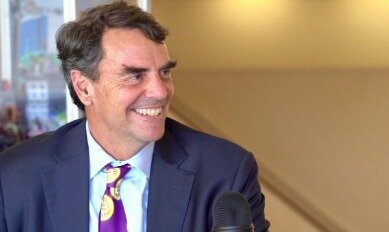

Bitcoin Price Prediction Of $250,000 Is ‘conservative’, Claims Billionaire Investor Tim Draper

Content

“In this article I solidify the basis of the current S2F model by removing time and adding other assets to the model,” the author clarified. On 1 July 2020, a person with the Twitter handle PlanB provided an update to a chart created for the BTC S2F Cross Asset Model, also known as S2FX. The model, which uses dots to chart Bitcoin’s price history relative to halving events, received a second red dot on 1 July.

His work can be seen on several forex blogs and trading educational websites. For Draper, even if the coin, with its limited supply, was wirth $250,000 in the next few years, it would only make up a mere 5 percent of the entire market share of the currency of the world.

Mar 2019: Bitcoin Could Surpass Us$50,000 In Next 20+ Years, Says Ryan Selkis

Other financial analysts have also predicted that the price of bitcoin is set to increase, though their market projections have been far more modest. Prominent investor Tim Draper has predicted bitcoin will experience huge price gains over the next four years, claiming the cryptocurrency grow more than 25-fold by 2023. Bitcoin’s most recent market surge has been boosted by major investments from high-profile firms, most notably a $1.5 billion buy in from Elon Musk’s Tesla. Fresh investments from Square, the payments firm run by Twitter co-founder Jack Dorsey, that have helped bitcoin’s price recover from last week’s dip. Think of it like found money to play with, football bitcoin prediction from expert. Based on the various expert predictions and the past price history, it is clear that the price of Bitcoin is on the uptrend.

This time around, he picked an even more seemingly unattainable figure of US$250K by 2022. He also expressed the view that within the next five years, cryptocurrencies would go fully mainstream and the use of fiat would become an oddity. Venture capitalist and angel investor Tim Draper predicted on 12 April that the Bitcoin price would reach US$250,000 by 2022. He announced his prediction at a ‘block party’ organized at Draper University. He founded the institution, located in San Mateo, California, to train entrepreneurs.

June 2019: Bitcoin Could Reach Us$25,000 ‘by The End Of 2019 Or Early 2020,’ Says Oliver Isaacs

This means it is only $3,500 (£2,518) short of the record $58,000 (£41,730) high it hit in February, as the cryptocurrency experiences a strong start to 2021. Learn two complete trading strategies to optimize your trading for fast-moving markets. Eno is a certified financial technician and member of the UK Society of Technical Analysts. Since 2009, he has consulted several financial companies as a trader and strategy developer.

The Bitcoin bull stated that the currency could place all workers under the same platform where the worth of 1 BTC will remain 1 BTC, unlike the dollar, which is losing its value. Speaking to cryptocurrency news show Blocktv, Mr Draper said his previous price predictions had come true and that his latest one may even fall short of bitcoin’s eventual value. The price of bitcoin has returned above $50,000 as it recovers from one of the most severe dips in its history. The latest gains come as prominent investor Tim Draper laid out his most positive predictions yet for the cryptocurrency.

The coming 2020 halving, coupled with an increase in demand, could drive the Bitcoin price towards the US$250,000 mark. The last halving that happened in 2016 is often given as one of the reasons that the Bitcoin price jumped from below US$200 in 2015 to US$19,000 in late 2017. Their efforts will introduce more people to cryptocurrencies in general, and Bitcoin in particular, over the next five years. After witnessing such accuracy, many have since asked him to make a new prediction. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. When considering potential options, investors can benefit greatly from conducting thorough due diligence. For example, if they want to consider the forecasts of different market experts, it could be quite helpful to investigate the background of these analysts.

- The strong move seen in the last one hour has provided an intraday violation of this level.

- He then said that if even 1% of that amount is invested in digital currencies, Bitcoin prices could rally to US$50,000 or higher.

- He noted that in the decade that it had been around, Bitcoin had only been valued above US$10,000 approximately 3% of the time.

