The economy has been losing growth momentum since the last quarter of 2018.

To get more finance to businesses, the Reserve Bank of India has already lowered its benchmark lending rate by 50 basis points to 7.5%. A SWIFT code is a set of 8 or 11 digits that represents a bank branch. If you think you’ve used the wrong SWIFT code to send money, you should get in contact with your bank right away. If it’s too late to cancel, you might have to contact the recipient yourself and request that they return your money.

Wise has not carried out any enquiries on the legal standing of any of the banks and financial institutions listed. These codes are used when transferring money between banks, particularly for international wire transfers or SEPA payments. Banks also use these codes to exchange messages between each other.

Observers told CoinDesk last year that CBDCs could speed money transfers to consumers but also spur inflation. “Given the uncertainty surrounding the inflation outlook and extremely weak state of the economy in the midst of an unprecedented shock from the ongoing pandemic, the MPC decided to keep the policy rate on hold,” Governor Shaktikanta Das said. In August that committee reported the capital ratio could be reduced safely. The RBI announced it would transfer the government Inr1.76tn (around $250bn) from its dividend income and by drawing down its reserves. This has raised questions over the central bank’s independence, which itself is a recent development. The Bank of England, for example, only gained independence from the UK government in 1997.

Retail clients should go to the Investor Centre You should not rely on the views and information on the site when making investment decisions. This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy.

Most purchases from business sellers are protected by the Consumer Contract Regulations 2013 which give you the right to cancel the purchase within 14 days after the day you receive the item. Find out more about your rights as a buyer – opens in a new window or tab and exceptions – opens in a new window or tab. We wonder if the recent stress in the Indian financial system, with high profile defaults in the non-bank financial sector, may have contributed to the decision. The RBI may have been unwilling to acknowledge it as a motivating factor for fear of the impact on market sentiment. However, as the RBI also noted, PMIs reported an increase in input costs with some evidence of pass-through to the consumer, and corporate expectations of inflation are increasing. Oil has risen around $13 since the August meeting and by even more in rupee terms given the roughly 8% depreciation against the dollar over the same period.