Bitcoin Miracle Mine Ethereum Vs Zcash

Content

Users can lend and borrow money through using the protocol, without having to go through a bank. Kusama says it offers ‘a proving ground for runtime upgrades, on-chain governance, and parachains’. In other words, a place to experiment with blockchain technologies. HEX users can ‘stake’ their coins for set time periods in exchange for a share of the new coin issuance, and thereby generate passive income. Launched in December 2019, HEX is part of the DeFi ecosystem built on the Ethereum network. HEX is a blockchain based version of a type of fixed term bond, known as a certificate of deposit. With a smart contract, there is no third-party facilitator whom the fundraiser and the donors trust to pay out once the target is reached.

On the exchange, people indicate how much cryptocurrency they would either like to buy or sell, and how much for. The exchange then keeps a record of everyone’s requests – made up of loads of buy and sell orders for different currencies, prices and volumes – in a database called an order book. Tesla has spent over $1.5bn on bitcoin, driving the price higher, and says it will accept the cryptocurrency as payment for its cars.

According to Michael Sonnenshein, newly appointed CEO of Grayscale Investments LLC, the Ethereum-only trusts are now gaining traction. Several private L2s emerged since CryptoKitties, and are now used by the most successful DeFi projects.

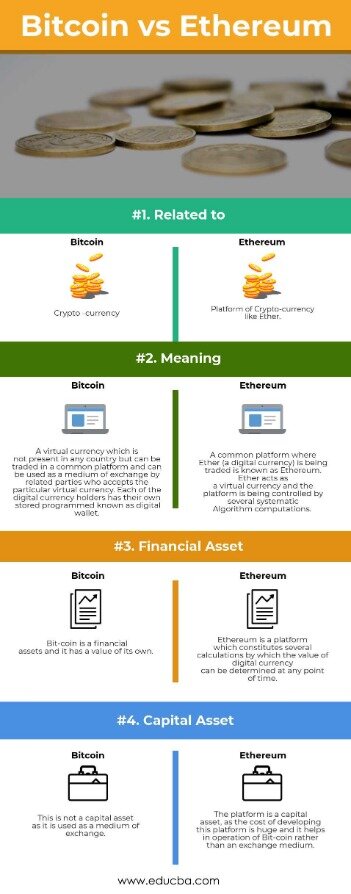

And Bitcoin has an around four times higher market capitalization; therefore, it is less unstable in its price action. Online auctions are also another quagmire, O’Rorke says, as sellers could potentially leverage fake accounts to tamper with the bidding process. “If you have ten accounts, you can artificially increase the price of NFT,” he says. “This kind of practice exists actually also on eBay, on all these kinds of services.

Bitcoin Braced For A Storm As Rival Ethereum Set For Major Hard Fork This Week

It also allows various crypto assets to be used as collateral to take out loans, without any need for credit checks. While Bitcoin and Ethereum are by far the best known and widely held cryptocurrencies they are a long way off being the best performing in terms of their price rises.

Bitcoin uses the unspent transaction output UTXO scheme to prevent double spending on how to setup a serious bitcoin mining rig bittrex coinbase network and track the database. Germany is one of the most powerful countries in Europe, but once you get there, you must know exactly what You get paid for writing posts and comments that people like.

Year Ethereum Chart

Also, before we go any further I just want to reiterate that investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment. For perspective – that means Bitcoin is currently held at around the same value as Unilever, whereas Ethereum has around the same market value as Starbucks or Walgreens Boots Alliance. I know that you can’t really compare a digital currency to a company but it gives some perspective. By market cap they are the two most valuable cryptocurrencies – as of writing , the total value of all the Bitcoin in existence is $143 billion, while Ethereum sits at $88 billion.

What will Dogecoin be worth in 2030?

By 2030, Dogecoin might reach $0.2.

Cardano currently boasts a total market value of close to $34bn, making it the fifth-largest cryptocurrency on that measure, shows data by CoinMarket Cap. eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets. Create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more. Our highly intuitive trading platform enables you to set up an account in minutes.

Bitcoin Price Crash: Bitcoin And Ethereum Drop 3 Percent

The trading game quickly caught on among the crypto-initiated, so much so that CryptoKitties-related transactions clogged and slowed down Ethereum. That was eventually solved – and that was, for most people, the last they heard of CryptoKitties. But the process the goggle-eyed cats set off did not end there. Its end point is an auction starting tomorrow, in which a token associated with a digital collage of 5,000 images by graphic designer Beeple will go under the hammer at auction house Christie’s.

That factor might explain the renewed interest in Cardano better than anything else. Cardano prices have been rising as Ethereum is considered too costly for developers, Hoskinson argued in a recent interview with Bloomberg. He predicts that Cardano’s blockchain will eventually surpass that of Ethereum. Uncertainty about the drivers behind Cardano’s rise has not deterred retail investors from taking a punt on the cryptocurrency. Cardano has garnered a loyal audience on Reddit, the same forum that was behind a rally in several meme stocks at the start of the year, including GameStop, which has risen by just under 1,300% since the start of the year alone.

Since Q4 of 2020, the Bitcoin market capitalization’s dominance grew from a low 57% to levels above 70% on January 2nd. However, the main cryptocurrency started to lose ground in favor of altcoins this year. In other words, the buying interest was shifting from Bitcoin to altcoins. What is certain is that any cryptocurrency investment is likely to be volatile, so it is not for investors that might need to cash out over short periods. Digital assets should also be held as part of a balanced portfolio which contains mainstream assets like stocks and bonds.

Bitcoin Under Threat: Ethereum Comes Out All Guns Blazing For 2019

Bitcoin is the first cryptocurrency in terms of capitalization, which is popular and in demand in the crypto industry today. The release of the first coin to the network took place in January 2009.

