3 Reasons Why Bitcoins Value Is Set To Soar This Year

Content

China recently banned bitcoin exchanges, whereas Japan enshrined the currency as legal tender. There are no signs, however, that it will become a more recognised currency than standard digital payments or cold, hard cash. Geopolitical factors such as the escalating US-Sino tensions, the US presidential election and Brexit will also likely bolster Bitcoin.

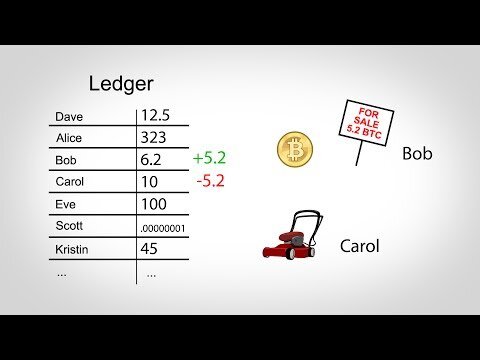

Like most other investment classes, bitcoin collapsed in mid-March to under $5,000 a coin, having previously sat at above $10,000 on Valentine’s Day – in the last day, it has rebounded to nearly $9,000 a coin. The chief executive of one UK-based bitcoin seller expected to see a surge in demand from investors for the rest of this year and believed, rather bullishly, that it could potentially reach $1million within half a decade. Bitcoin’s upcoming halving has led to a surge in interest from investors in the cryptocurrency, with some enthusiasts making wild predictions about how much it could be worth over the next few years. The underlying technology is blockchain, a financial ledger maintained by a network of computers that can track the movement of any asset without the need for a central regulator. There are reports that this has proved hard for some people.

Plus, you’ll also get instant access to a free report on how to double your money with cryptocurrency. This helps us pay for the great content, data and tools we provide to all investors. In order to make the advertising relevant to our users we need to understand whether you are an individual investor or financial professional. The information contained within is for educational and informational purposes ONLY.

It creates a global network of banks in which people can send and receive payments through Ripple technology. The consensus algorithm was new and unproven when it was initially presented but since then Ripple has carried out several validations for the transactions. These are held in place by a smart contract which releases 1 billion XRP per month over 55 months. This is the reason why Ripple is actually pretty undervalued currently.

How Are Cryptocurrencies Made?

Bloomberg last December declared it to be “the decade’s best-performing asset”, having yielded early investors an eye-watering 9,000,000 per cent rate of return on its starting price. Cryptocurrencies are one of the biggest inventions of the modern era, there is no denying that. They enabled us to complete instant transactions online and save a lot of money in the process. They are not controlled by any bank or government, so when trading with cryptocurrencies, people avoid all of the extra and/or hidden fees applied. Not only that, but traders also enjoy a certain level of anonymity with every completed transaction. With the prices of cryptocurrencies increasing dramatically over the last few years, scammers are now actively targeting potential investors.

This site generates high-profitable AI-powered algorithms and its platform is easy to use. Thousands of people around the world are trading here and a big majority of them have amassed huge amounts of profit thanks to their support. Even in times when Bitcoin was going through a downfall, it remained the top choice for many traders and maintained a high value. This was in 2018 and halfway through 2019, after the cryptocurrency collapsed and had a value of around $5,000.

Many big investors – including banks and hedge funds – have not yet entered into the market. The volatility and lack of regulation around Bitcoin are two reasons stopping these investors from jumping in. Without these fundamentals the price of Bitcoin largely reflects speculation. And there is some evidence that people are simply buying and holding Bitcoin in the hope it will keep rising in value . Bitcoin may be the best known cryptocurrency but it is also losing marketshare to other cryptocurrencies, such as Ethereum and Litecoin. Bitcoin currently accounts for 59.4% of the total global cryptocurrency market, but at the beginning of 2016 it was 91.3%.

Anyone considering it should be prepared to lose their entire investment. “Humans are incredibly influenced by other people in their environment,” says De Martino. “The social phenomenon is kind of an avalanche; it’s a self-fulfilling prophecy,” he says.

Even though those who were paid this way would see it converted back into regular money, the news saw bitcoin shoot up in value by around $800 in a day, according to figures from Coindesk. The steep climb in the price since mid-October means the cryptocurrency has risen 87 per cent in value earlier this week compared to last year, with the total value of the 18.5million coins in circulation now $243billion. It’s origins may seem unclear but Bitcoin could be a practical demonstration of an electronic currency that shows us the future of money. What we do know is that the technology behind most cryptocurrencies is enabling new models of value transfer through secure global consensus networks, and that is causing excitement and nervousness.

Many people seem to have an original theory about why some new technology will mean that certain new cryptocurrency is the future of money. All cryptocurrencies use blockchain technology or the decentralized digital ledger.

Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person’s sole basis for making an investment decision. Please contact your financial professional before making an investment decision. When more people or organizations use cryptocurrency over time, expect that they become more valuable. Overall, cryptos have critics, but they also have supporters.

This incurs currency exchange fees and takes time – which is why bank transfers between accounts in different countries often take up to three days to process. Even so, only a small number of people actually end up buying cryptocurrency. De Martino co-authored a study that looked at why certain people are more likely to get involved in a bubble market while others stay away.

