Bitcoin? ‘it’s God’s Way Of Telling Us There’s Too Much Money’

Content

More than 99% of people that ever bought Bitcoin and never sold are now in profit and the mainstream is getting really annoyed about that. We take reasonable care to correct errors or omissions on our site as soon as we can after we are made aware of them.

Is it worth mining bitcoin 2020?

The long answer it’s complicated. Bitcoin mining began as a well paid hobby for early adopters who had the chance to earn 50 BTC every 10 minutes, mining from their bedrooms. Successfully mining just one Bitcoin block, and holding onto it since 2010 would mean you have $450,000 worth of bitcoin in your wallet in 2020.

Austerity will not work to solve this crisis as stimulus is needed to restart the economy after lockdown. Bitcoin will likely surpass $100,000 per Bitcoin in 2021 due to the rapid adoption and understanding of its environmental benefits over traditional currency. Bitcoin has done more for the adoption of renewables than any other industry and although Bitcoin is a resource hog, the only reason these renewable energy plants exist is because of Bitcoin. The Bitcoin network is slowly undermining traditional infrastructure and this will create problems for countries that over-regulate cryptocurrencies.

The Investing Show

Although 2020 may have been the year of the Bitcoin, some experts still believe gold remains the overwhelming ‘safe haven’ of choice among most savers. We have taken reasonable steps to ensure that any information provided is accurate at the time of publishing. If you require any personal advice or personal recommendation, please speak to an independent qualified financial adviser.

Using Bitcoin also means that cross-border and global trading is simpler and faster and the ‘crypto’ aspect of the currency makes it secure. Bitcoin is a digital web-based currency that operates without the need for central banks and uses highly secure encryption (a crypto-currency) to regulate the currency units and to verify transfers of funds. Blockchain is an open and programmable technology that can be used to record transactions for virtually anything of value that can be converted to code and is often referred to as a kind of ‘incorruptible ledger’.

Digital Defender Snyk Quadruples Valuation, Rumoured To Eye Ipo

The post 3 cheap UK shares to buy for high dividend yields appeared first on The Motley Fool UK. Around one in three crypto investors have made their first investment since March 2020 when the stock markets plunged at the outset of the COVID-19 pandemic. Crypto exchange BTC Markets’ report surveyed 2,000 investors in Australia, finding that 12.6% held cryptocurrency compared to 12.1% holding precious metal, Motley Fool has reported.

The renowned investor George Soros is reportedly preparing to invest in bitcoin, having previously called it a bubble. Billionaire investor Bill Miller revealed in December 2017 that half of his hedge fund was tied up in bitcoin. Bitcoin is better than gold “on every front” and could eventually be worth around $700,000, according to an institutional investor. “While many expect the bitcoin rally to continue in 2021, I’m more concerned with what the Biden administration could mean for crypto,” Jesse Cohen, a senior analyst at Investing.com, told The Independent. A leaked report from senior Wall Street analyst Tom Fitzpatrick in November predicted that bitcoin could hit $318,000 in 2021, followed by a “painful correction”. Looking at past trends, some market analysts are hopeful it will continue to see massive growth before potentially crashing back down. Part of the reason for this is bitcoin’s finite supply – only 21 million units will ever exist – meaning it is not susceptible to artificial inflation techniques like quantitative easing.

Alternatively, investors can buy into an investment fund that either tracks the price of gold or holds shares in companies involved in gold mining. The value of stocks and shares and any dividend income, may fall as well as rise, and is not guaranteed so you may get back less than you invested. You should not invest any money you can’t afford to lose and should not rely on any dividend income to meet your living expenses. Exchange rate charges may adversely affect the value of shares in sterling terms, and you could lose money in sterling even if the stock rises in the currency of origin. Any performance statistics that do not adjust for exchange rate changes are likely to result in inaccurate real returns for sterling-based UK investors. Instead, the new hope is that it could emulate gold as a store of value that sits beyond the reach of government mismanagement.

