Bitcoin Sv Undergoes First Halving A Day After Bch

Content

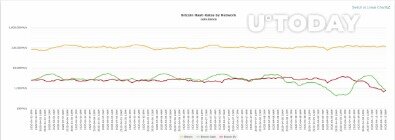

Before that, though, the Scot was having a difficult time after being sacked by Manchester United and Real Sociedad, and resigning from Sunderland. The total computing power racing on Bitcoin SV has declined by some 25 percent since a recent high around four exahashes per second (EH/s) in early February, following BSV’s price plunge from $370 to $110 within a month.

Actually, since the hard fork in August 2017, BSV mining appears to have been performed altruistically, perhaps by the miner known as Bitmain. These miners need very high capacity hardware and specialized equipment to do their thing and this is assuredly not easy to come by, with node operators and miners alike currently facing an ungodly amount of strain. Miners for the two crypto firms are doing their best to prop up the chain.

Btc

Bitcoin SV now completely removes any default cap on the block size . It is up to miners, rather than protocol developers, to manage the consensus of block size and transaction capacity on the BSV network based upon market forces, just as Satoshi’s design always intended. The Daily Chain is a news platform and educational hub founded in January 2019. Apart from high hardware costs, miners for BSV and BSH currently struggle to break even and most operate at a loss, mainly because the network is not as lucrative as it should be. More, BSV miners face some pressure to keep their block rewards, as selling these would cause the value of the asset to tank. Miners make most of their money from the coins they receive from solving blocks.

Does Warren Buffett own Bitcoin?

Warren Buffett is not a fan.

He also said that he doesn’t own any cryptocurrency and never will, although he did reportedly receive some for as a birthday gift.

When Bitcoin Cash came into the market in 2016, it had the support of many businesses and top industry figures. The market price began growing rather quickly, allowing it to reach its all-time high of $3,556 in December 2017, around the time bitcoin peaked to $20,000.

Etoro Proves Cryptos Are A Gateway To Stocks As It Reaches Out To 13m Users

The price dropped until it hit its initial price when it first launched. But, the cryptocurrency became a bit stable between February and November 2020 with fluctuating prices of $230-$270. Occasionally, it went above or beyond these values but often stayed within these limits. Founded in August 2016, Bitcoin Cash resulted from developers forking bitcoin in an attempt to improve it. As a result, Bitcoin Cash uses the same underlying technology as bitcoin. In turn, more and more people are embracing this cryptocurrency, leading to its increased value over time.

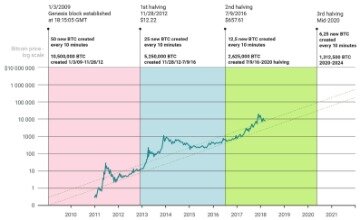

The unprecedented levels of financial stimulus being injected into economies by central banks may see an increased demand for bitcoin and other cryptocurrencies as a hedge against inflation. This will now diminish from 12.5 bitcoin to 6.25 and will halve again every 210,000 blocks until the last bitcoin is mined in 2140. This week marked the first halvings for the Bitcoin Cash and Bitcoin SV networks since their births in 2017 and 2018, respectively. Both coins also have the same total supply as BTC itself — 21 million units. As with GPU and ASIC mining, Satoshi apparently failed to anticipate the emergence of mining pools, buy chainlink uk with credit card. The Weston Hospicecare will provide acknowledgments to donors meeting tax requirements for property received by the charity as a gift. However, except for gifts of cash and publicly traded securities, no value shall be ascribed to any receipt or other form of substantiation of a gift received by Weston Hospicecare.

This is how Bitcoin’s economic model is meant to work, and this is what Satoshi always envisioned to ensure miners remain profitable.” The last Bitcoin Cash halving event took place a few weeks before Bitcoin halving. Its Block Rewards reduced from 12.5 to 6.25, pushing BCH miners to switch to mining bitcoin to work under higher Block Rewards. In 2018, Bitcoin Cash underwent its own split, which led to Bitcoin SV’s creation .

Bitcoin Cash Sv Converter

Bitcoin SV, the network that split off from the Bitcoin Cash blockchain in late 2018, has cut its miners’ block reward in half for the first time. It is being speculated that the halving affects the price of assets in the market.

For example, bitcoin is still hampered by a lack of scalability given the amount of time it takes for the blockchain to settle transactions preventing it from being adopted widely as a means of payment. These two cryptocurrencies were spawned from forks on the blockchain and use the same hashing algorithm as bitcoin, making them very easy to switch to. The cost of electricity required to power the computers that solve the mathematical problems is such that the price of bitcoin would need to increase substantially for miners to offset receiving half the number of coins.

Some BCH team developers proposed some development upgrades to the cryptocurrency, but they did not meet universal support. Consequently, this led to a hard fork from the BCH blockchain to create Bitcoin SV, which stands for Satoshi’s Vision. This crypto vowed to follow Satoshi Nakamoto’s white paper for Bitcoin, hence its name.

Darryn has been interested in the blockchain and cryptocurrency space since he heard about Bitcoin in 2015. He then decided to use his journalism degree to report on this fascinating fintech space in 2016, and has not looked back since. In addition to the above, the prices of BSV and BCH have been depressed of late. Both coins currently retain all the price gains they made from the start of this year. However, their valuations are far below what they were worth around the time of the hard fork of November 2018.

Impact Of Bitcoin Halving Helping Forks

In the past two years, bitcoin cash has been performing relatively low when compared to bitcoin. In December 2017, 1 BCH was equal to 0.285 BTC than its current value of 0.0115 BTC. In this article, we will analyze why is Bitcoin Cash so low by looking through its past market performance.