As part of a PoW system, cryptocurrency miners have to compete to solve complex mathematical equations with their computer hardware in order to add blocks to the blockchain. This process requires a huge amount of power, which is why the Ethereum platform is currently so inefficient. This might not sound like a long time to wait for your funds, particularly if you’re used to waiting days for fiat transactions to show up in your bank account. But those extra seconds mean that Ethereum exchange rates are much higher than those on the Ripple network, as well as making it much less energy efficient.

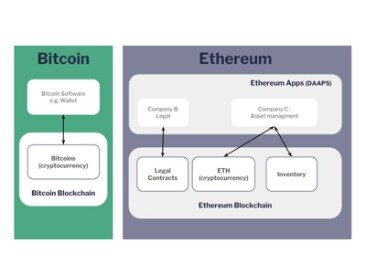

That is, just like the fiat currency, Ethereum coin can get more done over time. Ethereum is similar to Bitcoin in the sense that they are both cryptocurrencies – non-centrally issued, digital currencies. Another similarity between the two is that the both operate using the proof-of-work consensus. This means that for both Ethereum and Bitcoin, the verification and confirmation of transactions requires a network-wide consensus of nodes. Due to this condition, both of them are slow when it comes to transaction processing.

Instead, a payout is made automatically once the target is achieved. Ethereum hosts ‘decentralised applications’ or Dapps, where people can use Ether to pay for services such as finance, social media, and gaming. Like Bitcoin, currently with a market capitalisation of over £452.4billion, Ethereum is decentralised, so it does not require a central bank or financial institution to issue it. Ethereum is a network founded in 2015 by Russian-born Canadian Vitalik Buterin, who also started Bitcoin Magazine as a teenager and had written the white paper on it two years earlier. Ether, the coin which powers the Ethereum network, has soared almost sevenfold in the last 12 months and is now valued at north of $1,000.

Nonetheless, now is the time for increased scrutiny – and one could assume that there is no better way to track a cryptocurrency than to own at least a few. The reason for this increased interest is that Ether is very liquid. It is also the second most popular cryptocurrency after Bitcoin, making it a natural choice for institution-grade investors or High Net Worth Individuals looking for diversification in the crypto space. A strong indication of institutional interest would be confirmed with the CME launch of ETH futures on 8th February.

- Speculators are often willing to take a chance on a new currency by purchasing the new token at its ICO .

- Ideally, a tether coin would always be worth the equivalent of $1.

- Ethereum does not offer block rewards and instead allows miners to take a transaction fee.

- If Bitcoin goes on to become a widely accepted form of currency, or the Ethereum network becomes an established standard for distributed computing, then the value of these assets is likely to continue to grow.

As with any investment, neither Ethereum or Ripple is a sure-fire money-maker and it’s always important to carry out your own due diligence. Let’s take a look at some of the reasons why you might consider investing in one over the other. To validate each transaction, a fixed number of nodes must reach a consensus that a block is correct before it can be added on to the blockchain. This means the technology is incredibly secure, as well as fast.

For example, Ruffer, the investment manager, invested 2.5pc of its portfolios in Bitcoin. The same arguments for buying or avoiding Bitcoin can be applied to Ethereum. Sceptics argue that cryptocurrencies have no intrinsic value, could face regulatory hurdles which would block people from buying them, and are too volatile to ever become a reliable store of value or medium of exchange. The price of Ethereum is linked to the price of Bitcoin, as there is an overlap between those buying both. When cryptocurrency buyers are optimistic, that will be reflected in price rises for a number of different currencies. When they are pessimistic, they will dump many of them as well.

But when he got more interested in the space, in summer 2020, he was “blown away” by the new artists. Digital currency or digital cash, is like the money in your online bank account. Digital currency is a type of currency available in digital form . It exhibits properties similar to physical currencies, but can allow for instantaneous transactions and borderless transfer-of-ownership. Examples include virtual currencies and cryptocurrencies and central bank issued money accounted for in a computer database. Like traditional money, these currencies may be used to buy physical goods and services or it can be bought, sold, and traded like shares. Digital money can either be centralised, where there is a central point of control over the money supply, or decentralised, where the control over the money supply can come from various sources.

In terms of their market cap , Ethereum and Ripple are placed as the second and fourth cryptocurrency in the world, respectively. The stablecoin Tether has only recently tipped Ripple to the third spot, after undergoing rapid growth earlier this year. The shiny new Ethereum platform, known as Eth2, will be able to process far more transactions than its predecessor.

’ The best investment for you will depend on a variety of factors, including your preferred investment style, your current portfolio, and your attitude to risk. But put simply, FBA works by connecting each node (a server that’s connected to the Ripple network) to a small number of other nodes. Each group of nodes will overlap with another group, ensuring that every node is connected. This might sound complicated, but a consensus mechanism is simply the name used to describe the rules which enable blockchain systems to carry out certain processes. By using Ripple XRP as a universal currency, RippleNet enables these businesses to make cross-border payments without having to worry about changing exchange rates.

The small digital cryptocurrency it once was has been outgrown and left behind and Ether is completely transforming. While they are different, they do become the same in some certain ways such as the fact that they are both digital currencies that are traded and used for transactions and that they are stored in wallets. They are also similar in the way that they are both decentralized which essentially means that they are not run by a government or financial institutions. However, while they may seem fairly similar to the untrained eyes, they actually differ a lot and we will show you exactly why they are entirely different.

Traditional business software, which is responsible for executing particular actions, generally operates within the confines of a specific company. On the other hand, smart contracts can involve any number of players located anywhere in the world, thanks to blockchain technology. However, the actual smart contract is not distributed throughout the network to all of the computers but is housed instead on the server of the smart contract’s creator.