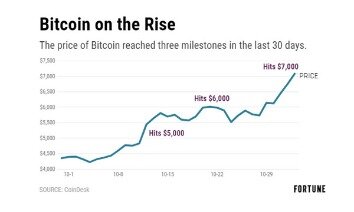

The cryptocurrency hit a new record high of $42,000 late last week, only to plunge by more than 20% over the weekend. Yet at around $34,500 in the middle of this week, bitcoin has still rocketed since October, when it cost $11,000.

The big tech firms understand Bitcoin is more efficient than gold and this will be a key driving factor over the years to come. I do not consider Bitcoin an investment, for me Bitcoin is a lifestyle choice. Buildings in Canary Wharf being heated and lit all day despite very few staff being in work is a waste in itself but the same applies during normal times also.

Bitcoin: Is The Virtual Currency The New Gold Standard?

Earlier this year, Chinese authorities cracked down on Bitcoin trading in an attempt to stop money flowing out of the country illegally. You could end up spending more money on electricity for your computer than the Bitcoin would be worth.

Mainstream adoption remains a long way off but investors increasingly refer to the notoriously volatile cryptocurrency as a safe-haven asset, with some analysts going as far as to call it “digital gold”. Its bounce back coincided with the enforcement of lockdowns around the world, as the full extent of the Covid-19 pandemic began to be realised. With economies stalling, funds flooded out of stock markets and into gold and cryptocurrency. Bitcoin has risen in price by nearly 300 per cent in 2020, outperforming the combined gains of gold and the Dow Jones stock market by a factor of 10. If you’re thinking of investing in one you need to be prepared for your investment to go up or down. It’s even possible its value could fall to zero… making it worthless.

Crashes are commonplace on the market, and no matter when you buy cryptocurrency, there is no guarantee that your capital is not going to halve in a month. Bitcoin, often described as a cryptocurrency, a virtual currency or a digital currency – is a type of money that is completely virtual.

Bitcoins Value set To Quadruple After It Rivals Gold As Safe Haven

Cryptoassets are generally held as investments by people who expect their value to rise. I choose to ditch traditional currency, I keep what I need to survive and store all my value in Bitcoin because of the huge money printing that is happening all over the globe.

With so little Bitcoin changing hands each day it doesn’t take much demand to move the price up and when the price rises it attracts more interest which helps drive the price further. These speculative bubbles have appeared several times in Bitcoin and in my view, this is what we are seeing this year. Not only does Bitcoin have a limited supply, but there is also the issue of liquidity.

Bitcoin is a cryptocurrency, so called due to the encrypted data used in its transaction. Bitcoin was first created by an anonymous group of programmers known as Satoshi Nakamoto, and was first released as open source software in 2009. Police were investigating the killing of a local journalist by an unknown gunman at a barber shop in Pakistan’s southern Sindh province, officials said Saturday. Ajay Lalwani, 31, a reporter for a local television station and an Urdu language newspaper, was shot multiple times while having his hair cut at a barber shop Thursday, said Ashiq Mirani, the area police chief.

Since peaking in late 2017 at around $20,000, bitcoin spent the best part of two years in steady freefall before its resurgence in March this year. Recent gains have propelled the cryptocurrency to new record highs of close to $30,000 (£22,000), having traded below $5,000 as recently as March.

Physical gold is extremely difficult to buy, sell, and trade across national borders, and nearly impossible to use as legal tender. Gold turnover is subject to heavy taxation, and many prefer to invest in precious metal accounts instead of physical gold. Cryptocurrencies, on the other hand, are easy to buy and sell, can be freely traded across borders, and their use as legal tender is becoming increasingly more common. But the closer scrutiny from Beijing only briefly sent the currency lower. After it had soared to record highs in January, it has since picked its steady rise in value.

“Bitcoin is the first viable candidate to replace gold the world has ever seen,” Mr Pfeffer said. “So if bitcoin becomes the dominant non-sovereign store of value, it could be the new gold, or new reserve currency.” John Pfeffer, a partner at UK-based Pfeffer Capital, made the remarks at the Sohn investment conference in New York. That event traditionally serves as a place for investors to recommend the best stocks to invest in – and has never seen anyone recommend cryptocurrency before. Others believe that economic and geopolitical stability caused by the global roll-out of Covid-19 vaccination may see a shift away from cryptocurrency investment and back towards traditional markets. The geopolitical uncertainty brought about by the coronavirus pandemic, which saw stock markets crash around the world, would typically see investors look towards stable assets like cash or gold.