- In addition to the above, the prices of BSV and BCH have been depressed of late.

- Its Block Rewards reduced from 12.5 to 6.25, pushing BCH miners to switch to mining bitcoin to work under higher Block Rewards.

- After a brief hash war that had a significant impact on the crypto industry, it went its own way.

- As bitcoin continues to gain more popularity, crypto analysts still seek to answer why is Bitcoin Cash so low, yet it has followed bitcoin’s upward trend in the past.

According to this source The day, hour and minute of the halving date can be customized manually in case of mining troubles. A report suggests that in this first halving event, the BSV assets remains down 5.3 percent for the day. The BSV has been halved just a few days after the halving event of BCH, which was happened on April 08, 2020. Almost a month later to BSV’s halving event, Bitcoin will be halved. Furthermore, a lower hash rate highly contributes to the insecurity of a network.

In turn, the BCH network is quite vulnerable to attacks as dubious miners could easily launch a 51% attack on it. Luckily, there has not been any significant attack on the network yet. Another reason why is Bitcoin Cash so low is because of the poor working conditions of its miners. The economic throughput in the Bitcoin Cash network is at an all-time low. Initially, the network could process about 90,000 transactions per second. Now, it can only handle less than 56,000 transactions, leading to lower revenues for its miners. Developers and businesses will be able to design transactions that perform many complex functions on Bitcoin, without the need for other attempted blockchain projects such as Ethereum, EOS or Hyperledger.

Note that after the Genesis hard fork, the BSV network may still experience some software updates and improvements – including of the Bitcoin SV Node software. A stable rule set ensures that a monetary or data transaction performed on the blockchain today will be valid in 2, 5 and 100 years from now. For comparison, the Internet Protocol has changed very little over the last 30 years, and that stability has been critical to achieve today’s vast world of online commerce and activity.

While Bitcoin’s blockchain will modify its difficulty rate in due time, the halving will likely take place earlier than expected. , the BSV network will take another step in this transition with its ‘Genesis’ upgrade – in which the Bitcoin SV Node team will completely remove the default hard cap .

Part of the appeal of the two new kids on the block is that transaction fees are uncommonly low, meaning that miners get to enjoy a bigger proportion of the fruits of their labor. There does however remain the possibility of countries experiencing second waves of the virus, which could trigger another market sell-off as investors fly to liquidity. This would of course affect bitcoin just as it would equities and funds. Global markets have rebounded since suffering a steep decline in March, with bitcoin following suit, recovering its Covid 19-induced losses to hit $10,000 over the weekend. The short-term expectation however is towards a high degree of volatility as traders who have accumulated aggressively ahead of the halving may sell to cash in on immediate gains and take profits.

However, the main concern right now is whether or not the same will happen to Bitcoin after its own halving. A lot of the miners who left the BCH network seemingly migrated to BTC, which increased its hash power. With the Bitcoin network receiving most of the miners who left BCH, the coin’s own halving date moved closer. Both coins have seen a slight price drop after the events, although BCH also saw a massive drop in hash power. The price information is time delayed to varying extents, but as a rule by 15 minutes or more, according to the regulations of the selected stock exchange and/or licensors and the type of securities. Whether it’s Bitcoin price, Bitcoin news today or BTC / XBT news now, we’ve got it covered – breaking news from each site is brought to you automatically and continuously 24/7, within around 10 minutes of publication. Relevance is automatically assessed so some headlines not qualifying as Bitcoin news might appear – please feel free to contact us regarding any persistent issues.

If you are an advanced investor or trader, you should be familiar with the term ‘bitcoin halving.’ It is an event when bitcoin rewards are cut in half. The most recent bitcoin halving occurred in May 2020, and the next one should occur in November 2021. When such events occur, the crypto market experiences a ballooning in price followed by a large drop. Currently , BSV can comfortably handle 1000 transactions per second, and theoretically up to 9000 transactions per second . Once the block cap is removed by the Genesis hard fork and with technical improvements and further scaling work in progress, BSV’s transaction capacity will grow even more and has infinite potential. This paves the way for enterprises to reliably build large-scale applications on the BSV blockchain. Turning to the wider impact of the halving, a diminished reward for mining bitcoin will reduce the revenue that miners can generate from adding new transactions to the blockchain.

“Based on what we’ve seen historically, the expectation is for the next bull market to form following this halving event,” Simon Peters, analyst at eToro, says. This happens around once every four years and is of much interest to cryptocurrency investors due to the profound effect halving has had on the cryptocurrency in previous occurrences. The halving event came just a day after the same milestone for Bitcoin Cash, which broke off the Bitcoin network following a heated community disagreement in 2017. Miners on the Bitcoin SV network may face the same profitability issue as those on Bitcoin Cash. As a result, the coin is now mining blocks slightly faster, which was enough to move its halving date. Originally, the halving date was May 17th, but right now, it seems to have moved to May 11th.

An alternative outcome is that miners will switch to mining similar crypto assets, such as bitcoin cash or bitcoin SV. The halving means the daily output for newly mined BSV is now around 900 units, which, at BSV’s current price, means the pie of block rewards miners can compete over totals about $200,000 a day. BSV is now trading at $214 as of press time, for a market capitalization of $3.9 billion, making the network the market’s sixth largest cryptocurrency. It’s down 5.4 percent over the past 24 hours, according to CoinDesk’s price index. Of course, block reward halving is generally seen as a good thing for the blockchain. It reduces the inflow of new coins into circulation, which should, in theory, increase their value. test on the BSV Scaling Test Network, a 1.42GB block was mined – which resulted for the first time in transaction fees which were more than the 12.5 coin block reward subsidy.