Besides, they were asked to spend the funds within a few days before they disappear, an excellent way to promote digital renminbi and encourage its use. Mr Green is joined by several other industry figures in predicting short-term gains, with some pointing to the record bitcoin mining rates in recent days acting as a key metric towards future gains. He stood by this forecast following the anticipated interest rate cuts, adding that cryptocurrencies will “continue to do well as the global economy slows and central banks ease monetary policies in response to this”. “Bitcoin is likely to break out of its recent sideways trading pattern and be given a healthy boost by the Fed’s rate cut,” he told The Independent. The venture capitalist said he may have underestimated bitcoin when he previously predicted it will reach $250,000 (£201,000) – a figure he first forecast when bitcoin was worth around $5,000 in 2018.

Btcusd Daily Chart

Big banks are expected to introduce custody services to hold Bitcoin and other digital assets on behalf of their clients. When the World Health Organization declared a global pandemic in March 2020, Bitcoin price dropped as low as $4,000.

One prediction that initially seemed quite optimistic and bold has now been thought to be not bold enough. The investment bank sees a pattern of increased investments from financial institutions, following the likes of MassMutual and MicroStrategy in getting exposure to Bitcoin. BITCOIN value will increase ten-fold a top US venture capital investor has claimed, as international investment bank JP Morgan estimates the price of each coin could soar to $650,000 (£485,763). It is important to understand that Tim Draper’s forecast could be biased, considering that he has a skin in the game, as does McAfee and others who have predicted high prices. If you choose to make personal investment decisions regarding Bitcoin, you may want to take into account factors other than their words alone. The founder of the company behind the McAfee antivirus software believes the price of Bitcoin will hit US$1 million by 2020.

“It won’t go there (US$20 trillion) right away,” he stated, adding that once major financial institutions start offering custodial solutions, it could provide a key impetus. Late in 2018, Citigroup and Morgan Stanley announced their plans to offer such services. Bitcoin prices could reach US$96,000 by 2023, according to a report released by ICO advisory firm Satis Group.

Bitcoin price prediction platform Stock-to-Flow bets the coin will achieve $100,000 per token by December 2021. Different banks have also given their predictions as to how the coin will end the year. For instance, CitiBank analysts give a figure that is slightly higher than that of Pompliano; $300,000 by December 2021. Although it does not give an exact number, the bank seems confident of Bitcoin’s future growth.

During both of the aforementioned periods, Bitcoin suffered sharp losses and fell more than 80%, according to industry data provided by cryptocurrency hedge fund manager Tim Enneking. However, when Bitcoin bottomed out in 2015, it enjoyed a very strong advance, Brandt said.

“Since the data points are indexed in time order, it is a time series model.” “Bitcoin is the first scarce digital object the world has ever seen,” PlanB wrote in the Medium post. “A statistically significant relationship between stock-to-flow and market value exists. The likelihood that the relationship between stock-to-flow and market value is caused by chance is close to zero.”

Will Dogecoin hit 10 dollars?

Dogecoin might initiate the trade at $1.5 during 2022. If the DOGE manages to acquire the attention of marketers, the price could reach up to $5. The meme token may also hit $10 with the support of major well-known influencers.

Regardless of all this, the benefits of Bitcoin hugely exceed the disadvantages and risks. A decade ago, Bitcoin investment was an opportunity of a lifetime, and still might be today. Even though nobody knows what the price of BTC will be at the end of the year, many are confident that the bull market is here and will likely continue. As the Chinese government transitions to nationwide digital renminbi adoption, the demand and interest for Bitcoin will drop.

After this next halving takes place, the rate at which new units of bitcoin enter the system will be reduced, affecting supply. Should enough anticipation build up going into the subsequent halving, which is scheduled to take place in 2024, bitcoin could potentially reach US$100,000, said Vays. However, he emphasized that even after the next halving took place in 2020, market observers would need to wait another four years for the subsequent event in 2024. Peter Brandt tweeted in June 2019 that Bitcoin was “experiencing its fourth parabolic phase dating back to 2010” and that it had taken “aim” at a “target” of US$100,000. “No other market in my 45 years of trading has gone parabolic on a log chart in this manner. Bitcoin is a market like no other.” Lee provided background for this prediction during a Binance podcast in June 2019.