It’s generally slower and more expensive to pay with cryptocurrency than a recognised currency like sterling. Some people find this appealing because they think they have more control over their funds but in reality, there are significant risks. With no banks or central authority protecting you, if your funds are stolen, no one is responsible for helping you get your money back.

JPMorgan estimates that bitcoin would have to quadruple before the total market value matched the $2.7trn that private investors have put into gold. Bitcoins may suit those looking to engage in business in economies that simply cannot be as easily reached through conventional payment avenues. As an investment resource, bitcoins’ lack of physical form doesn’t undermine its transparency, as investors can monitor “block chains” and online ledgers that visibly convey the cryptocurrency’s value. Joining institutional investors have been other major players entering the market and buying up the limited number of bitcoins in circulation. Among them is PayPal, which announced in October that it would open up cryptocurrencies to its roughly 350 million users worldwide in early 2021.

The “chaos and despair” of 2020 has shaken faith in conventional monetary and political systems, says Lex Sokolin of blockchain business Consensys. As a result, institutional investors are looking for an “apocalypse hedge”. Slowly but surely, bitcoin is “being domesticated” says Gian Volpicelli on wired.co.uk. The latest bitcoin run has felt positively “staid” compared to the unbridled mania of the 2017 boom and crash, when investors burnt their savings on “unrealistic promises of endless revenues”. Crypto-based hedge funds doubled their assets under management to $2bn between 2019 and 2020, according to a report from PwC and Elwood. If the US financial regulator — the SEC — denies them, expect a sudden slump in the price of bitcoin.

I found it a bit of a faff setting up my digital wallet but then I’m no techie, and I was shocked at the trading fees on some sites, which swallowed up more than 10% of my coinage. In the spirit of disclosure, I should say that I have an itty-bitty holding in Bitcoin, although sadly, I bought too recently to have made serious money. Bitcoin was on a roll before the cyber attack but its price has dipped since, possibly in consequence.

Gold’s safe haven investment remains during the course of the current economic uncertainty. Elements of change such as Article 50, political leadership in the USA and UK, as well as market growth factors in forthcoming superpowers such as India and China will see more and more investing in gold to protect their wealth.

- If you invest in UK gold coins which are legal tender you will not be charged any Capital Gains Tax.

- Renowned stock-picker Mark Rogers and his analyst team at The Motley Fool UK have named 6 shares that they believe UK investors should consider buying NOW.

- Bitcoin is in the headlines again as this week Elon Musk, the founder of Tesla, announced his company had bought $1.5bn.

- These cheap UK shares could be attractive income investments to buy and hold for the long term in a low-interest-rate environment.

Then they work out complicated mathematical puzzles using extremely powerful computers to find out if the transactions are valid. If they are valid, the miners record them on a public log of who owns what. You may have heard of the term distributed ledger technology, that’s what it means. The ledger is called the block chain because as transactions are validated they are bundled up into blocks, which are then added to the end of the ledger. Each block includes a reference to the previous one, linking them all together in a long chain. Linking blocks together in this way makes it very difficult to tamper with the ledger.

This has been the Chinese currency’s weakest performance in more than 20 years. Despite a crack-down on Bitcoin trading by Chinese authorities who feared that it was being used to channel money out of the country illegally, Bitcoin surged to reach new heights. Predictions of its possible demise and a fall in the value of Bitcoin were fuelled by its collapse on the MtGox exchange in Japan in 2014 as a result of a hack. After a tenfold increase in its value in only two months and a surge in value to $1,163 back in 2013, Bitcoin has had its share of turbulent waters. As a relatively newly introduced model of currency, Bitcoin has taken some time to gain popularity. The Benefits of Bitcoin as a currency for users are that payments can be transferred easily and quickly and anonymously , across borders, continents and time-zones.