Bitcoin Price will Hit $50,000 This Week After Tesla Investment, Analysts Predict

Content

Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Donovan Mitchell scored eight of his 31 points in the final minute and a half to lead the Utah Jazz to a victory over the Toronto Raptors on Friday night. Pascal Siakam’s 3-point shot at the final horn spun around and out for the Raptors, who have lost seven straight. Joe Ingles came off the bench with 19 points for Utah, which avoided losing on consecutive nights for the first time since Jan. 5-6. The sell-off began on Monday, seemingly triggered by comments from US Treasury Secretary Janet Yellen.

Tesla’s move may help accelerate adoption, but this won’t happen overnight. As long as governments worldwide continue to pay employees in fiat currency and collect tax in fiat currency, the use of Bitcoin and its peers seems unlikely to become widespread. Yet, the company’s decision to begin accepting Bitcoin as a method of payment for its vehicles may inspire other companies to start using Bitcoin, which could drive a virtuous cycle. This is the primary reason why most analysts believe other blue-chip stocks will not follow the electric car company. This article is for information only and must not be considered as financial advice.

What will bitcoin be worth in 2023?

The forecast

Mr Swift expects the Bitcoin price will hit somewhere between US$92k and US$137k in October of 2023.

Arthur Hayes, co-founder and CEO of digital currency exchange BitMEX, predicted on CNBC in May 2018 that Bitcoin prices would climb to US$50,000 by the end of the year. He reiterated this forecast in July 2018, appearing once again on CNBC’s “Fast Money” and offering further detail. A sharp and broad-based sell-off has hit the cryptocurrency market, piercing a recent bull run powered by corporate and retail interest alike. If you want to buy bitcoin and other cryptos – and sell them again – there’ll be several fees, such as transaction fees, deposit fees, withdrawal fees, trading fees and escrow fees of usually a few percent of the total transaction value. Gemini, founded by the Winklevoss brothers , is a digital exchange that allows customers to buy, sell and store cryptocurrencies. It was recently awarded an operational licence by the Financial Conduct Authority, and is regulated by the New York State Department of Financial Services.

The Crypto Hunters Searching For Billions In Lost Bitcoin

And rather than being issued from the top down like traditional currency, bitcoin is ‘mined’ through powerful computing. What it is, why it has been so volatile of late and what it could mean for you. We’ll provide you with some preliminary information here as you grapple with that decision. Bitcoin prices are “heading to 6-figures,” said Max Keiser, host of the Keiser Report, said on Twitter. He predicted the digital currency would experience a retracement before then, also stating in the same communication that “$28,000 is in play before we see a pullback.”

Bitcoin has risen over 400% since the start of October and recently reached a new all-time record above $58,000. “Tesla and bitcoin are increasingly tied together and the latter had a crazy day, trading down -16.53% at one point before closing -4.21% in its worst daily performance this month,” said Jim Reid, a senior strategist at Deutsche Bank. “It’s not clear if the moves were prompted by a delayed reaction to an Elon Musk tweet on Saturday in which he said that the bitcoin did ‘seem high’.” Analysts also pointed to tweet from Elon Musk over the weekend saying bitcoin and ethereum prices “seem high.” Ethereum (ETH-USD), the world’s second biggest crypto, was down 14.8% to $1,600.96.

Are Premium Bonds A Good Investment?

Bitcoin has seen its price increase by more than 700 per cent since March. If you would like to see our company updates and industry insights, follow our LinkedIn pagehere. Bitcoin has sparked intense debate and is followed intently, but compared to traditional markets, it is still a minnow. By December it soared to almost $20,000, a level not matched again until December 2020 and the current bull run. In November 2018, it was back below $3,500, to the horror of terrified investors. Certainly, many multinational businesses are considering including bitcoin within their global treasury function. I will look deeper into the opportunities for treasury departments in a future blog.

Crypto Traders can build a diversified portfolio with the most popular coins. According to DigitalCoinPrice’s predictions, the price of Bitcoin will peak in 2023.

Bitcoin’s Volatile History In Pictures

Some of the new markets, including Bangladesh, Pakistan and Nigeria, have some of the biggest emerging internet audiences in the world. The company also announced a number of tweaks to the platform, including better tools for bedroom artists to create music, improved playlists and a launch in 80 new countries, including Asia, Africa, Caribbean and Europe. “Turns out that we can even predict what kinds of podcasts listeners might enjoy based on their taste in music,” he said during the company’s annual investor conference. ustav Söderström, Spotify’s head of research and development revealed that the company is working on making its discovery function just as effective for its podcasts, as it is for its music. See today’s front and back pages, download the newspaper, order back issues and use the historic Daily Express newspaper archive. Just last week, Mr Pompliano predicted that bitcoin will one day reach a value of $1million (£734,000). But, if one prediction is correct, investors could once again see huge surges.

Will Bitcoin go up 2021?

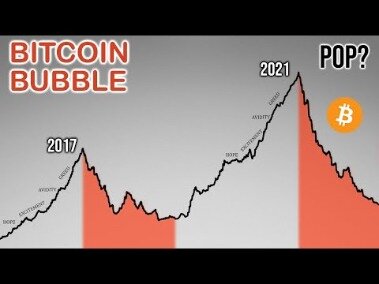

“2021 is going to be a lot like 2017 which means bitcoin should do even better in 2021 than it did in 2020, so something above 300%,” Lee told CNBC. Following a strong 2020 that saw Bitcoin march to all-time highs for a gain of around 300%, 2021 could be even stronger.