The price of Bitcoin could reach US$85,000 if investors pull enough of their money out of gold and put it into the digital currency. That’s according to the digital asset trading firm QCP Capital, which was citing analysis conducted by hedge fund Bridgewater Associates. In April 2019, veteran trader Peter Brandt predicted that Bitcoin could enter a parabolic bull market, climbing to US$50,000 in the next two years. He elaborated on this prediction when speaking with Yahoo Finance YFi PM and emphasized the digital currency’s market history. At the time, when the digital currency was trading below US$10,000, he also forecasted that it would hit US$25,000 by the end of 2018. He cited a valuation model that considered variables such as the expansion of the money supply and alternatives to that money supply, such as gold. Away from the price, one should bear in mind that the governments and central banks worldwide will be closely monitoring Bitcoin’s swelling market capitalisation.

The digital asset is powered by Blockchain, an open-source code that creates a ledger that can be accessed by anyone. This block is ‘chained’ to the central code to create a permanent record of every transaction ever made. So, as Satoshi Nakamoto’s invention breaks through to unimaginable levels this year, more people are developing interest and looking to invest in one of the most popular digital asset coin. Apple is the most valuable company in the world, with a market capitalization of over $2 trillion. Its brand name is essentially gold in the consumer electronics market, and the company has an installed base of 1.65 billion devices around the globe.

“So if that constant maintains and if 3 billion people ever own Bitcoin it would be worth ~ $21 trillion (~ $7,000 x 3 billion) or $1 million per Bitcoin.” Moreover, a leaked CitiBank report in December 2020 suggested that one of the bank’s chief analysts thinks the Bitcoin price will possibly hit $318,000 by the end of 2021. The Immediate Edge predicted that Bitcoin price could hit $100,000 by the end of 2021. These bold predictions indicate how much confidence firms and individuals have in the top cryptocurrency. Even though the CO sports betting law does not increase existing taxes, it had to survive a statewide vote because it establishes a new tax on licensed sports betting operators. Despite the ballot question’s awkward phrasing, voters approved the bill to formally legalize in-person and mobile / online sports betting.

Despite the potential bull market April run, Bitcoin remains down about 50 percent from its all-time high price of $19,000. Bitcoin’s value has been buoyed by a combination of factors, including Wall Street banks announcing plans to hold the cryptocurrency, and big firms like Tesla investing in the coin.

Being one of the most outspoken Bitcoin supporters, Keiser has previously made bullish predictions concerning the price of Bitcoin. Although predicting the prices of cryptocurrencies is not as easy as predicting price movement in the stock market, there are a few predictions that came true.

The price of BTC would have to rally by nearly five folds too, to match the $575 billion valuations of private gold held in gold bars, according to JPMorgan Chase. Nevertheless, in 2020 we witnessed a remarkable development in adopting the world’s largest cryptocurrency by market cap.

Andy Edstrom of WESCAP, an investment advisory firm, draws from Novogratz prediction and places Bitcoin’s market cap at $8 trillion by 2030. Bitcoin is the world’s leading cryptocurrency by market capitalization, daily volumes, price and even popularity. Launched in 2009, Bitcoin was the first decentralized form of digital cash that sought to make it easier for people to send and receive money without the need for mainstream intermediaries like banks. InvestingCube is a news site providing free financial market news, analysis, and education.

Bitcoin was trading below $44,000 earlier this week, having hit an all-time high the week before above $58,000. Its rebound suggest the third great price rally in its history may still be underway, with Mr Draper claiming that it holds the potential to rise a further 100-fold. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition. The volume traded over the last 24 hours was $77,167,053,879, down from $82,875,877,323 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained. We closed yesterday, February , at a price of $52,149.01 – up from $49,199.87 the day before.

He pointed to Facebook’s Libra and how the announcement of the proposed payment system affected the markets, which included a rise in Bitcoin’s price. During the interview with Trenchev, it was pointed out that the cryptocurrency’s price had climbed 9,000,000% in 10 years. Further, he stated that we should think of Bitcoin as being digital gold, and that if the digital currency was worth even 10% of gold’s market value, Bitcoin’s price would rise to US$50,000. As Bitcoin has experienced these sharp price fluctuations, market observers and analysts have repeatedly predicted where its price will go further down the line. This article will review several notable predictions involving the cryptocurrency, in chronological order. Investors should keep in mind that any and all predictions are speculative, and they may never materialise. Bitcoin, the world’s largest digital currency by market capitalisation , has experienced sharp price volatility since coming into existence in January 2009.