Bloomberg Catches Cryptocurrency Fever

Content

So maybe there’s nothing more to it than Cardano being the latest coin to hitch a ride on the current mania. Cryptocurrency Cardano has shot up in value to become one of the crypto-world’s biggest currencies behind Bitcoin and Ethereum. The decision to list ripple, ether and litecoin is the latest sign of the frenzy over digital currencies.

He noted that in the decade that it had been around, Bitcoin had only been valued above US$10,000 approximately 3% of the time. “If you look at past cycles, once you get to that 3% threshold, the typical surge in the next five months is 200% to 400%,” he said. “The net effect of the trade war between the US and China has led to the sudden interest in bitcoin as a hedge on investments.” Isaacs also pointed to the growing adoption of Bitcoin by major companies. “It won’t go there (US$20 trillion) right away,” he stated, adding that once major financial institutions start offering custodial solutions, it could provide a key impetus. Late in 2018, Citigroup and Morgan Stanley announced their plans to offer such services. In November 2017, John McAfee, a technologist and entrepreneur who is associated with McAfee Antivirus, predicted on Twitter that Bitcoin would reach US$1 million by the end of 2022.

Grayscale is owned by Digital Currency Group, which is also the parent company of CoinDesk. Increasing demand and diminishing supply means Bitcoin has the potential to hit the $100,000 price level this year as it builds towards becoming a global digital reserve asset, states the report. he price of Bitcoin is close to its all-time high after interest from major companies has led to renewed interest in the digital asset. “We can take positions in crypto tokens, real assets or any alternative financial instruments, if that helps the mission of our world-changing companies,” Taavet Hinrikus said.

Dec 2018: Bitcoin Could ‘easily’ Surpass Us$100k In 3

The topics of central bank digital currency and distributed ledger technology are often implicitly linked. The genesis of recent interest in CBDC was the emergence of private digital currencies, like Bitcoin, which often leads to certain assumptions about the way a CBDC might be implemented – i.e. that it would also need to use a form of blockchain or DLT.

- A 10-day 99% VaR of -10% tells you that 99% of the time your 10-day return on the asset would be no worse than a 10% loss.

- Bitcoin’s recent move to a new record high of $19,920 has happened roughly seven months following the May 11 reward halving.

- The price of a single Bitcoin is close to $55,000 after dropping from more than $56,000 overnight.

- Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders.

“Bitcoin is the first scarce digital object the world has ever seen,” PlanB wrote in the Medium post. “A statistically significant relationship between stock-to-flow and market value exists. The likelihood that the relationship between stock-to-flow and market value is caused by chance is close to zero.” PlanB explained this in a 2019 Medium post, noting that given BTC’s current stock and rate of new supply, it would take 25 years of new units being created to reach the existing stock, compared to 22 for silver and 62 for gold. On 1 July 2020, a person with the Twitter handle PlanB provided an update to a chart created for the BTC S2F Cross Asset Model, also known as S2FX.

Mr Gates told host Andrew Sorkin that he preferred to invest in companies “that make products”, citing malaria and measles vaccines as examples. As cyber attacks and data breaches are in the news on an increasingly regular basis – with regulatory penalties and customer trust on the line for financial services firms – it has never been more crucial to be compliant in the cloud. Instant payments are creating new business opportunities for banks by providing more touchpoints than ever. With these evolutions underway, Featurespace brought leading industry experts together to discuss how they are protecting customers from fraudsters in real time, utilizing innovative and disruptive solutions to reduce fraud. stresses that the past three decades have not been good for commodity investors and increasing electrification, decarbonisation, and digitalisation points to a growing role for Bitcoin.

Bitcoin Price Bounces Back Above $50,000 As Prominent Investor Predicts It Could Rise To $5m

For currency pairs and commodities, we chose the most and least volatile ones (in terms of standard deviation of 10-day returns) out of the most liquid in each category. And we chose the most and least volatile FTSE 100 equities (again, in terms of standard deviation of 10-day returns). The fixed Bitcoin mining schedule sets it apart from most assets and markets with uncertain supply and demand meaning, BI said, meaning it is ripe for adoption as a global store of value – and in the process see its market capitalisation exceed that of Amazon.

US Treasury Secretary Janet Yellen also may have caused owners of the currency to sell-off, saying on Monday that Bitcoin was an “extremely inefficient way of conducting transactions”. The rapid increase in bond yields was the latest setback in what has been a tumultuous week for Bitcoin. A steep rise in bond yields on Thursday suggests a potential acceleration of growth and inflation which has led traders to reconsider their position on riskier assets with stocks in tech shares such as Tesla and Peloton taking a hit. Competitors also took a hit with Bloomberg Galaxy Crypto Index – which tracks five cryptocurrencies including Bitcoin – down 23%. Your login credentials will be emailed to you upon completion of scheduled weekend maintenance. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. When considering potential options, investors can benefit greatly from conducting thorough due diligence.

June 2019: Bitcoin Is Heading To Us$100,000, Says Peter Brandt

If history were to repeat itself, the digital currency could enter a parabolic bull market after falling sharply in 2018. The more speculative activity there is, the longer it takes to make a payment. But the future value of cryptocurrency depends on its usefulness as a means of payment. Speculation therefore affects price formation through a channel that does not exist for other asset classes. This can explain the high price volatility of cryptocurrencies, and is consistent with the low adoption rate so far. The price of Bitcoin could rise to as much as US$600,000, Guggenheim global chief investment officer Scott Minerd stated during a CNN Interview. He noted that previously, the digital currency didn’t have a large enough total market value to draw the interest of institutions.