“The original BTC S2F model is a formula based on monthly S2F and price data,” they wrote. “Since the data points are indexed in time order, it is a time series model.” “Bitcoin is the first scarce digital object the world has ever seen,” PlanB wrote in the Medium post. “A statistically significant relationship between stock-to-flow and market value exists. The likelihood that the relationship between stock-to-flow and market value is caused by chance is close to zero.”

The upcominggovernment media code demands that Facebook and Google agree direct fees with news producers, or instead accept a price decided from an official arbitrator. In November, a governor for the People’s Bank of China said more than 2 billion yuan ( £220 million) had been spent in the digital currency so far. The participation of MYbank alongside Tencent-backed WeBank is likely to expand the digital yuan’s reach as China pushes for the central bank digital currency to become a world first. MYbank’s service will be introduced to the digital yuan app which is run by the People’s Bank of China, according to a company spokesperson.

- 76.31% of retail investor accounts lose money when trading CFDs with this provider.

- “Stablecoins continue to develop and be the potential solution to the problems of volatility and credibility for cryptoassets.

- When arriving at this figure, the two authors of the report, an analyst and a head of research for Satis Group, made use of fundamental analysis.

It was only a month ago when bitcoin made the headlines after reaching a record value of $20,000 per coin. You will have no right to complain to the Financial Ombudsman Services or to seek compensation from the Financial Services Compensation Scheme. All investments can fall as well as rise in value so you could lose some or all of your investment. This article does not provide any financial advice and is not a recommendation to deal in any securities or product. Investments may fall in value and an investor may lose some or all of their investment.

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions.

Elon Musk has come under fire before for his lax approach to corporate governance and shareholders’ treatment. Suppose the value of Bitcoin were to fall, and it turned out that he had effectively gambled away $1.5 billion of shareholder funds.

To explain how he determined this figure, Selkis pointed to the “Great Wealth Transfer” that could see Millennials inherit US$30 trillion in the next 20 or more years. He then said that if even 1% of that amount is invested in digital currencies, Bitcoin prices could rally to US$50,000 or higher.

It is very important to do your own analysis before making any investment based on your personal circumstances. No news or research item is a personal recommendation to deal or invest in any particular company or product, nor does Valuethemarkets.com or Digitonic Ltd endorse any investment or product. The move marked the first time a blue-chip business had acquired such a large amount of cryptocurrency. The company’s decision to pursue a Bitcoin payment strategy is also a first in the blue-chip space. This can, in large part, be attributed to worries about regulatory clampdowns by the world’s banks and governments. As moves by banks to ban buying bitcoin on credit cards, for example, became increasingly widespread, investors started getting spooked, pushing prices lower.

This will help us to support the content of this website and to continue to invest in our award-winning journalism. “Stablecoins continue to develop and be the potential solution to the problems of volatility and credibility for cryptoassets. In contrast to cryptos, stablecoins have actual assets behind them, like regular currencies,” he says. By entering your details, you acknowledge that your information will be used in accordance with our privacy policy. Receive regular articles and guides from our experts to help you make smarter financial decisions. “And I’m even toying with the idea of selling my gold to buy bitcoin, more Bitcoin.”

“The world is moving online more and more and bitcoin sits at the heart of online transactions, and with this kind of endorsement from a multi-billion dollar company, it’s likely the price will hit $50,000 by the end of the week.” Mr Draper has since remained bullish about bitcoin’s future prospects, claiming in 2019 that the cryptocurrency would reach well beyond its previous peak of $20,000, which it hit in late 2017. Bitcoin was trading below $44,000 earlier this week, having hit an all-time high the week before above $58,000. Its rebound suggest the third great price rally in its history may still be underway, with Mr Draper claiming that it holds the potential to rise a further 100-fold. Regarding Bitcoin, it is worth to note that we should not expect a strong correction,FXOpen experts say. First, large crypto investors do not sell their coins, but on the contrary, withdraw liquidity from exchanges, which has a positive effect on the price.

From January, UK cryptocurrency investors may find it slightly more difficult to buy into bitcoin. This time one month ago, on January 18, the price of Bitcoin was around $36,700. But people can still continue to buy cryptocurrencies directly and invest them or use them as currency. Meanwhile, in October 2020, the FCA banned Brits from buying a “harmful” type of cryptocurrency-related investment in the UK known as an Exchange Traded Note. In a warning last month, the FCA said Brits risk losing their money if the price of Bitcoin plummets. Like with all cryptocurrencies, this means if you choose to invest in Bitcoin, you can lose your money if the value of it drops. Investing in cryptocurrencies or stocks and shares is not a guaranteed way to make money.

We always recommend that you seek independent financial advice before making any financial decisions. Forex Capital Markets Limited is authorised and regulated in the United Kingdom by the Financial Conduct Authority. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. “For bitcoin, this is certainly not the first major pullback during this cycle, nor is it even the most severe,” said Mati Greenspan, founder of Quantum Economics. “We’re up about 80% year-to-date, and even a normal bull market retracement from the peak right now would take us all the way back to $40,000 per coin. The slump follows a surge over the last few months that has propelled the market to new highs.

Market analysts have provided a wide range of forecasts regarding what Bitcoin prices will do in the future. A few days later, he offered additional insight into the matter in a second tweet.

Since the start of the pandemic panic of March 2020, the TOTAL index, which takes into account all cryptocurrencies, has grown by almost 1000%. from the point of view of the analysis of trading volumes in interaction with the price. Citi analysts predict the price of Bitcoin at the level of $300,000 at the end of 2021. Although JPMorgan does not give exact numbers, it confirms that Bitcoin has the potential for further growth, as it competes with gold as an alternative means for storing capital.