XRP is a token used for representing transfer of value across the Ripple Network. Different to bitcoin, where new coins are created as rewards for participants offering computing power to maintain the blockchain network, Ripple created 100 billion XRP coins at its inception. If the bitcoin bubble does come crashing down, everything you just read about is likely to happen in reverse. The herd mentality will shift from buying to selling, and people with a more heightened theory of mind will sell their bitcoin, anticipating that other people are about to do the same. “The problem with the real bubble in economics is that we just don’t know it’s a bubble until it’s crashed,” says De Martino. The reason for the link, De Martino says, is to do with something called theory of mind.

A major Tesla investor predicts the price to between $50,000 and $500,000 in the next five years. A former Goldman Sachs hedge fund manager – Raoul Pal – predicts a price of $1M within five years. And of course, a former Facebook executive couldn’t miss getting in on the hype-train with their prediction of $1M bitcoin price. Large transactions are still done in over the counter markets. I regularly get approached to ask if I know someone who will do a deal for thousands – or even millions – of Pounds Sterling for BTC. And from the way the conversations go, it feels like a back-alley drug deal.

This Is How The Bitcoin Bubble Will Burst

A year later, Fugge had a working product that enabled consumers to be able to secure transactions over the internet, just 5 years after the internet boom. In order to read or download bitcoin trading and investing a complete beginners guide to buying selling investing and trading bitcoins litecoins cryptocurrency book 2 ebook, you need to create a FREE account.

Some go back to bitcoin’s original proposition as an alternative to existing currencies as a reason for its high price, and point to a small number of merchants outside the dark web that accept bitcoin for goods and services. Bitcoin has value, they argue, because it could become widely used as an alternative to existing currency. With the rising price has come rising awareness and media attention.

Trading Sites Help You Make Money

When examined objectively, bitcoin does prove to be an improvement over fiat currency and gold, but it still requires mass adoption to become a viable currency and/or store-of-value. Bitcoin might be the best invention since sliced bread, but if it isn’t used on a global scale, it won’t ever be a true alternative to traditional currencies for the masses. After all, much of the general public still has the question what is cryptocurrency. He added the exchange, which allows people to buy bitcoin and other cryptocurrencies, had seen an increase in customers every month of this year.

Ponzi scams usually involve making strong or unrealistic claims about the returns you are able to make by investing in cryptocurrencies. They often have referral programmes to encourage investors to sign up their friends and families. You may see the investment opportunities of Bitcoin and other cryptocurrencies being marketed on social media and via email – these will send you to fake exchanges which can often disappear overnight. Lastly, the unstable nature of the currencies means that if you’re investing with the hope of making money, it’s very easy to lose some or all your original investment.

We are not sure what the future will be, but we will definitely be watching with excitement what happens in this space. This is also the way current banks operate and is top 20 cryptocurrencies to invest in 2019 ohiosoft altcoin of the building blocks of the current financial. For many Ripple was going to become the defacto banking cryptocurrency so a sort of self-fulfilling prophecy occurred.

Is The Volatility Of Bitcoin Good Or Bad For Trading?

On November 21, cryptocurrency Tether reported a $31m theft, which led to bitcoin’s prices temporarily plummeting. It’s a digital currency, used to pay for items online without any additional bank charges, or government control. Companies and people can buy or sell items using bitcoin as payment. In 2017, these companies include Microsoft, Virgin Airlines, WordPress and Subway. “$250,000 means that bitcoin would then have about a 5 per cent market share of the currency world and I think that may be understating the power of bitcoin,” Mr Draper said in September.

Several high-profile institutional investors have touted bitcoin as long-term investment with significant upside potential, even after its previous surge. Cryptocurrencies gained a massive popularity due to the use and trend of online financial services. While Bitcoins were the first and most popular crypto in the market, other coins also emerged. The main purpose of these cryptocurrencies is to provide a digital currency decentralized form that can serve as a traditional currency alternative. While Bitcoin is a digital currency intended as a means of payment for goods and services, Ripple is a payment settling, currency exchange and remittance system intended for banks and payment networks.

- All cryptocurrencies rely on the project development’s overall progress and viability.

- Bitcoin ATMs are being installed in many countries, including Australia.

- You don’t need to invest thousands of pounds to get one single bitcoin.

- Those in the UK generally need to register with the Financial Conduct Authority .

- This has kept bitcoin as a fringe investment for finance professionals and pundits who have more to gain than to lose from a new form of currency.

A combination of supply and demand for the cryptocurrency which is driven by cryptocurrency exchanges. The only problem is the millions of dollars in bitcoin transactions occurring every day might not actually be real transactions at all. One advantage bitcoin does have on its competitors is what is known as network effects. A network effect occurs when a good or service increases in value as a direct result of the number of people using that good or service.

Selling Larger Amounts Of Bitcoin

Originally conceived as a digital, encrypted alternative to traditional currencies controlled by central banks, bitcoin has also been attracting more interest from mainstream investors. For example, BlackRock recently added prospectus language giving three of its funds the flexibility to invest in bitcoin futures.