Secondly, Cardano’s price growth may also have to do with the fact that the blockchain has a number of uses. It acts as cash in the way that bitcoin does; however it also holds voting rights. Usually, miners are the ones who vote to make changes to a blockchain’s protocol.

He confirmed that he was sticking by this bet multiple times, reiterating his wager on Twitter in February 2018 and then informing Newsweek in August 2018 that he had not changed his mind. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services.

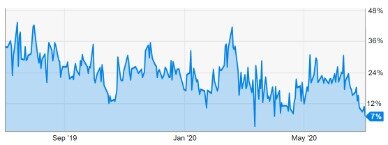

Bitesize: How Volatile Is Bitcoin?

Bitcoin may be on its way to replacing gold as a “store of value,” and if it succeeds in this respect, the digital currency could “easily” exceed US$100,000 in the next three or four years, market analyst Lou Kerner told Bloomberg during an interview. Arthur Hayes, co-founder and CEO of digital currency exchange BitMEX, predicted on CNBC in May 2018 that Bitcoin prices would climb to US$50,000 by the end of the year. He reiterated this forecast in July 2018, appearing once again on CNBC’s “Fast Money” and offering further detail. While the odds appear stacked in favor of the bulls, the cryptocurrency remains vulnerable to a March-like panic sell-off in the global equity markets, according to Bloomberg analysts. Proponents of private cryptocurrencies argue they are a better store of value than traditional “fiat” currency. But even if a cryptocurrency’s value cannot be inflated away by large supply increases, that doesn’t automatically mean its value is stable in terms of ability to buy goods and services.

Tickr’s founders approached Dolman, who spent years Monzo’s chief financial officer since it was started in 2015, via LinkedIn two years ago and he initially became an advisor to the business. aavet Hinrikus, the co-founder of currency transfer business Wise has set up a new investment firm with Sten Tamkivi, the co-founder of Teleport. Those raising capital for the first time secured only £41m across 54 deals, compared to £101m across 76 deals the prior year, in a sign that the earliest-stage businesses were having difficulty securing backing from investors. A spokesman for Atom Bank declined to comment on the company’s valuation but said the “news comes at a time of substantial growth for Atom.” He said the business has seen strong revenue growth during the pandemic. Down rounds in financial technology businesses aren’t uncommon, especially as some have struggled during the pandemic due to a drop in card payments. he valuation of financial technology business Atom Bank has halved as part of its latest funding round, Sky News reports. So instead of partnering with Hyundai or Kia as it had initially planned, Apple is now turning to its vast supply chain in Asia which it currently uses to produce products including the iPhone and its Mac computers.

At that point, the aforementioned reward for completing a block will fall to 6.25 BTC. Schiff told Lee that “My gold forecast came a lot closer than your Bitcoin forecast.” He then added, “Plus at least gold will eventually hit 5k.” Lee provided background for this prediction during a Binance podcast in June 2019.

The article containing this info, dated 1 March 2019, made it clear that at the time, Bitcoin was worth approximately US$4,000. Arthur Hayes, cofounder and CEO of digital currency exchange BitMEX, wrote in a March newsletter that “The 2019 chop will be intense, but the markets will claw back to US$10,000.” “That is a very significant psychological barrier,” he added. He added that while central banks may issue their own versions of cryptocurrencies, these digital assets will be pegged to fiat currencies, and no one knows how what the money supply of these fiat currencies will be going forward. As Bitcoin has experienced these sharp price fluctuations, market observers and analysts have repeatedly predicted where its price will go further down the line.

This episode is sponsored byCrypto.com,Nexo.ioand this week’s special product launch,Allnodes. Figure 2 shows Bitcoin’s VaR is high, but the VaR of the other most liquid crypto-assets is higher. The product offering in Deutsche Börse’s ETF and ETP segment currently comprises a total of 1,564 ETFs and 192 ETCs and ETNs. With this selection and an average monthly trading volume of around €13 billion, Xetra is the leading trading venue for ETFs and ETPs in Europe. In 2018 he said in an interview with CNBC that he would “short” it if he could. Short-selling, or shorting, refers to the practice of borrowing something , selling them, waiting for the price to drop and then buying them back cheaper and returning them.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. “If you consider the supply of bitcoin relative … to the supply of gold in the world, and what the total value of gold is, if bitcoin were to go to those kinds of numbers, you’d be talking about $400,000 to $600,000 per bitcoin,” said Minerd.

Bitcoin’s most recent market surge has been boosted by major investments from high-profile firms, most notably a $1.5 billion buy in from Elon Musk’s Tesla. Fresh investments from Square, the payments firm run by Twitter co-founder Jack Dorsey, that have helped bitcoin’s price recover from last week’s dip.

Qualcomm Inc CEO Steve Mollenkopf said he is “seeing improvement” in efforts to ease chip shortages that have caused disruptions across several industries, and that demand for older chips is easier to respond to. Demand has soared for chips in recent months, with panic buying further squeezing capacity and driving up costs of even the cheapest components of nearly all microchips. Speaking in the same panel, president and CEO of Micron Technology Inc Sanjay Mehrotra said the chipmaker would aim to increase its supply in line with the growing demand for the company’s products. Prime Minister Boris Johnson received his first dose of the Oxford/AstraZeneca coronavirus vaccine on Friday evening.